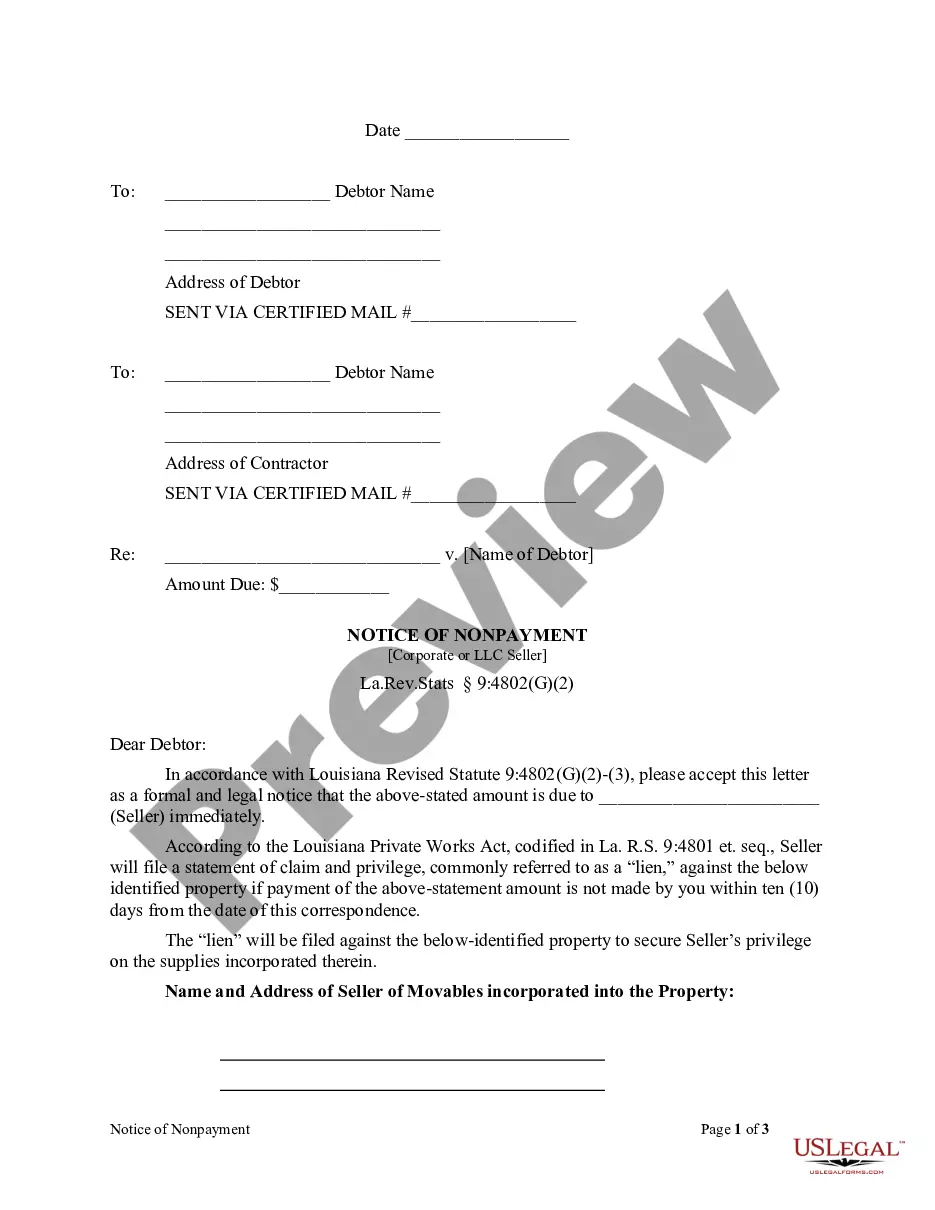

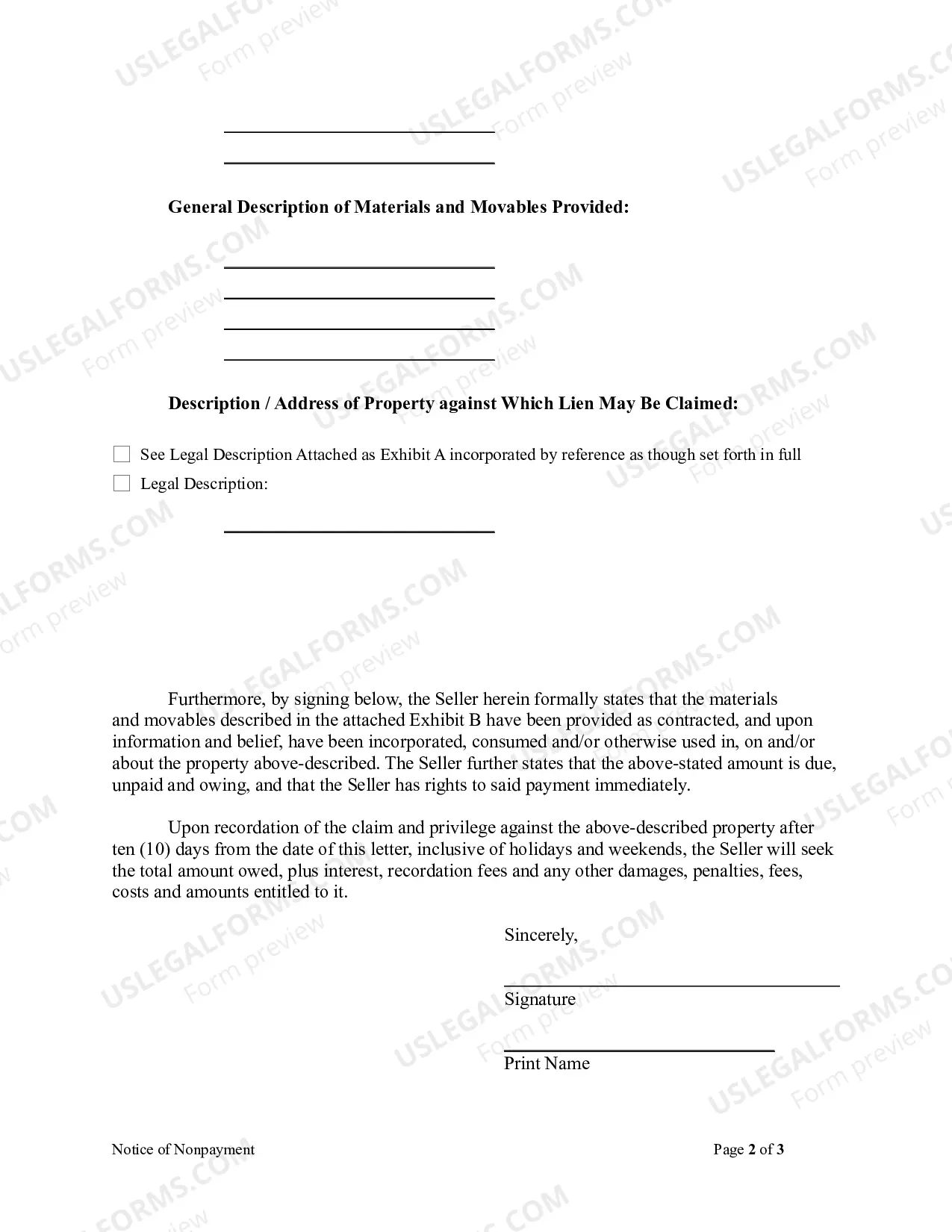

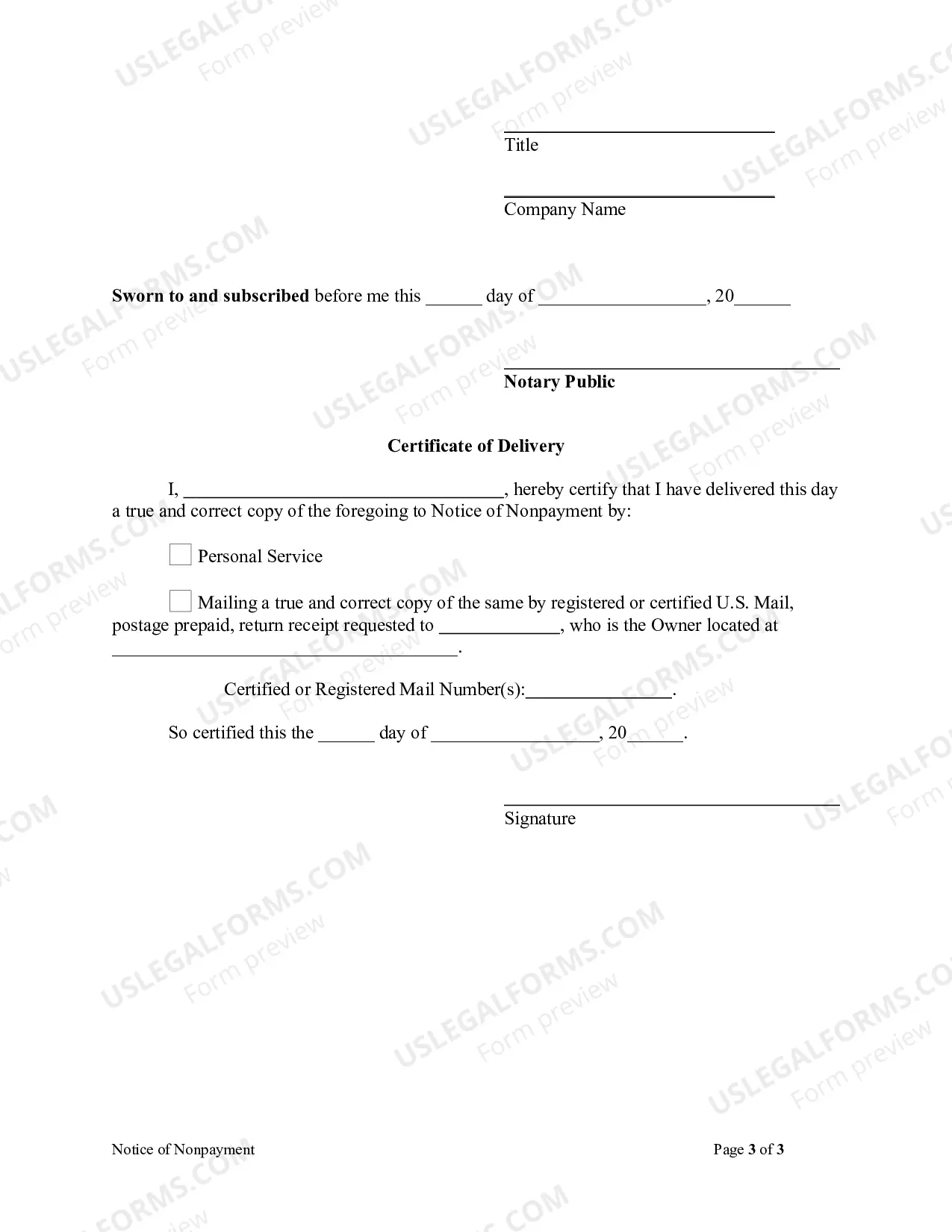

This Notice of Non-Payment (Seller of Movables) form is for use by a corporation or LLC in accordance with Louisiana Revised Statute 9:4802(G)(2)-(3) to provide notice that a specific amount of money is immediately due to the seller of movables. This notice states that the seller will file a statement of claim and privilege against the identified property if payment of the statement amount is not made within ten days from the date of the notice. The notice includes the name and address of the seller of movables incorporated into the property, the general description of materials and movables provided, and the description/address of the property against which the lien may be claimed.

Louisiana Notice of NonPayment (Seller of Movables) - Corporation or LLC

Description

How to fill out Louisiana Notice Of NonPayment (Seller Of Movables) - Corporation Or LLC?

Searching for Louisiana Notice of NonPayment (Seller of Movables) - Corporation or LLC forms and completing them can be quite a problem. To save time, costs and effort, use US Legal Forms and find the correct example specifically for your state in a couple of clicks. Our legal professionals draw up all documents, so you just need to fill them out. It really is so easy.

Log in to your account and return to the form's web page and download the document. All of your downloaded templates are kept in My Forms and are available at all times for further use later. If you haven’t subscribed yet, you have to sign up.

