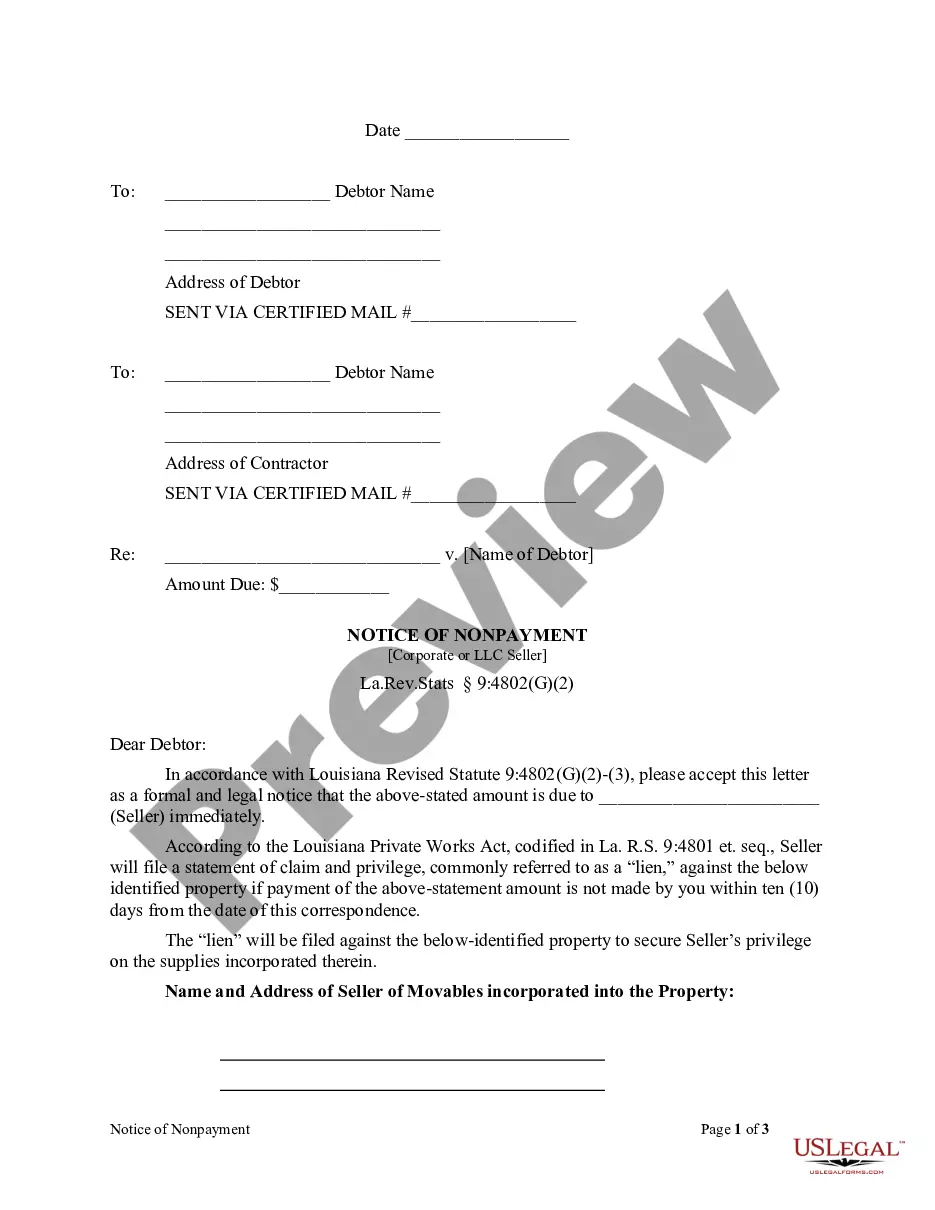

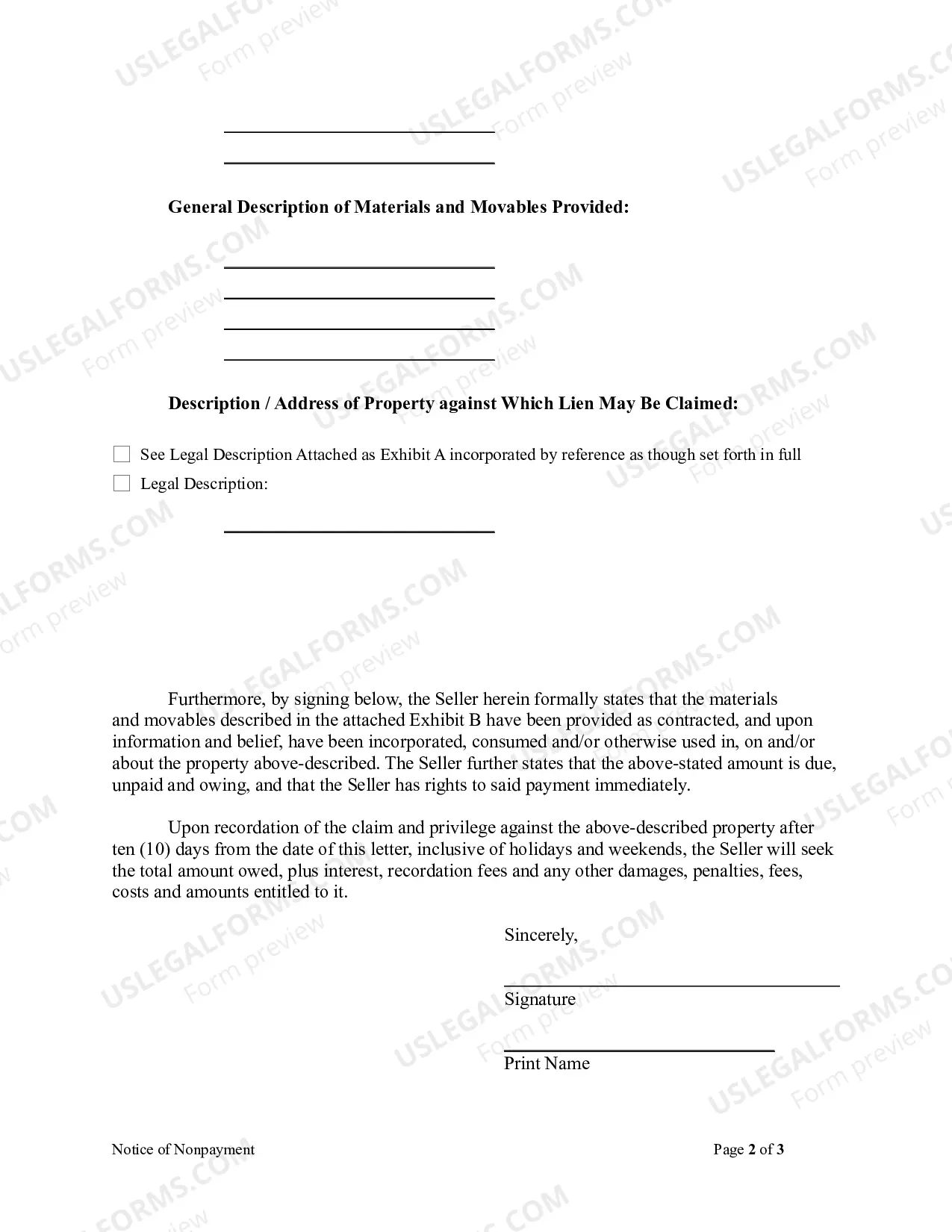

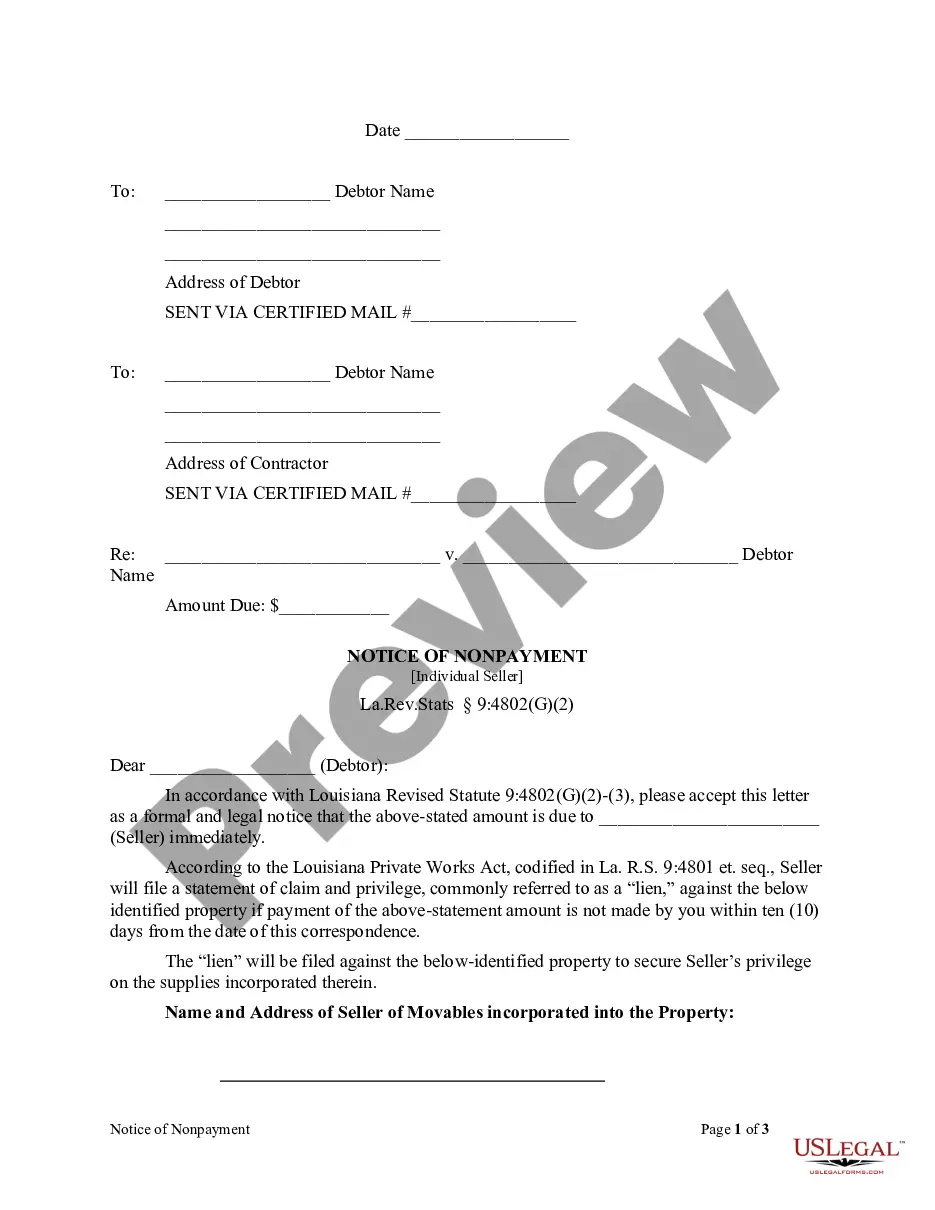

This Notice of Non-Payment (Seller of Movables) form is for use by a corporation or LLC in accordance with Louisiana Revised Statute 9:4802(G)(2)-(3) to provide notice that a specific amount of money is immediately due to the seller of movables. This notice states that the seller will file a statement of claim and privilege against the identified property if payment of the statement amount is not made within ten days from the date of the notice. The notice includes the name and address of the seller of movables incorporated into the property, the general description of materials and movables provided, and the description/address of the property against which the lien may be claimed.

