Kentucky Permission For Deputy or Agent To Access Safe Deposit Box

Description

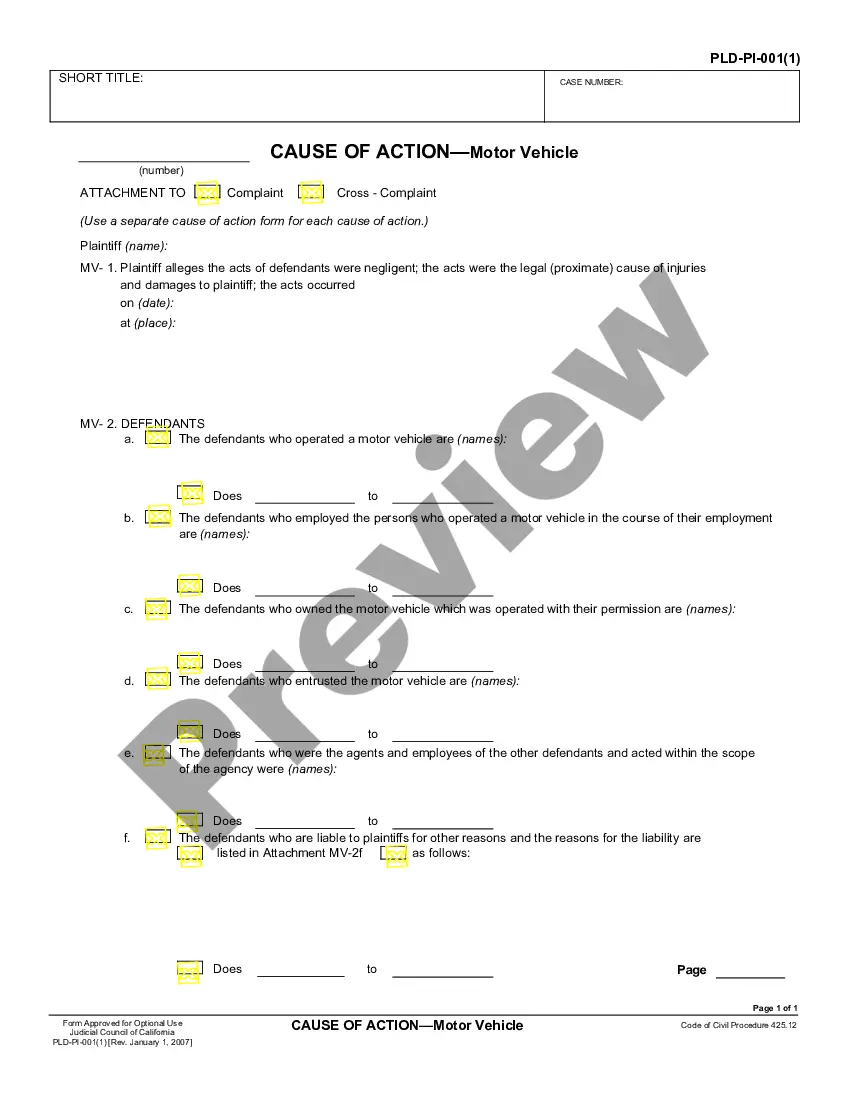

How to fill out Permission For Deputy Or Agent To Access Safe Deposit Box?

You can spend hours online searching for the legal document template that meets the state and federal regulations you require.

US Legal Forms provides a vast selection of legal forms that are vetted by experts.

You can easily download or print the Kentucky Permission For Deputy or Agent To Access Safe Deposit Box from the service.

If available, use the Preview option to review the document template as well. If you wish to find another version of the form, use the Search field to locate the template that satisfies your needs and requirements. Once you have identified the template you want, click Get now to proceed. Select the pricing plan you desire, enter your information, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make adjustments to your document if necessary. You can complete, modify, sign, and print the Kentucky Permission For Deputy or Agent To Access Safe Deposit Box. Download and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- Next, you can complete, modify, print, or sign the Kentucky Permission For Deputy or Agent To Access Safe Deposit Box.

- Every legal document template you receive is yours permanently.

- To obtain another version of a purchased form, visit the My documents section and click on the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the region/town of your preference.

- Review the form details to confirm you have selected the appropriate template.

Form popularity

FAQ

Yes, a power of attorney can give access to a safe deposit box, provided it explicitly states such authority. This legal document can be used to establish Kentucky Permission For Deputy or Agent To Access Safe Deposit Box. It’s essential to ensure that the power of attorney includes specific language allowing access to your safe deposit box for it to be valid.

To add someone to your safety deposit box, you need to visit your bank and request to modify the access list. This involves filling out forms that grant Kentucky Permission For Deputy or Agent To Access Safe Deposit Box to the individual you wish to add. Once the bank processes your request, the new person will have the authority to access your box.

Yes, your husband can access your safety deposit box if you grant him permission. By establishing Kentucky Permission For Deputy or Agent To Access Safe Deposit Box, you can allow him to access the box and its contents. It is essential to complete the required documentation at your bank to formalize this arrangement.

To give someone access to your safe deposit box, visit your bank or financial institution. You will need to provide the necessary identification and fill out forms to establish Kentucky Permission For Deputy or Agent To Access Safe Deposit Box. This process ensures that your chosen individual has the legal right to access your box.

Yes, you can give someone access to your safety deposit box. This is typically done by granting Kentucky Permission For Deputy or Agent To Access Safe Deposit Box. By doing this, you allow a trusted individual to access your box and manage its contents as needed.

In Kentucky, access to your safety deposit box typically requires a specific legal framework. Generally, you can grant permission for a deputy or agent to access your box through a legal document. By obtaining Kentucky Permission For Deputy or Agent To Access Safe Deposit Box, you can ensure that trusted individuals can help manage your affairs. It's wise to consult a legal expert or use platforms like US Legal Forms to navigate this process and ensure compliance.

Come to the bank with your safe deposit box key. You will need to sign an admission slip to get access to the Safe Deposit area of the vault. A Safe Deposit Area attendant will take you to the vault. With the bank's Guard Key and your key, open your Safe Deposit Box slot.

You'd think that an executor, spouse, family member of the deceased, or anyone with a key can walk into the bank and open a safe deposit box. But, that's not the way it works. In most states, safe deposit boxes are sealed and cannot be accessed when the original renter passes away.

Law Enforcement Access In criminal cases investigators can force the box open and seize its contents. For noncriminal matters like tax cases, the IRS can have a hold placed on the box until the owner's debt is satisfied.

Dual control: Two peopleusually a bank employee and the renterare required to open the box. In this way, no one person can ever open the box and remove the contents. Authorized signature: When the safe deposit account is opened, all persons authorized to access the box sign a signature card.