Kentucky Clauses Relating to Capital Withdrawals, Interest on Capital

Description

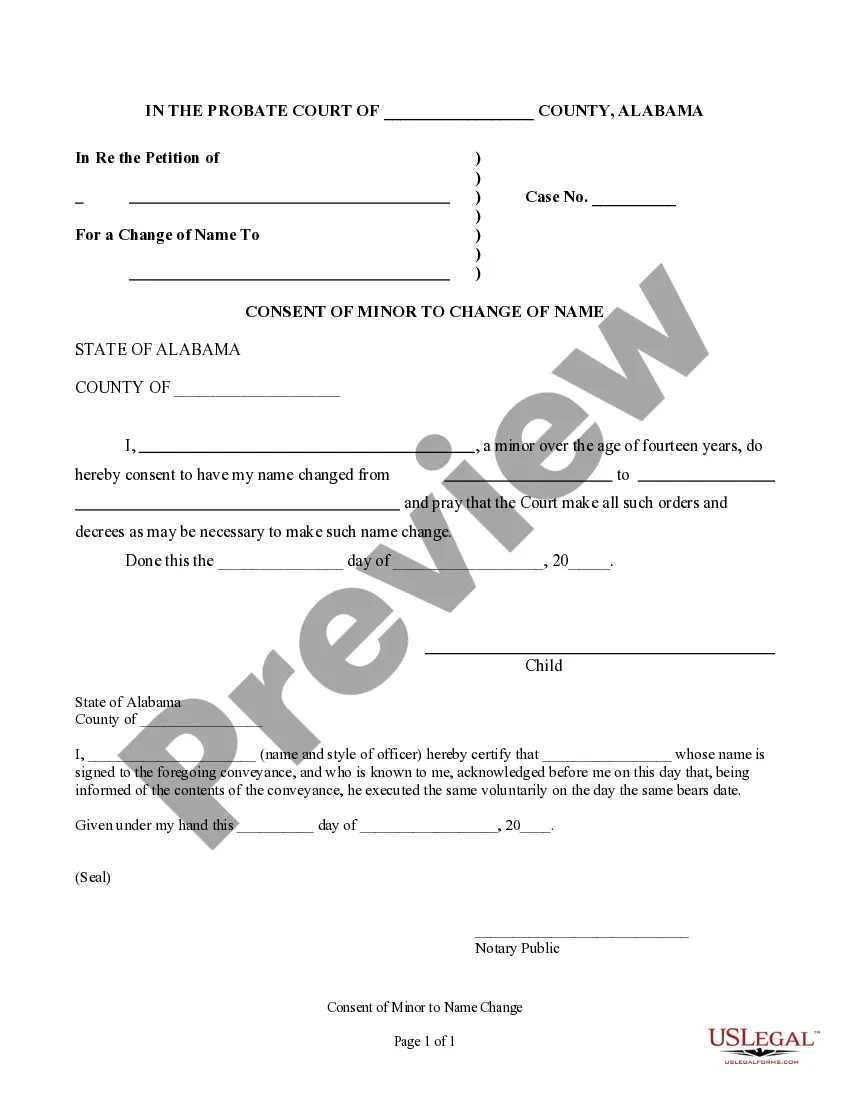

How to fill out Clauses Relating To Capital Withdrawals, Interest On Capital?

If you need to comprehensive, obtain, or produce authorized record web templates, use US Legal Forms, the largest variety of authorized kinds, which can be found on the Internet. Use the site`s easy and practical look for to obtain the documents you want. A variety of web templates for business and specific functions are sorted by groups and says, or keywords and phrases. Use US Legal Forms to obtain the Kentucky Clauses Relating to Capital Withdrawals, Interest on Capital with a handful of mouse clicks.

Should you be presently a US Legal Forms consumer, log in for your bank account and click on the Down load button to have the Kentucky Clauses Relating to Capital Withdrawals, Interest on Capital. Also you can access kinds you formerly downloaded in the My Forms tab of your own bank account.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have selected the form for that right city/region.

- Step 2. Use the Review option to look over the form`s articles. Don`t forget about to read through the explanation.

- Step 3. Should you be not satisfied together with the form, utilize the Look for discipline at the top of the screen to get other models from the authorized form format.

- Step 4. Upon having located the form you want, go through the Get now button. Pick the pricing program you prefer and include your credentials to register on an bank account.

- Step 5. Approach the financial transaction. You may use your credit card or PayPal bank account to accomplish the financial transaction.

- Step 6. Select the structure from the authorized form and obtain it in your system.

- Step 7. Full, edit and produce or sign the Kentucky Clauses Relating to Capital Withdrawals, Interest on Capital.

Each and every authorized record format you get is your own property eternally. You have acces to each form you downloaded inside your acccount. Click on the My Forms section and decide on a form to produce or obtain once again.

Be competitive and obtain, and produce the Kentucky Clauses Relating to Capital Withdrawals, Interest on Capital with US Legal Forms. There are many skilled and state-specific kinds you can utilize for your personal business or specific requirements.