Check out our detailed instructions concerning how to get your Louisiana Notice of NonPayment (Seller of Movables) - Corporation or LLC template in a couple of minutes:

- To get an qualified example, check out its validity for your state.

- Look at the example using the Preview function (if it’s available).

- If there's a description, read it to learn the details.

- Click on Buy Now button if you identified what you're searching for.

- Select your plan on the pricing page and create your account.

- Pick how you wish to pay out with a card or by PayPal.

- Download the form in the preferred format.

You can print the Louisiana Notice of NonPayment (Seller of Movables) - Corporation or LLC template or fill it out making use of any online editor. Don’t concern yourself with making typos because your sample can be utilized and sent, and printed as many times as you wish. Try out US Legal Forms and access to above 85,000 state-specific legal and tax files.

Form popularity

FAQ

If the Notice of Contract is filed, a contractor has 60 days from the filing of a Notice of Acceptance to file a Louisiana mechanics lien. If no Notice of Contract has been filed, a contractor has 60 days from completion on the project to file a Louisiana mechanics lien if the contract amount is less than $25,000.

With the judgment in hand, a judgment creditor can place a judgment lien on your real estate and occasionally on personal property depending on the state in which you live.

Subject to some exceptions, a lien for materials, services, or wages may be registered any time up to 45 days from the day the last materials, services, or wages were provided, or since the contract was abandoned. After those 45 days elapse, the lien expires.

Complete the Louisiana Statement of Claim and Privilege form. Record the claim form with the recorder of mortgages office in the parish where the property is located. Serve notice of the lien claim to the property owner.

A judgment lien in Louisiana will remain attached to the debtor's property (even if the property changes hands) for ten years.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

A lien on property is a common way for contractors to make sure they get paid. Legally, an unpaid contractor, subcontractor or supplier can file a lien (sometimes called a mechanic's lien) that could eventually force the sale of your home in place of compensation.

If the contractor defaults or otherwise doesn't take care of your wages, you can file a claim with the surety company to get at least part of your money. The surety company then takes the contractor to court to recover the amount.

2. States where the lien law doesn't require a written contract. In these states, contractors and suppliers are generally allowed to file a lien even if they don't have a written contract.These states typically permit parties with verbal, oral, or even implied contracts to claim lien rights.