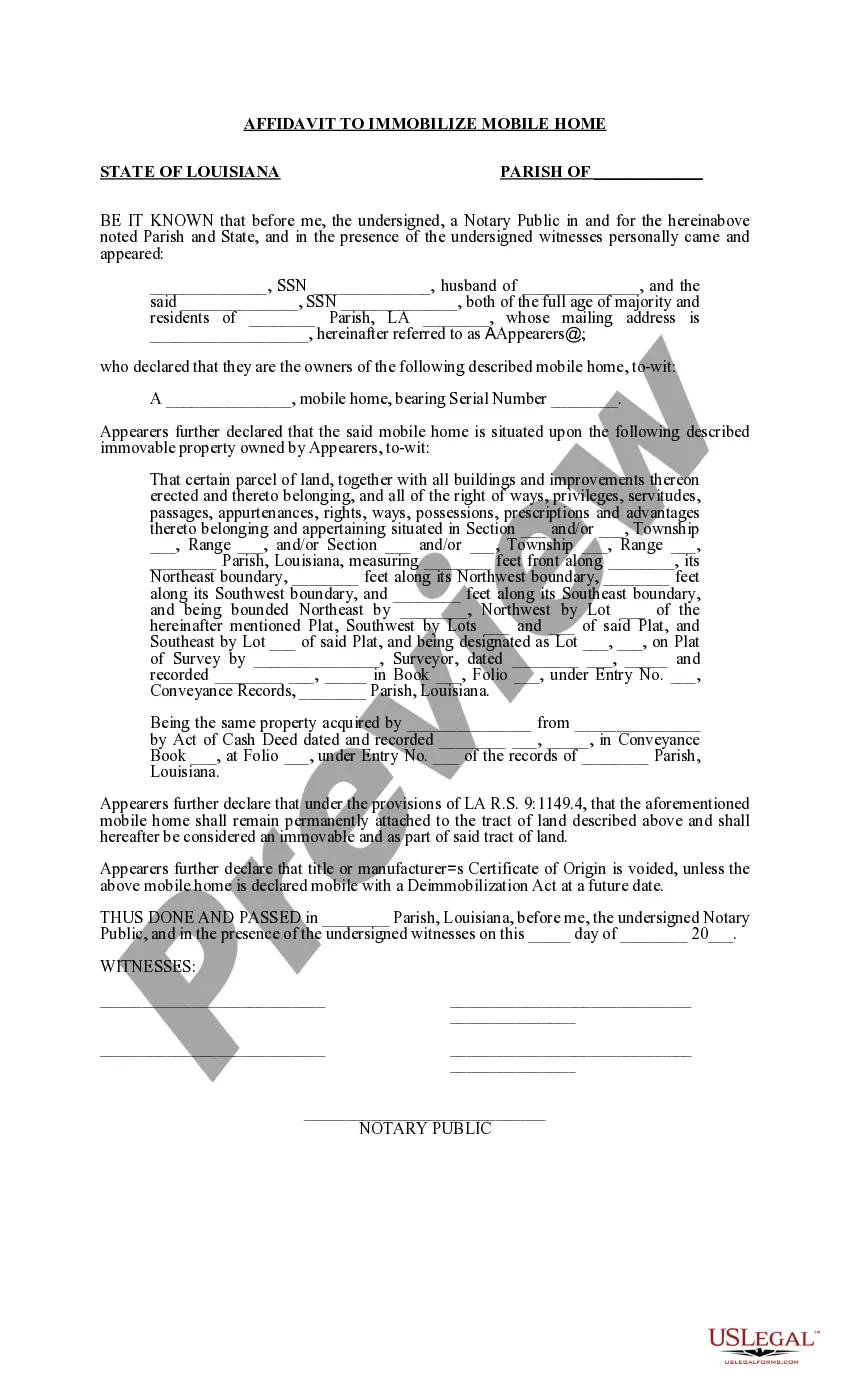

Louisiana Affidavit to Immobilize Mobile Home

Description

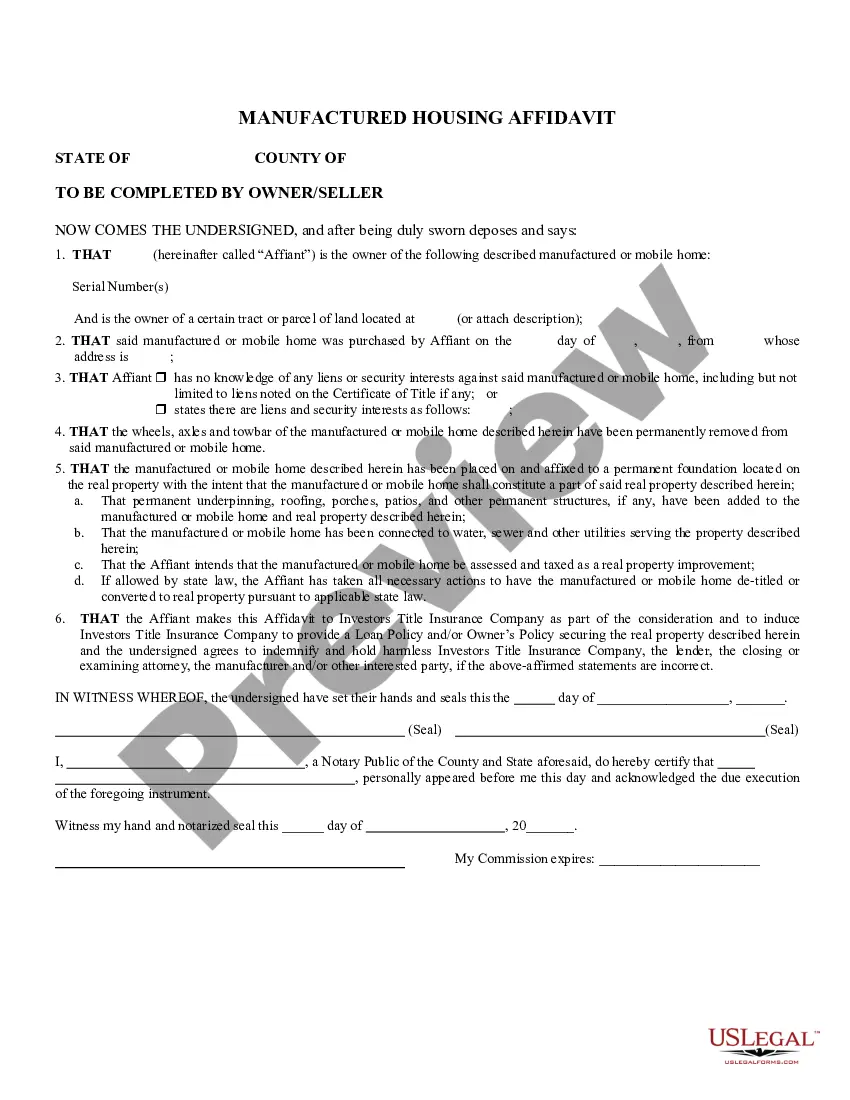

How to fill out Louisiana Affidavit To Immobilize Mobile Home?

Searching for a Louisiana Affidavit to Immobilize Mobile Home example and completing it can be a significant hurdle.

To conserve time, money, and effort, utilize US Legal Forms to locate the appropriate template specifically designed for your state in just a few clicks.

Our attorneys prepare every document, so you only need to complete them. It's truly that straightforward.

Choose your plan on the pricing page and create your account. Decide whether you want to pay by credit card or via PayPal. Save the document in your desired format. You can print the Louisiana Affidavit to Immobilize Mobile Home template or fill it out using any online editor. There's no need to stress about making errors because your template can be utilized and submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log into your account and navigate back to the form's page to save the sample.

- All your downloaded samples are stored in My documents and accessible at any time for future use.

- If you haven't registered yet, you need to sign up.

- Review our detailed instructions on how to obtain your Louisiana Affidavit to Immobilize Mobile Home template in a matter of minutes.

- To retrieve an authorized sample, verify its relevance to your state.

- Examine the sample using the Preview feature (if available).

- If there’s a description, read it to understand the details.

- Click Buy Now if you located what you're seeking.

Form popularity

FAQ

