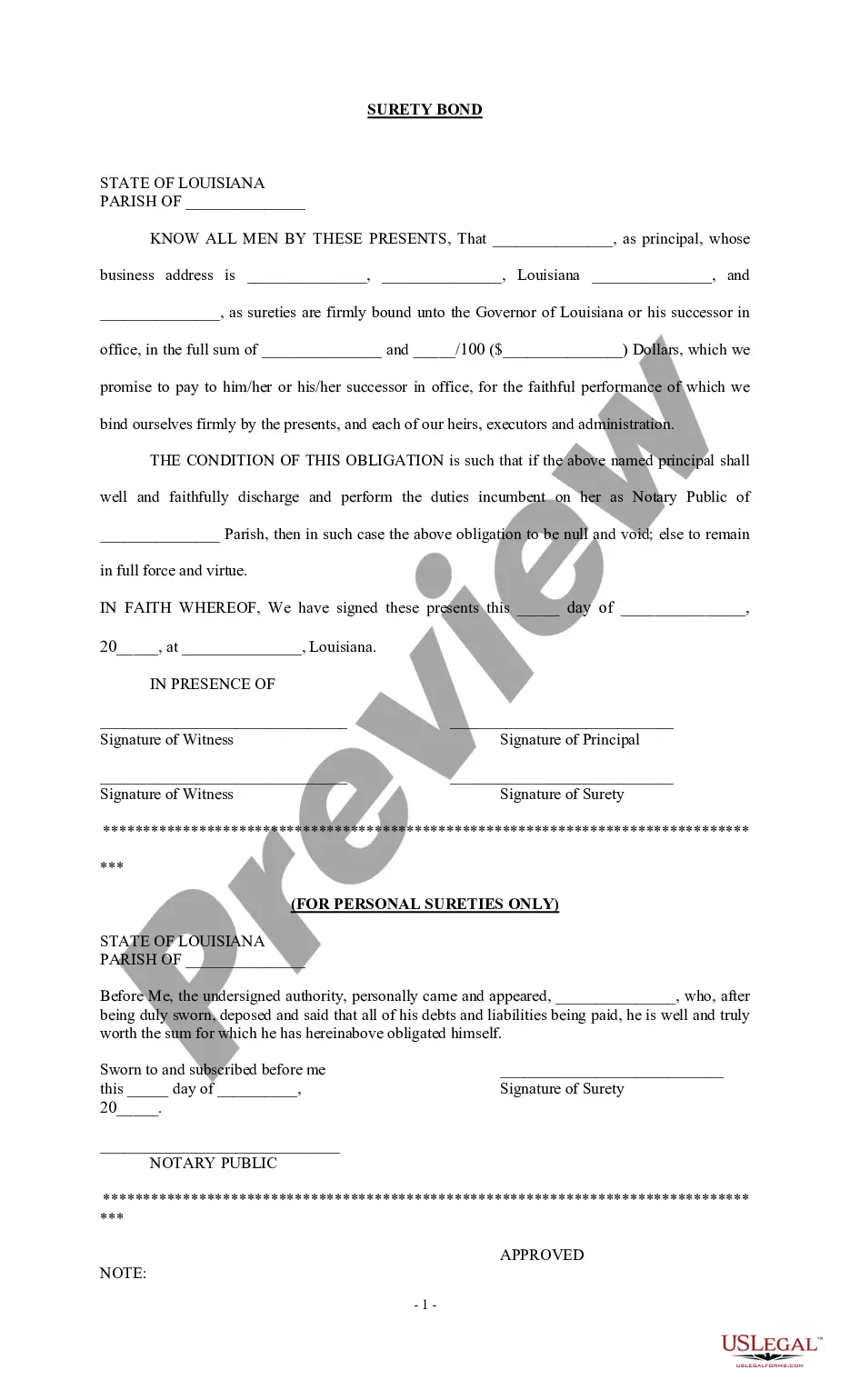

Louisiana Surety Bond

About this form

A Surety Bond is a legal document that guarantees a party will fulfill its obligations to another party. In simple terms, it involves three parties: the principal, who undertakes an obligation; the obligee, who is protected; and the surety, who assures the obligee that the principal will meet their commitments. This form differs from other agreements because it includes a guarantee from a surety, who becomes liable if the principal defaults on their obligations. Surety bonds are commonly required for professionals, such as notaries public, to ensure they perform their duties faithfully.

Key components of this form

- Principal's name and business address

- Sureties' names and signatures

- Amount of the bond in dollars

- Specific duties of the principal

- Conditions under which the obligation is void

- Witness signatures

- Notary acknowledgment

When to use this document

This Surety Bond form is necessary when a professional, such as a notary public or other licensed individuals, is required to guarantee their performance of duties. It is typically used when applying for a license or permit, where the governing authority requires assurance that the principal will fulfill their responsibilities and adhere to relevant regulations.

Who can use this document

This form is intended for individuals or businesses that are:

- Notaries public in Louisiana

- Contractors or service providers needing to guarantee compliance with contractual obligations

- Businesses seeking permits that require a surety bond

Completing this form step by step

- Identify the principal and ensure all business addresses are complete.

- Enter the names of the sureties who will be signing the bond.

- Specify the total amount of the bond in both numeric and written form.

- Include the specific duties that the principal must perform.

- Have all parties sign the form in the presence of witnesses.

- Ensure the form is notarized for legal validity.

Does this document require notarization?