Louisiana Notice of NonPayment (Seller of Movables) - Corporation or LLC

Description

How to fill out Louisiana Notice Of NonPayment (Seller Of Movables) - Corporation Or LLC?

Locating Louisiana Notice of NonPayment (Seller of Movables) - Corporation or LLC documents and completing them may be quite challenging.

To conserve time, expenses, and energy, utilize US Legal Forms to discover the appropriate template specifically for your state within a few clicks.

Our legal experts prepare all paperwork, so you merely have to complete them. It is truly that simple.

Choose your plan on the pricing page and set up your account. Opt for your payment method using a credit card or PayPal. Download the form in your preferred format. You can print the Louisiana Notice of NonPayment (Seller of Movables) - Corporation or LLC template or fill it out using any online editor. Don’t worry about making errors since your sample can be used and submitted, and printed as many times as you desire. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's web page to download the document.

- All your downloaded templates are stored in My documents and are accessible at any time for future use.

- If you haven’t registered yet, you need to sign up.

- Refer to our comprehensive instructions on how to acquire your Louisiana Notice of NonPayment (Seller of Movables) - Corporation or LLC template in just a few minutes.

- To obtain a valid example, verify its suitability for your state.

- Examine the example using the Preview feature (if available).

- If there's a description, review it to understand the particulars.

- Click the Buy Now button if you found what you're looking for.

