Louisiana Succession of Decedent, Petition for Authority to Continue Business, Verification of Petition, Certificate of Publication and No Opposition, and Order Authorizing

Description

How to fill out Louisiana Succession Of Decedent, Petition For Authority To Continue Business, Verification Of Petition, Certificate Of Publication And No Opposition, And Order Authorizing?

Welcome to the greatest legal documents library, US Legal Forms. Here you can get any example such as Louisiana Succession of Decedent, Petition for Authority to Continue Business, Verification of Petition, Certificate of Publication and No Opposition, and Order Authorizing forms and download them (as many of them as you want/require). Make official papers within a couple of hours, instead of days or even weeks, without having to spend an arm and a leg on an attorney. Get the state-specific sample in a couple of clicks and be confident with the knowledge that it was drafted by our state-certified attorneys.

If you’re already a subscribed consumer, just log in to your account and then click Download near the Louisiana Succession of Decedent, Petition for Authority to Continue Business, Verification of Petition, Certificate of Publication and No Opposition, and Order Authorizing you want. Due to the fact US Legal Forms is online solution, you’ll always get access to your saved templates, no matter the device you’re utilizing. Locate them within the My Forms tab.

If you don't come with an account yet, just what are you waiting for? Check out our instructions below to start:

- If this is a state-specific form, check its validity in your state.