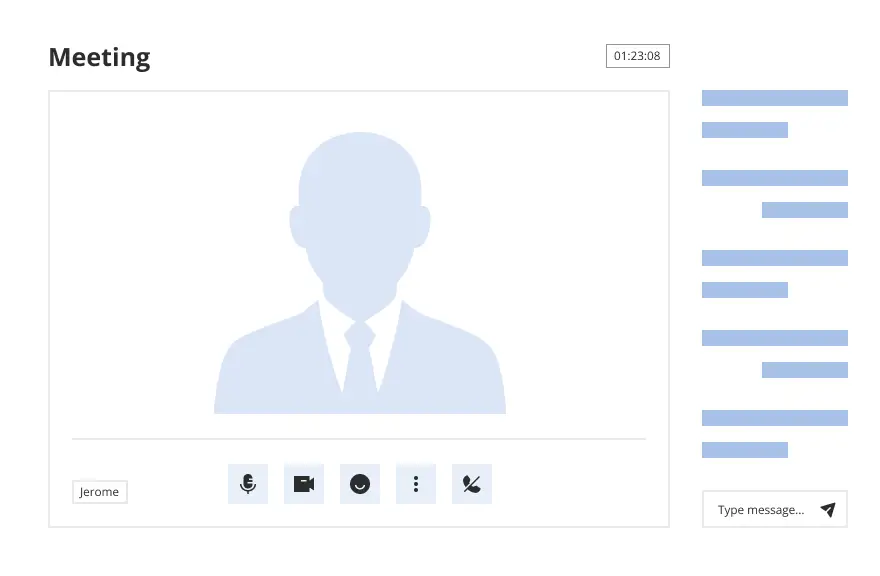

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

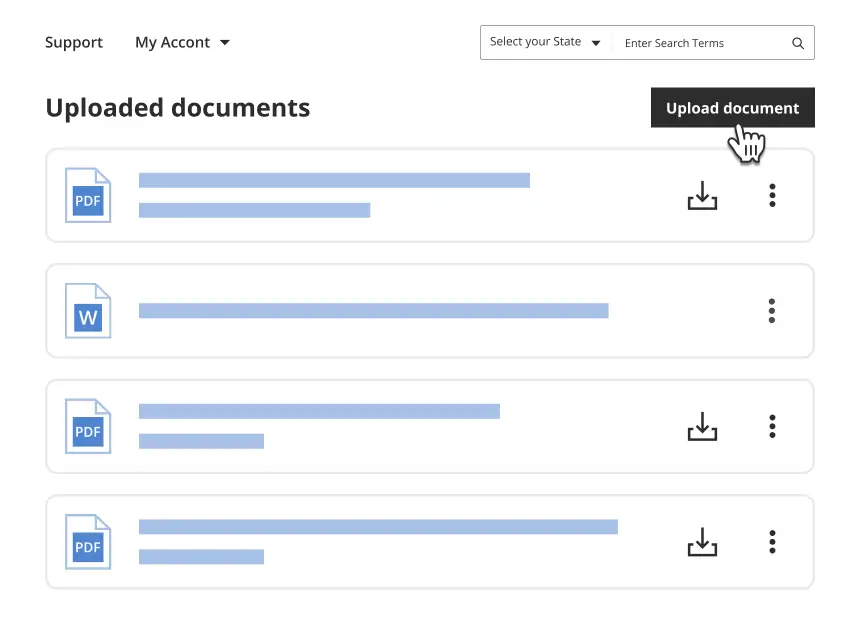

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all required signatures and witness information.

- Entering an incorrect bond amount.

- Not specifying the exact duties of the principal.

- Neglecting to notarize the form, if required.

Why use this form online

- Convenient access to legal documents anytime and anywhere.

- Editable templates that allow customization for specific requirements.

- Increased reliability with professionally drafted forms by licensed attorneys.

Summary of main points

- A Surety Bond ensures a party's obligations are met, providing legal protection.

- Complete all sections accurately to avoid any issues or delays.

- Notarization is typically required for this bond to be enforceable.

Looking for another form?

Form popularity

FAQ

A $50,000 surety bond is a legal agreement that ensures a party will fulfill their obligations. Essentially, it's a three-party deal among the principal, the surety, and the obligee. In the context of a Louisiana Surety Bond, it provides financial assurance that the bondholder will comply with local laws and regulations. Understanding this bond is crucial for anyone looking to engage in certain business activities or licenses in Louisiana.

Name of the lender and the borrower. Address of the lender and the borrower. The amount being lent/borrowed. The purpose for which the amount is being borrowed. The time period for which the amount is being lent. The interest to be levied on the amount.

Your Louisiana Notary Surety Bond. Louisiana law requires all Notaries to purchase and maintain a $10,000 Notary surety bond or errors & omissions insurance (E&O) every five years. The Notary bond protects the general public of Louisiana against any financial loss due to improper conduct by an Louisiana Notary.

How long will it take to get my bond? In most instances, surety experts can issue a bond within 24 hours of the initial application. The turnaround time can take longer for riskier bonds that require more complicated underwriting processes, such as contract bonds for construction projects.

Examples of these bonds include construction and environmental performance, payment, supply, maintenance, and warranty bonds. Commercial surety helps obtain capacity at the lowest cost for all corporate surety needs.International surety examines the unique surety requirements internationally.

Examples of these bonds include construction and environmental performance, payment, supply, maintenance, and warranty bonds. Commercial surety helps obtain capacity at the lowest cost for all corporate surety needs.International surety examines the unique surety requirements internationally.

Write the name of the obligor, or project owner, on the line preceded or followed by are held and firmly bonded to. Write the amount of money at issue in the bond on the line designated for the bond amount. Sign the bond in the presence of a notary public and have the bond notarized.

A surety bond application is a form required by the surety carrier. It provides the basic information needed about the bond and the principal for the approval process. It also often serves as the legal contract between the surety carrier and the principal.

Gather the information required to apply for your surety bond. Common necessary details include your business name and address, license number (if you are renewing your bond), and ownership information.