Form popularity

FAQ

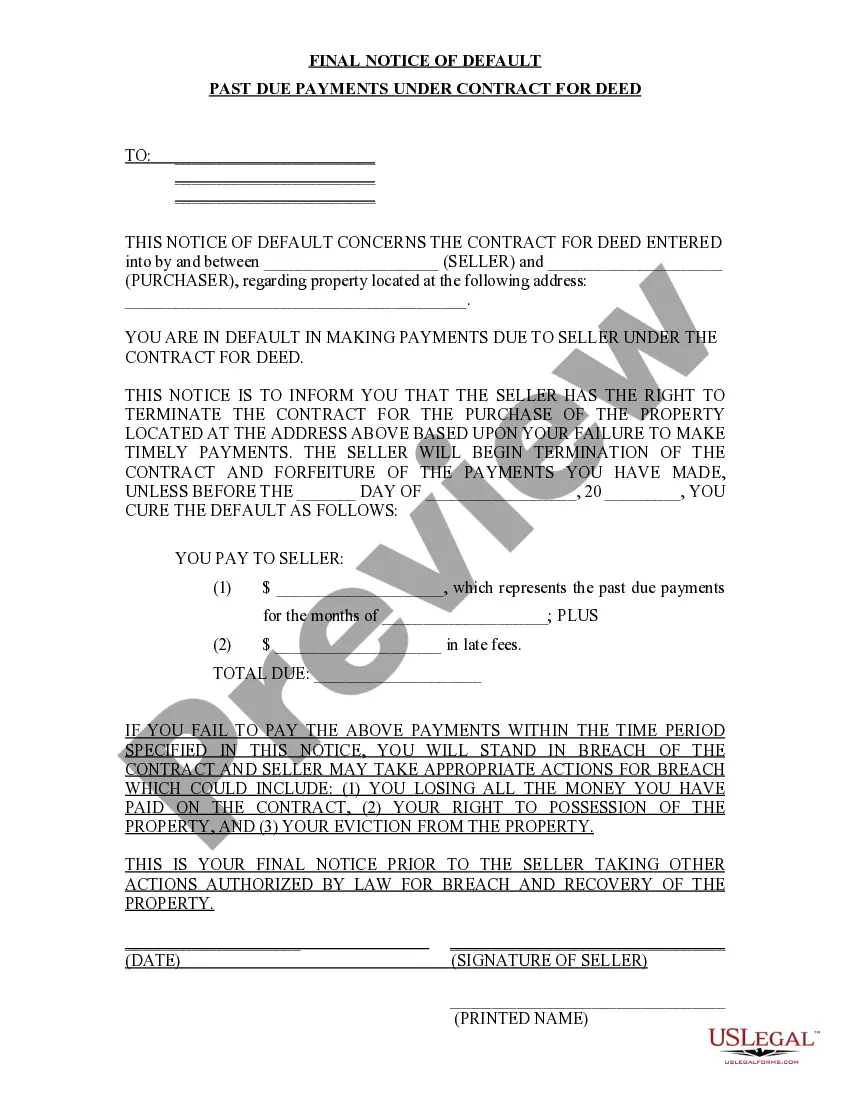

If the Notice of Contract is filed, a contractor has 60 days from the filing of a Notice of Acceptance to file a Louisiana mechanics lien. If no Notice of Contract has been filed, a contractor has 60 days from completion on the project to file a Louisiana mechanics lien if the contract amount is less than $25,000.

With the judgment in hand, a judgment creditor can place a judgment lien on your real estate and occasionally on personal property depending on the state in which you live.

Subject to some exceptions, a lien for materials, services, or wages may be registered any time up to 45 days from the day the last materials, services, or wages were provided, or since the contract was abandoned. After those 45 days elapse, the lien expires.

Complete the Louisiana Statement of Claim and Privilege form. Record the claim form with the recorder of mortgages office in the parish where the property is located. Serve notice of the lien claim to the property owner.

A judgment lien in Louisiana will remain attached to the debtor's property (even if the property changes hands) for ten years.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

A lien on property is a common way for contractors to make sure they get paid. Legally, an unpaid contractor, subcontractor or supplier can file a lien (sometimes called a mechanic's lien) that could eventually force the sale of your home in place of compensation.

If the contractor defaults or otherwise doesn't take care of your wages, you can file a claim with the surety company to get at least part of your money. The surety company then takes the contractor to court to recover the amount.

2. States where the lien law doesn't require a written contract. In these states, contractors and suppliers are generally allowed to file a lien even if they don't have a written contract.These states typically permit parties with verbal, oral, or even implied contracts to claim lien rights.