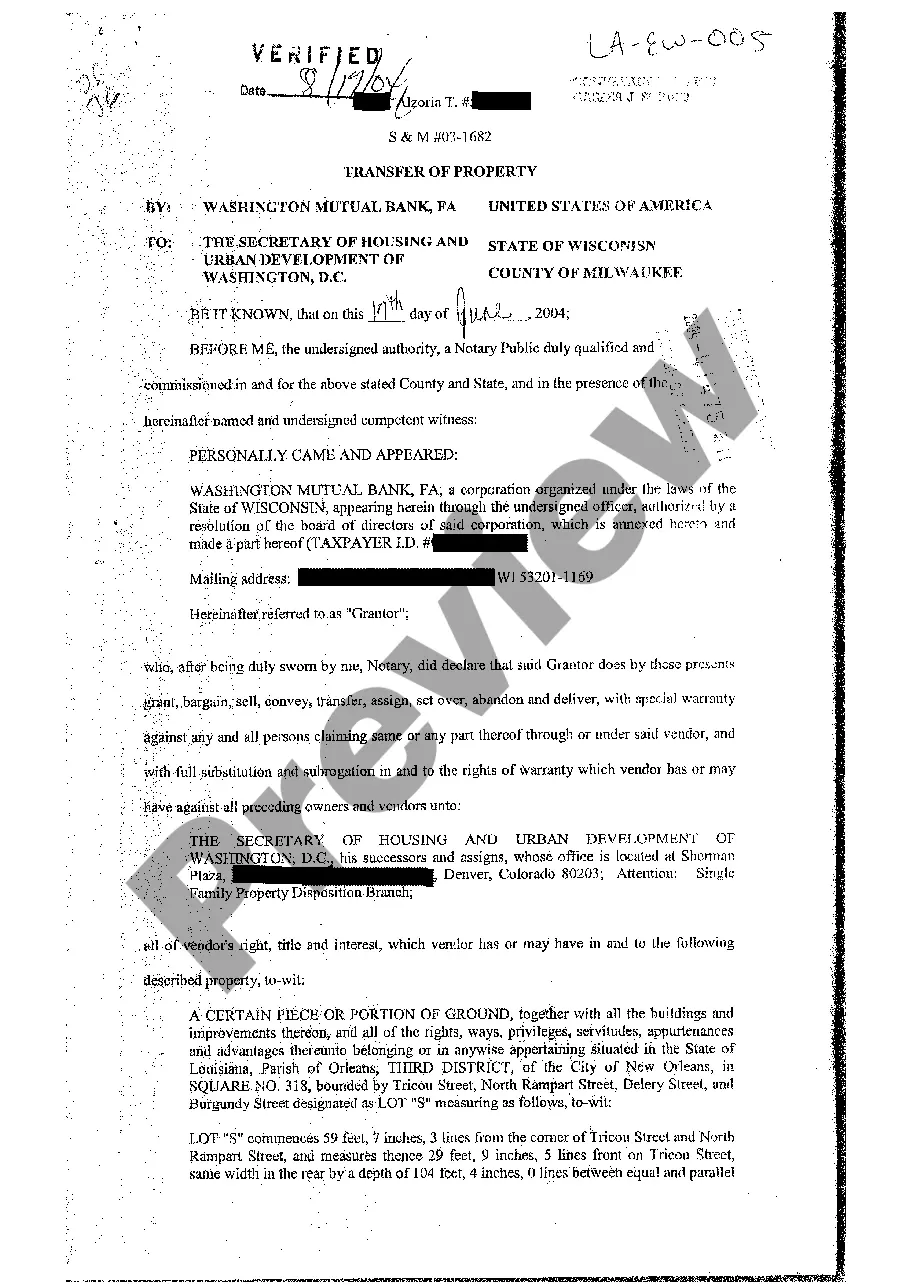

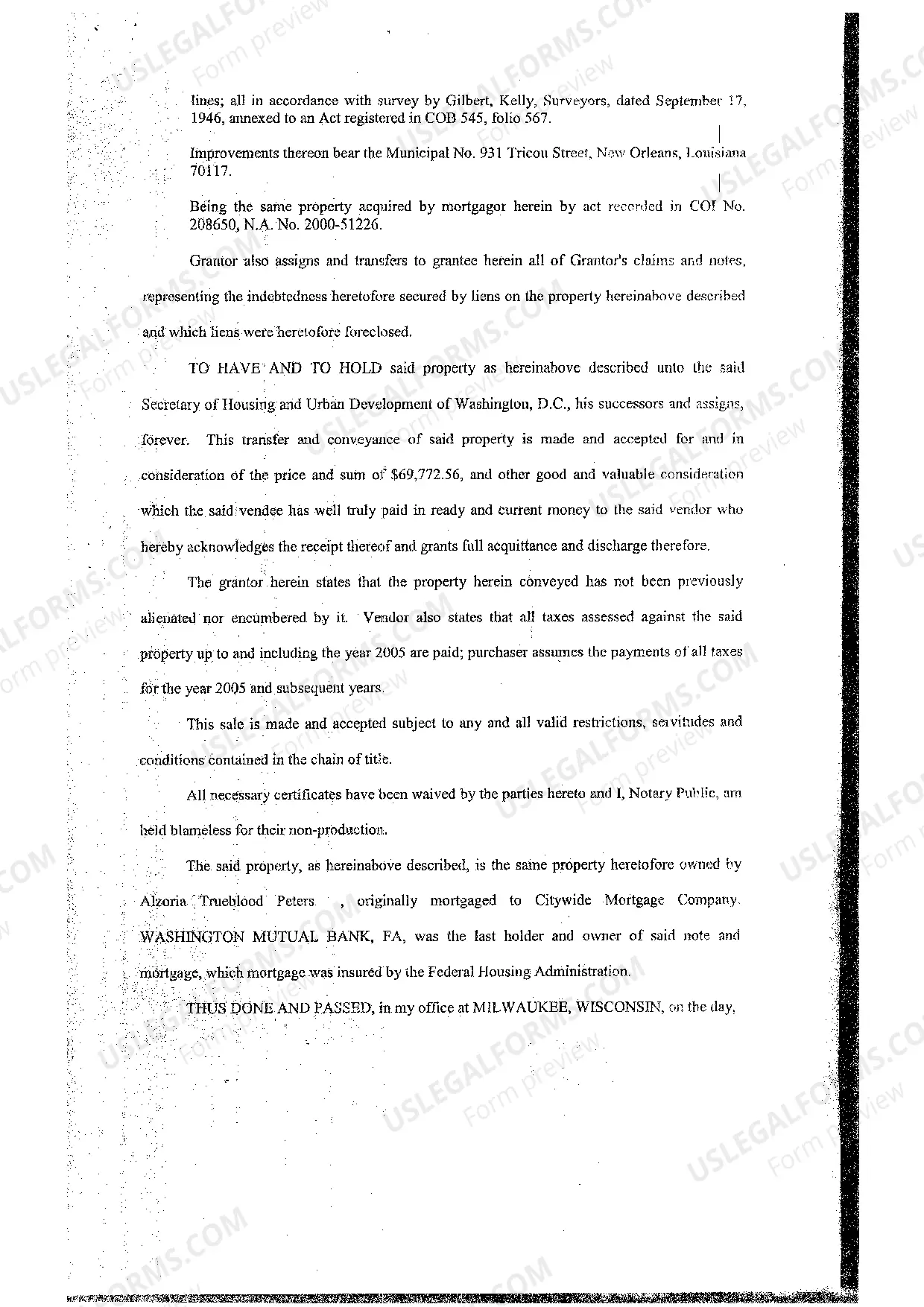

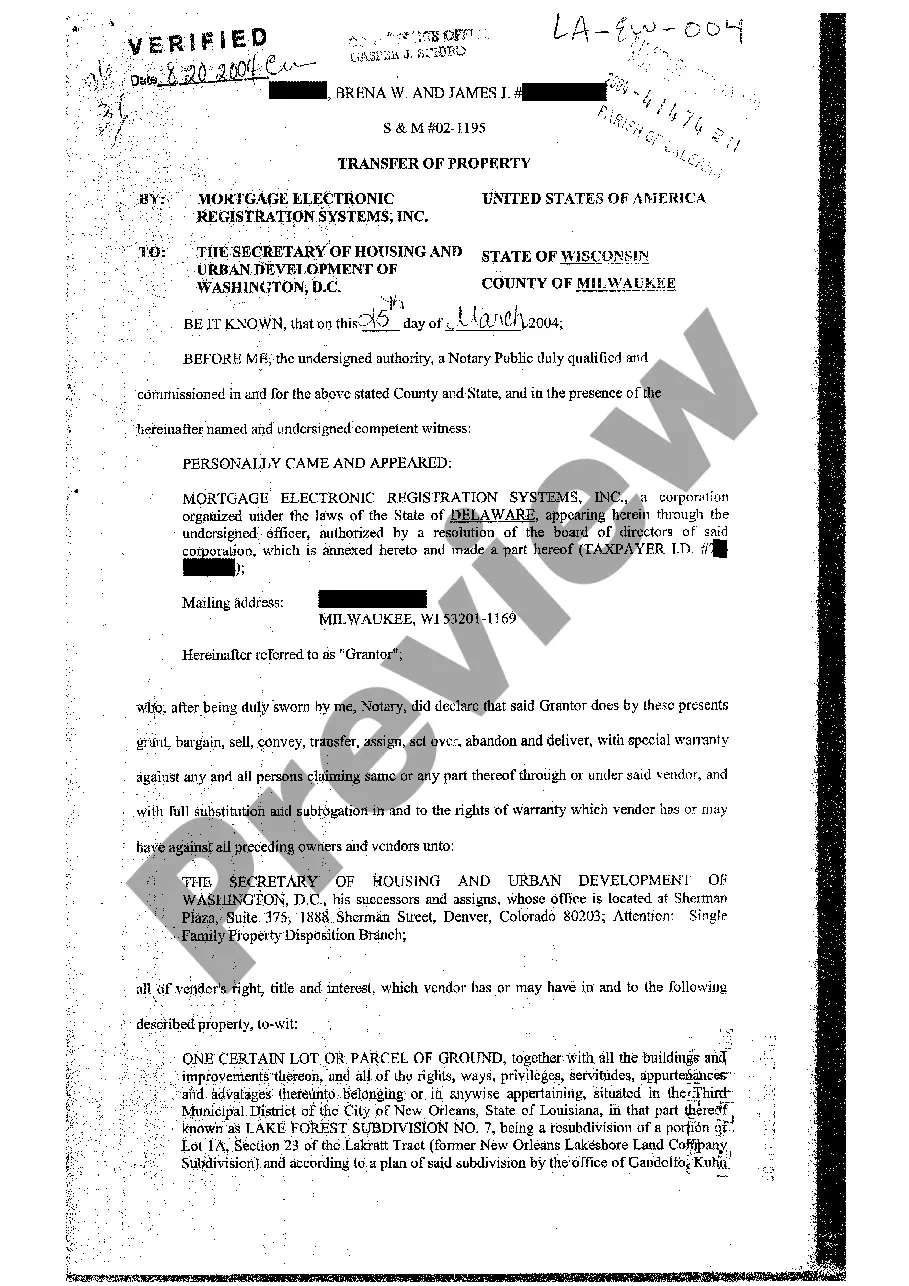

Louisiana Foreclosed Mortgagee Sale to Third Party with Written Contract of Authority to Sell

Description

How to fill out Louisiana Foreclosed Mortgagee Sale To Third Party With Written Contract Of Authority To Sell?

You are invited to the largest legal documents archive, US Legal Forms. Here, you will discover any template including Louisiana Foreclosed Mortgagee Sale to Third Party with Written Contract of Authority to Sell forms and download them (as many as you desire). Prepare official documents within a few hours, rather than days or even weeks, without spending a fortune with a lawyer. Obtain your state-specific form in just a few clicks and rest assured knowing it was created by our state-certified attorneys.

If you’re already a registered customer, simply Log In to your account and click Download next to the Louisiana Foreclosed Mortgagee Sale to Third Party with Written Contract of Authority to Sell you need. Since US Legal Forms is an online solution, you’ll always access your saved forms, regardless of the device you’re using. View them under the My documents section.

If you don't have an account yet, what are you waiting for? Follow our instructions below to get started: If this is a state-specific template, verify its validity in your state. Examine the description (if available) to see if it’s the correct sample. Explore more material with the Preview feature. If the template meets all your requirements, click Buy Now. To create an account, select a pricing plan. Use a credit card or PayPal account to register. Save the template in the desired format (Word or PDF). Print the document and complete it with your or your business’s details. Once you’ve finalized the Louisiana Foreclosed Mortgagee Sale to Third Party with Written Contract of Authority to Sell, forward it to your attorney for verification. It’s an additional step but a crucial one to ensure you’re fully protected. Join US Legal Forms now and gain access to a vast array of reusable templates.