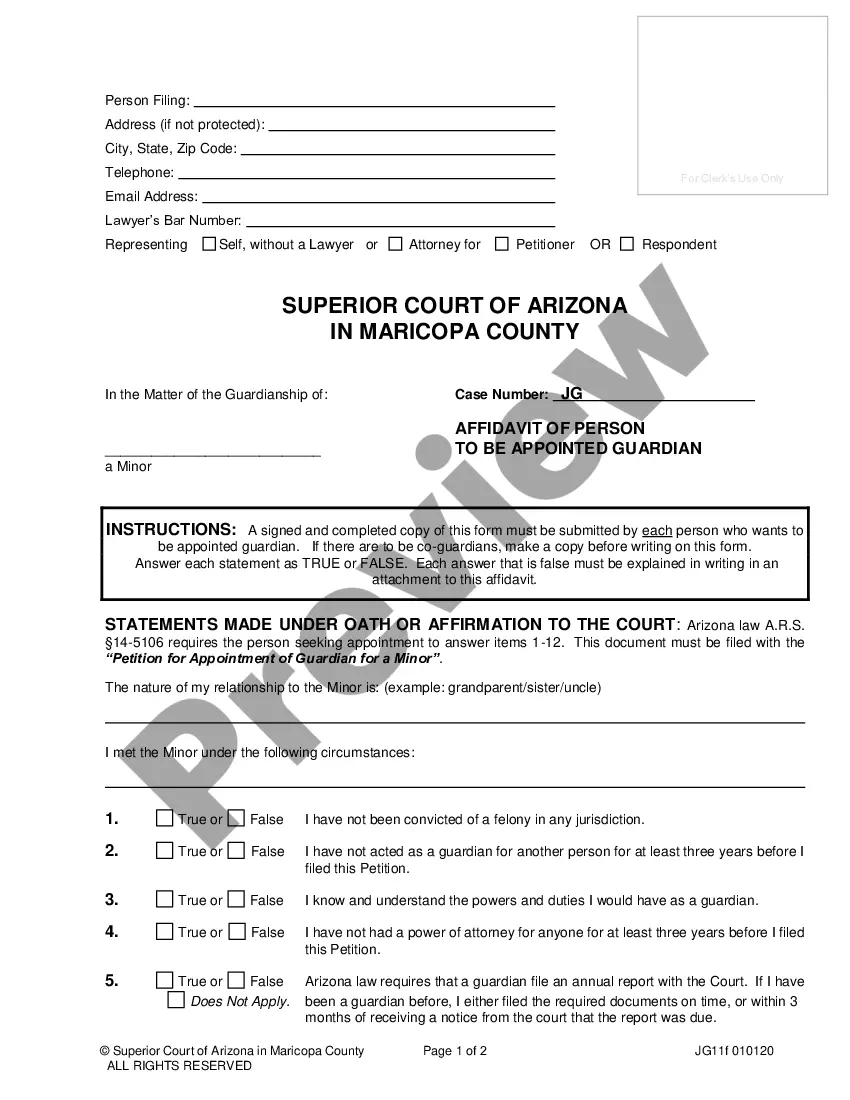

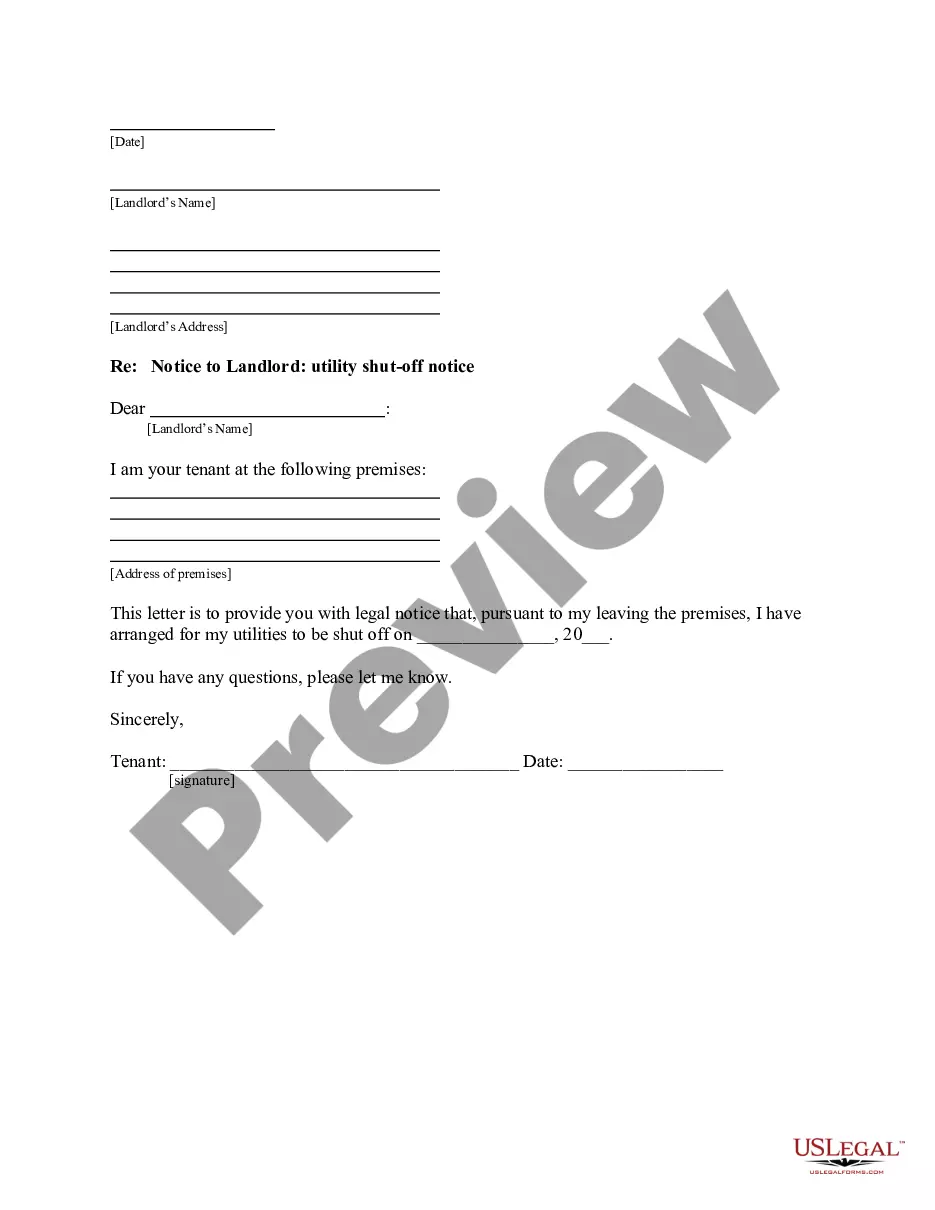

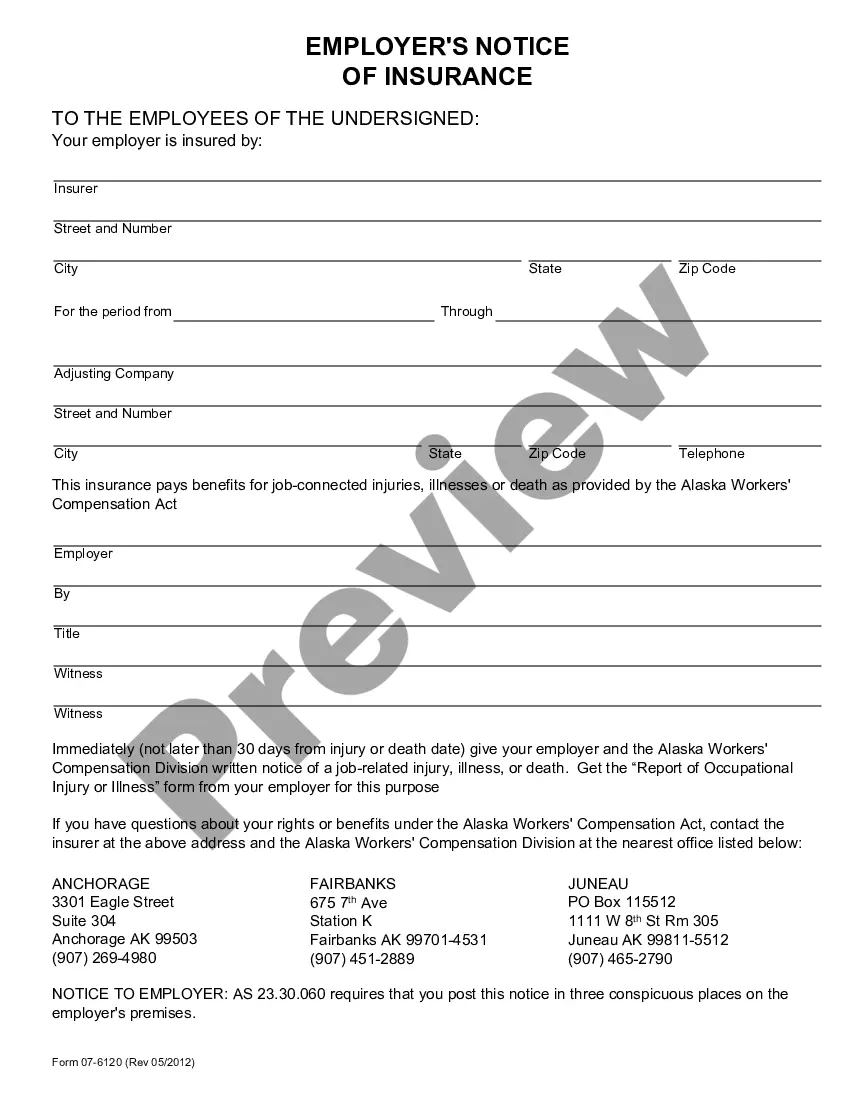

- See the description (if offered) to learn if it’s the proper example.

- See a lot more content with the Preview feature.

- If the sample meets all of your requirements, just click Buy Now.

- To make an account, pick a pricing plan.

- Use a card or PayPal account to sign up.

- Save the file in the format you require (Word or PDF).

- Print out the file and fill it with your/your business’s information.

When you’ve completed the Louisiana Succession of Decedent, Petition for Authority to Continue Business, Verification of Petition, Certificate of Publication and No Opposition, and Order Authorizing, give it to your lawyer for confirmation. It’s an additional step but an essential one for making confident you’re fully covered. Sign up for US Legal Forms now and access a large number of reusable samples.

Form popularity

FAQ

Article 2891 specifically addresses the requirements for obtaining a succession without administration in Louisiana. This law lays out the criteria that must be met for heirs to avoid formal probate proceedings. By being aware of this article, you can efficiently prepare your Order Authorizing the distribution of assets.

Article 2811 of the Louisiana Civil Code outlines the rules regarding the succession of property following an individual's death. It details how property transfers to heirs and the legal steps required to establish ownership. Understanding this article is vital when navigating through the complexities of a Louisiana Succession of Decedent.

Inheritance Laws in Louisiana. Louisiana does not impose any state inheritance or estate taxes. It's also a community property estate, meaning it considers all the assets of a married couple jointly owned.

