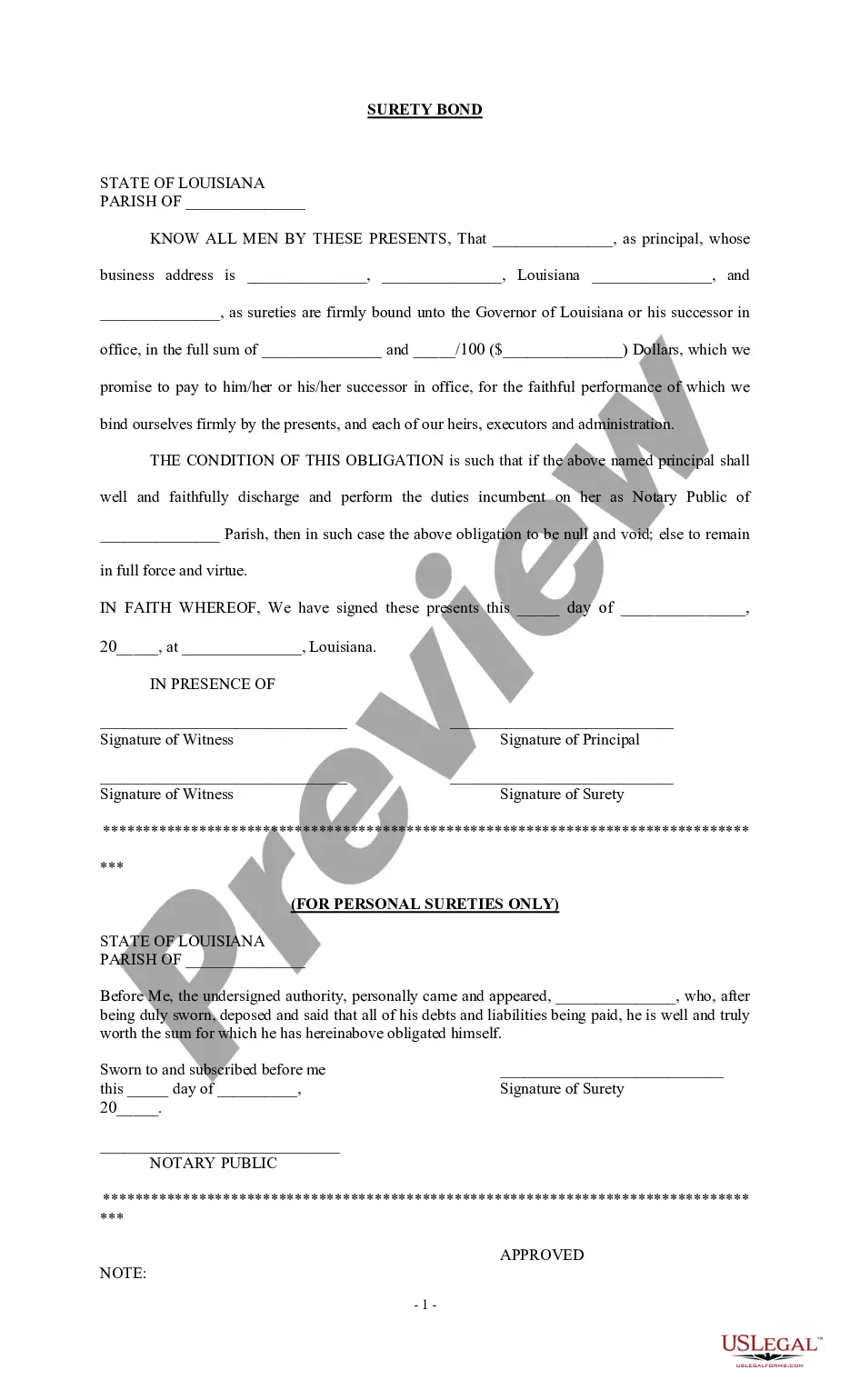

Louisiana Surety Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Surety Bond?

Searching for Louisiana Surety Bond documents and completing them may pose a challenge.

To conserve significant time, expenses, and effort, utilize US Legal Forms to discover the appropriate template specifically tailored for your state in just a few clicks.

Our attorneys prepare all paperwork, so you simply need to complete them. It is genuinely that straightforward.

You can print the Louisiana Surety Bond template or complete it using any online editor. No need to stress about typos since your form can be utilized and submitted, and printed as frequently as you desire. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log into your account and revisit the form's page to save the template.

- All your downloaded samples are stored in My documents and are accessible at any time for future use.

- If you haven’t registered yet, you must sign up.

- Review our comprehensive guidance on how to acquire your Louisiana Surety Bond template within minutes.

- To obtain an authorized template, verify its applicability for your state.

- Examine the template using the Preview feature (if available).

- If there’s a description, read it to understand the key aspects.

- Click on the Buy Now button if you have found what you are seeking.

Form popularity

FAQ

A $50,000 surety bond is a legal agreement that ensures a party will fulfill their obligations. Essentially, it's a three-party deal among the principal, the surety, and the obligee. In the context of a Louisiana Surety Bond, it provides financial assurance that the bondholder will comply with local laws and regulations. Understanding this bond is crucial for anyone looking to engage in certain business activities or licenses in Louisiana.

Name of the lender and the borrower. Address of the lender and the borrower. The amount being lent/borrowed. The purpose for which the amount is being borrowed. The time period for which the amount is being lent. The interest to be levied on the amount.

Your Louisiana Notary Surety Bond. Louisiana law requires all Notaries to purchase and maintain a $10,000 Notary surety bond or errors & omissions insurance (E&O) every five years. The Notary bond protects the general public of Louisiana against any financial loss due to improper conduct by an Louisiana Notary.

How long will it take to get my bond? In most instances, surety experts can issue a bond within 24 hours of the initial application. The turnaround time can take longer for riskier bonds that require more complicated underwriting processes, such as contract bonds for construction projects.

Examples of these bonds include construction and environmental performance, payment, supply, maintenance, and warranty bonds. Commercial surety helps obtain capacity at the lowest cost for all corporate surety needs.International surety examines the unique surety requirements internationally.

Examples of these bonds include construction and environmental performance, payment, supply, maintenance, and warranty bonds. Commercial surety helps obtain capacity at the lowest cost for all corporate surety needs.International surety examines the unique surety requirements internationally.

Write the name of the obligor, or project owner, on the line preceded or followed by are held and firmly bonded to. Write the amount of money at issue in the bond on the line designated for the bond amount. Sign the bond in the presence of a notary public and have the bond notarized.

A surety bond application is a form required by the surety carrier. It provides the basic information needed about the bond and the principal for the approval process. It also often serves as the legal contract between the surety carrier and the principal.

Gather the information required to apply for your surety bond. Common necessary details include your business name and address, license number (if you are renewing your bond), and ownership information.