Form popularity

FAQ

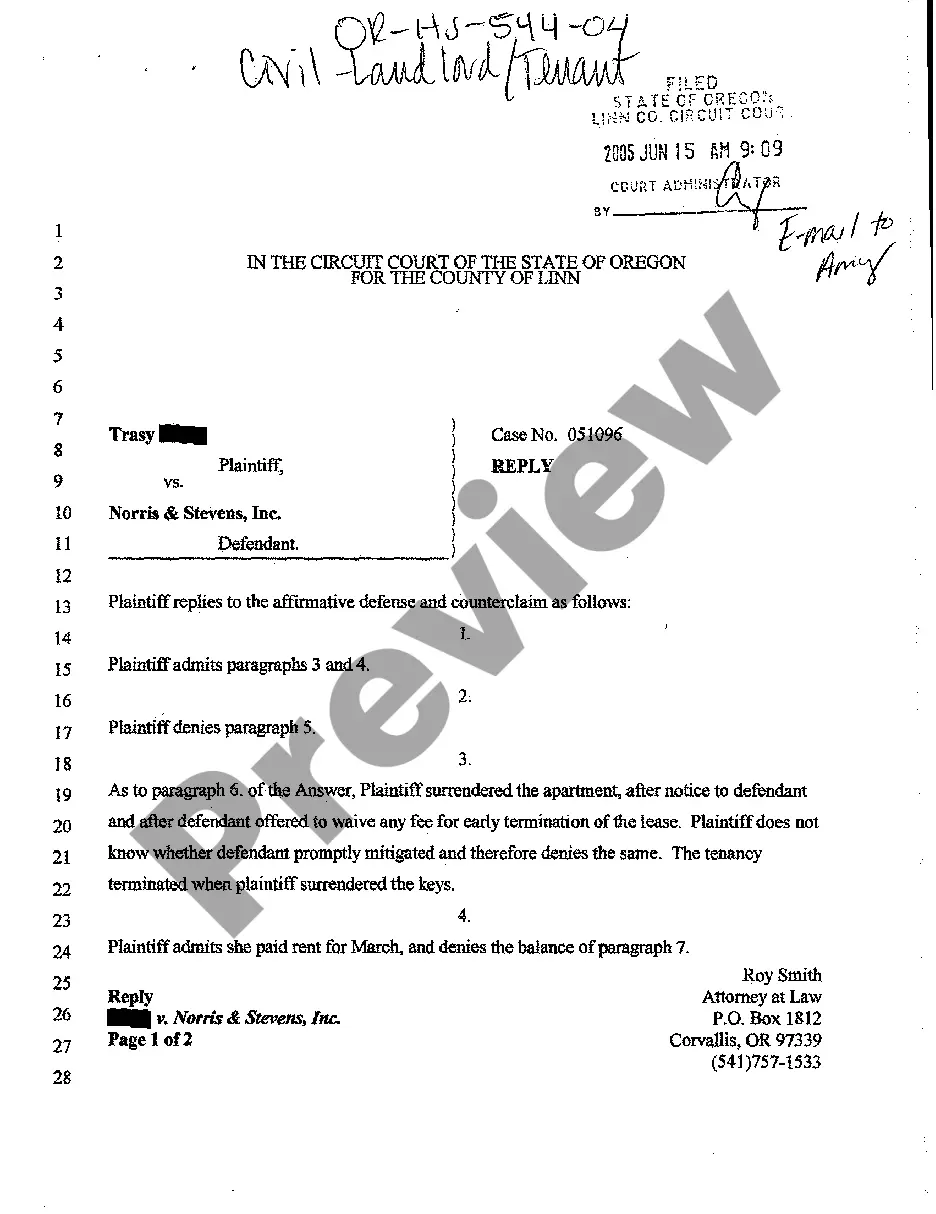

An example of a third party would be the escrow company in a real estate transaction; the escrow party acts as a neutral agent by collecting the documents and money that the buyer and seller exchange when completing the transaction. A collection agency may be another example of a third party.

Third-Party Sale means the sale of any Trust Mortgage Loan or REO Property to a third party purchaser; provided that any sale of a Trust Mortgage Loan or REO Property shall not be a Third-Party Sale if such sale results from an optional or mandatory repurchase of such Trust Mortgage Loan or REO Property by such third-

After the court orders the sale by issuing a writ of seizure and sale, the sheriff can seize (take) the property and sell it to a new owner. The sheriff will serve you the notice of seizurewhich must include the time, date, and place of the sheriff's saleby personal service or domiciliary service.

A third-party mortgage originator is any third-party that works with a lender to originate a mortgage loan.Some third-party mortgage originators facilitate online lending by offering lenders customized technology platforms and applications.

Once your property is sold at auction, you no longer own the property. The sheriff will make you leave your property sometime after the sale. You will likely not receive any notice to vacate and there is no eviction proceeding in court. It is almost impossible to challenge a sheriff's sale after it happens.

The borrower/owner sells the property to a third party during the pre-foreclosure period. The sale allows the borrower/owner to pay off the loan and avoid having a foreclosure on his or her credit history. A third party buys the property at a public auction at the end of the pre-foreclosure period.

Third-party sales are sales conducted by anyone other than the producer. Even when there are four or five parties involved, we refer to all of them as third parties. Third-party sales are often vexing for marketers.

"Third-party review required" means the homeowner has not sought approval yet from his/her lender to do a short sale or approval is pending review of the homeowner's application.Plus there is a risk that the homeowner will not qualify for a short sale in which case the property will need to be sold at a higher price.

If a foreclosure sale results in excess proceeds, the lender doesn't get to keep that money. The lender is entitled to an amount that's sufficient to pay off the outstanding balance of the loan plus the costs associated with the foreclosure and salebut no more.