A signed bill of sale provides important legal protections to the buyer and even to the seller. For the buyer, the bill of sale proves that a transaction took place. This information is extremely important if something serious is wrong with the vehicle that the seller knew about but failed to notify the buyer of.

Find the value of your mobile home And, that's how you use the NADA mobile home blue book to get the value of your mobile home.

Alabama. Arkansas. Colorado. Connecticut. Hawaii. Idaho. Maine. Nebraska.

Can a Bill of Sale Be Handwritten? A bill of sale is a legal document that verifies you have sold your car and provides basic information about the vehicle or any other item and the terms of the sale.As, with any legal written document a bill of sale can be handwritten.

License plate number. Expiration date (as shown on vehicle's registration) Vehicle identification number. Driver's license number or company EIN (as shown on vehicle's registration) Name and address of buyer.

Although a Louisiana bill of sale isn't always required, it's an important document to have because it proves that the vehicle was sold. The registration process is completed through the Office of Motor Vehicles.

Purchase Price ($); Buyer's name and Mailing Address; Seller's name and Mailing Address; Trailer Details; Make; Model; Year; 17 character VIN; and. Date of sale; Witness's signature, name in print and date; and. Notary Acknowledgement (if applicable).

Louisiana. Maryland. Nebraska. New Hampshire. West Virginia. Montana.

Sales of immovable property are not subject to Louisiana sales and use tax. A dealer is allowed an exemption for the purchase of manufactured homes for resale as tangible personal property. The Department of Revenue issues Form R-1018, Sales Tax Exemption for Mobile Home Dealers, for this purpose.