Louisiana PLLC Notices and Resolutions

What this document covers

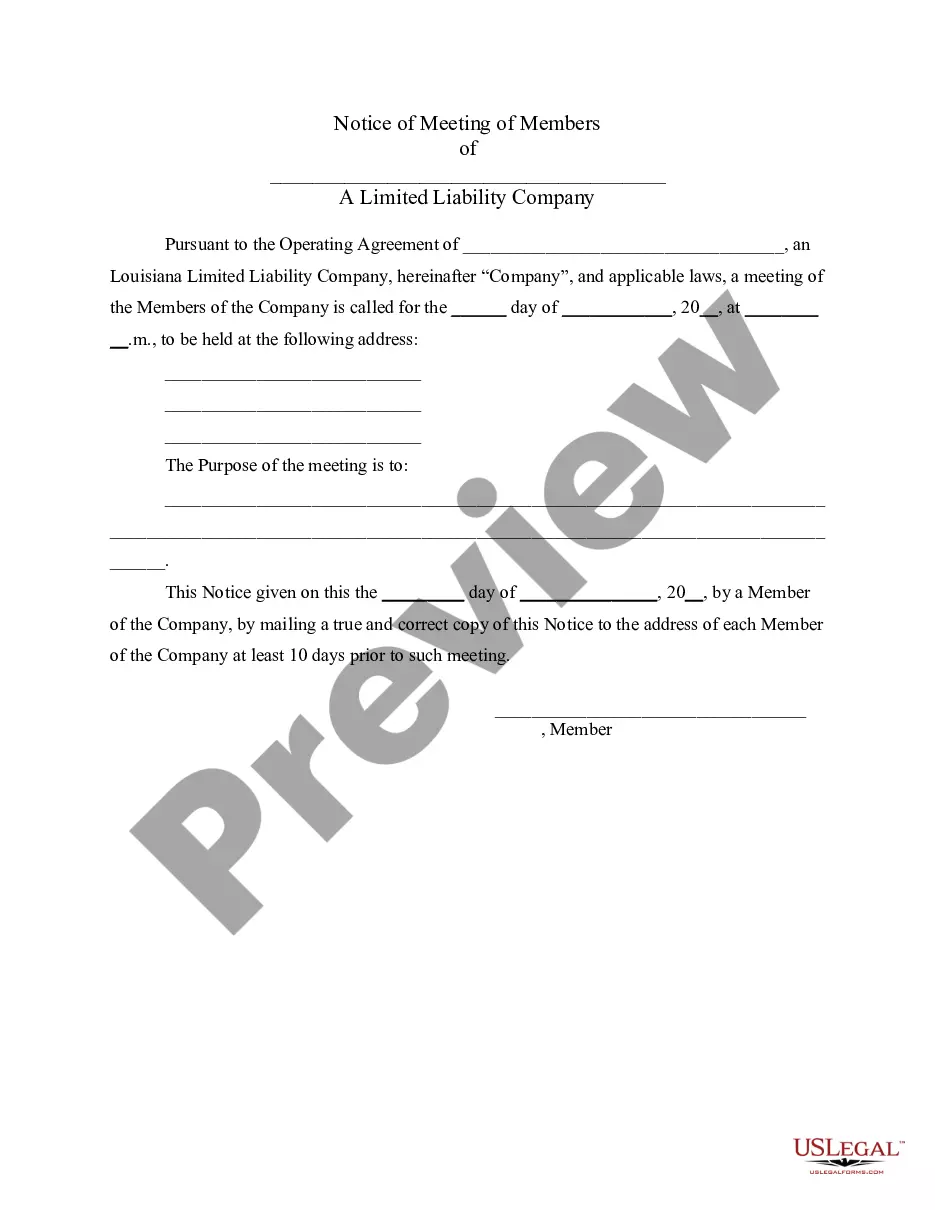

The PLLC Notices and Resolutions collection consists of essential documents used for the effective operation of a Professional Limited Liability Company (PLLC). These forms, drafted by licensed attorneys, provide a structured way to facilitate meetings, amend articles of organization, and handle various matters concerning the management and membership of a PLLC. Unlike general business forms, these documents are specifically tailored to meet the unique needs and legal requirements of PLLCs.

Key components of this form

- Notice of meeting for various purposes, such as general business, amendments, or dissolution.

- Resolutions made during meetings, documenting decisions like accepting resignations or disbursements.

- Assignment of member interest, detailing the transfer of ownership within the PLLC.

- Demand for indemnity by member/manager related to legal claims.

When this form is needed

This collection is utilized when a PLLC needs to document critical actions or decisions formally. Typical scenarios include calling a meeting to discuss amendments to articles of organization, considering the dissolution of the company, admitting new members, or handling management changes. Using these forms ensures compliance with legal requirements and helps maintain clear and formal records of decisions made by members and managers.

Who should use this form

- Members and managers of a Professional Limited Liability Company.

- Individuals responsible for the administration and compliance of a PLLC.

- Legal professionals advising PLLCs on proper governance issues.

- Business owners looking to maintain order and legality in their business operations.

Completing this form step by step

- Identify the purpose of the meeting and fill in the appropriate notice or resolution form.

- Enter the date, time, and location of the meeting, ensuring compliance with notice requirements.

- Document the agenda clearly, specifying what decisions will be made during the meeting.

- Have members sign the resolution after the meeting, confirming their agreement with the decisions made.

- File any required documents with the Secretary of State or relevant local authorities as needed.

Notarization requirements for this form

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide adequate notice to all members before a meeting.

- Not including a clear purpose in the notice, leading to confusion.

- Neglecting to document actions taken during meetings properly.

- Using incorrect dates or details in resolutions, which can cause legal issues.

Why use this form online

- Easily downloadable and editable documents, allowing for quick customization.

- Access to templates drafted by licensed attorneys, ensuring legal compliance.

- Convenience of completing forms at your own pace, reducing the need for legal consultations.

- Secure storage of your documents for future reference and use.

Looking for another form?

Form popularity

FAQ

Professional LLCs PLLCs offer the same benefits as LLCs. The main difference between a LLC and a PLLC is that only professionals recognized in a state through licensing, such as architects, medical practitioners and lawyers, can form PLLCs.

A PLLC is a special kind of business entity available to licensed professionals. By Christine Mathias, Attorney. A professional limited liability company (PLLC) is a business entity that offers tax benefits and limited liability for professionals, such as lawyers, accountants, and doctors.

Forming your personal service business as a PLLC will protect you personally from creditors seeking unpaid debts owed by the PLLC, provides legal liability protection from any legal claims brought against the business, and also provides asset protection.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

To form a PLLC, a licensed professional must sign all filing documents as well as include their professional license number and a certified copy of their license. Importantly, they must submit these documents for approval with their state licensing board before filing them with their state's secretary of state.

A professional limited liability company (PLLC) is a business entity that offers tax benefits and limited liability for professionals, such as lawyers, accountants, and doctors.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.