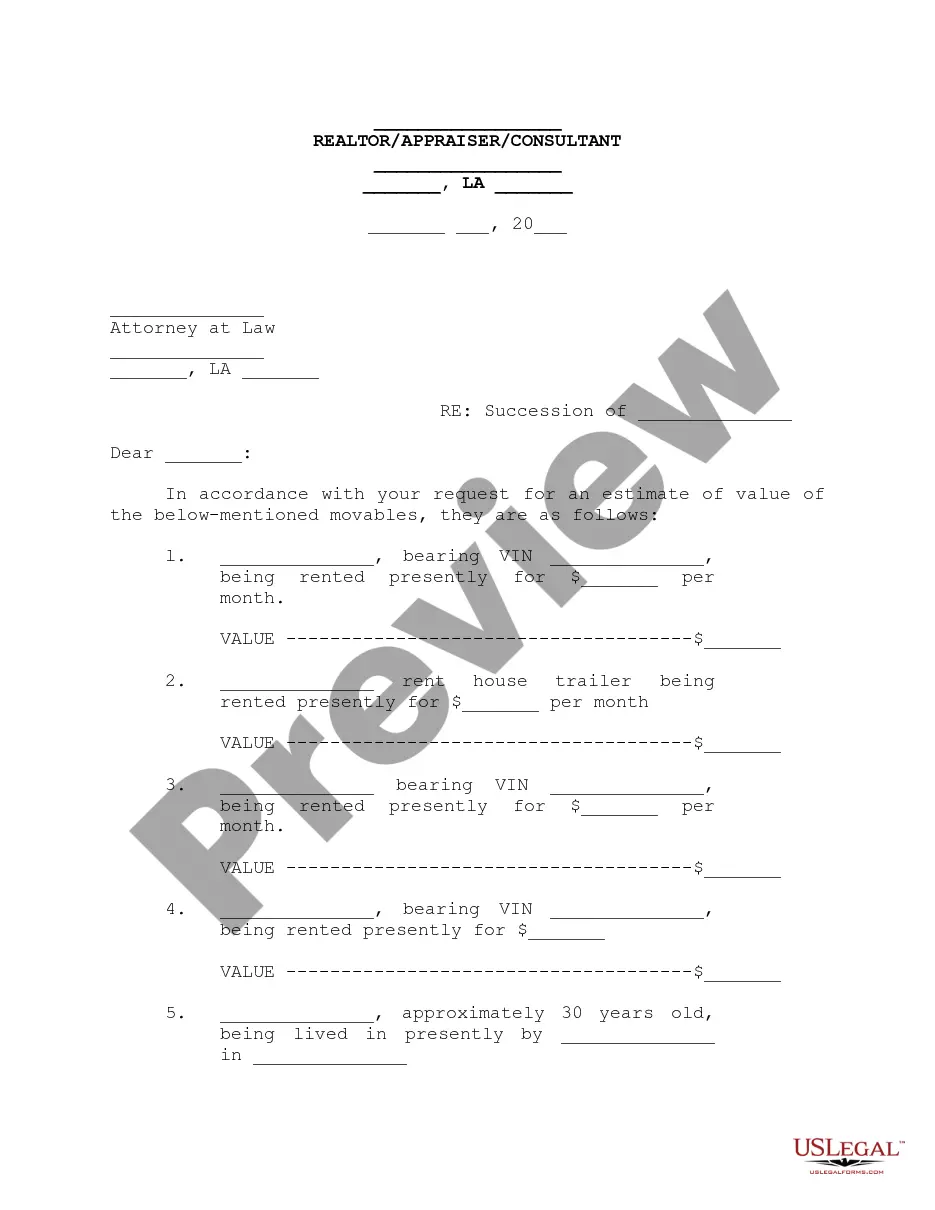

Louisiana Letter Appraisal of Movable Property of Succession

Description

How to fill out Louisiana Letter Appraisal Of Movable Property Of Succession?

Seeking for Louisiana Letter Assessment of Movable Assets of Succession example and completing them might be a difficulty.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the precise example particularly for your state in just a few clicks.

Our legal professionals prepare every document, so you merely need to complete them. It truly is that simple.

Click on the Buy Now button if you discovered what you are looking for. Select your plan on the pricing page and create an account. Choose how you want to pay via a card or by PayPal. Download the form in the preferred file format. You can now print the Louisiana Letter Assessment of Movable Assets of Succession template or fill it out using any online editor. No need to worry about making mistakes since your template can be utilized and submitted, and printed as many times as you like. Try out US Legal Forms and gain access to around 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the document.

- All your downloaded templates are kept in My documents and are available at all times for future use.

- If you haven’t registered yet, you must sign up.

- Examine our comprehensive guidelines on how to acquire your Louisiana Letter Appraisal of Movable Property of Succession template in a few minutes.

- To obtain a qualified example, review its relevance for your state.

- Review the sample using the Preview feature (if it’s accessible).

- If there is an explanation, read through it to understand the details.

Form popularity

FAQ

Inheritance Laws in Louisiana. Louisiana does not impose any state inheritance or estate taxes. It's also a community property estate, meaning it considers all the assets of a married couple jointly owned.

Court costs for Louisiana successions can range from $250 to $500 depending on parish. If any issues are apparent or litigation is necessary, the cost could easily go higher.

A succession is required regardless if someone dies testate (with a will) or intestate (without a will), unless all of the assets can be transferred by other methods. The typical method to avoid probate for non-beneficiary designated assets is by establishing a revocable trust (aka living trust).

The executor can sell property without getting all of the beneficiaries to approve.Once the executor is named there is a person appointed, called a probate referee, who will appraise the estate assets. Among those assets will be the real estate and the probate referee will appraise the real estate.

A succession (probate) is required when there is no other method to transfer a deceased person's assets to their heirs.If someone who owns real estate in Louisiana dies while domiciled in another state, a succession will have to be opened to transfer the Louisiana property to the heirs.

In Louisiana, your children are forced heirs if, at the time of your death, they have not attained age 24. Children of any age, who because of mental incapacity or physical infirmity, are permanently incapable of taking care of their person or administering their estate at the time of your death are also forced heirs.

Technically, there is no time limit on opening a succession in Louisiana. It can be done months or even years after a person's death. However, it's recommended that the probate process be started soon as possible.