Court costs for Louisiana successions can range from $250 to $500 depending on parish. If any issues are apparent or litigation is necessary, the cost could easily go higher.

A succession (probate) is required when there is no other method to transfer a deceased person's assets to their heirs.If someone who owns real estate in Louisiana dies while domiciled in another state, a succession will have to be opened to transfer the Louisiana property to the heirs.

If a married person dies without a will, the surviving spouse inherits a usufruct over the deceased spouse's one-half of the community property until the surviving spouse's death or remarriage.

Court costs for Louisiana successions can range from $250 to $500 depending on parish. If any issues are apparent or litigation is necessary, the cost could easily go higher.

In Louisiana, your children are forced heirs if, at the time of your death, they have not attained age 24. Children of any age, who because of mental incapacity or physical infirmity, are permanently incapable of taking care of their person or administering their estate at the time of your death are also forced heirs.

A succession (probate) is required when there is no other method to transfer a deceased person's assets to their heirs.If someone who owns real estate in Louisiana dies while domiciled in another state, a succession will have to be opened to transfer the Louisiana property to the heirs.

If a person dies without a valid Last Will and Testament in Louisiana, he or she is said to have died intestate. His or her estate will be handled by intestate succession. This means that the deceased person's assets will be distributed under Louisiana intestate law.