Kentucky Dissolution of Unit

Description

How to fill out Dissolution Of Unit?

US Legal Forms - one of the greatest libraries of legitimate forms in the USA - delivers an array of legitimate record layouts you are able to acquire or printing. While using site, you will get a huge number of forms for organization and specific functions, sorted by categories, states, or keywords.You will discover the most up-to-date models of forms such as the Kentucky Dissolution of Unit in seconds.

If you already have a subscription, log in and acquire Kentucky Dissolution of Unit through the US Legal Forms catalogue. The Down load key will appear on each and every develop you view. You have access to all in the past delivered electronically forms from the My Forms tab of your account.

In order to use US Legal Forms initially, allow me to share basic recommendations to obtain started:

- Be sure to have chosen the proper develop for your personal area/area. Click the Preview key to examine the form`s content. Read the develop outline to actually have selected the correct develop.

- When the develop doesn`t match your requirements, use the Search discipline towards the top of the display to find the one that does.

- If you are pleased with the shape, confirm your option by clicking the Purchase now key. Then, opt for the pricing program you favor and offer your qualifications to sign up to have an account.

- Approach the purchase. Utilize your Visa or Mastercard or PayPal account to finish the purchase.

- Find the file format and acquire the shape on the gadget.

- Make modifications. Complete, edit and printing and sign the delivered electronically Kentucky Dissolution of Unit.

Every single design you included with your bank account lacks an expiration time and is your own property permanently. So, if you wish to acquire or printing an additional duplicate, just check out the My Forms segment and click around the develop you require.

Get access to the Kentucky Dissolution of Unit with US Legal Forms, by far the most substantial catalogue of legitimate record layouts. Use a huge number of specialist and status-particular layouts that meet up with your company or specific needs and requirements.

Form popularity

FAQ

The maximum penalty is for the LLC to be administratively dissolved or terminated. This means that the LLC's right to conduct business is ended and the only action the LLC can lawfully take is to wind up its affairs, pay its remaining debts and distribute the remaining assets to the owners.

The Secretary of State shall file the original of the certificate and advise the entity of that determination. (3) An entity administratively dissolved continues its existence but shall not carry on any business except that necessary to wind up and liquidate its business and affairs.

Administrative dissolution is an action taken by the Secretary of State that results in the loss of a business entity's rights, powers and authority.

A dissolved business can't operate or conduct business other than that which is necessary to wind up its affairs and liquidate its assets.

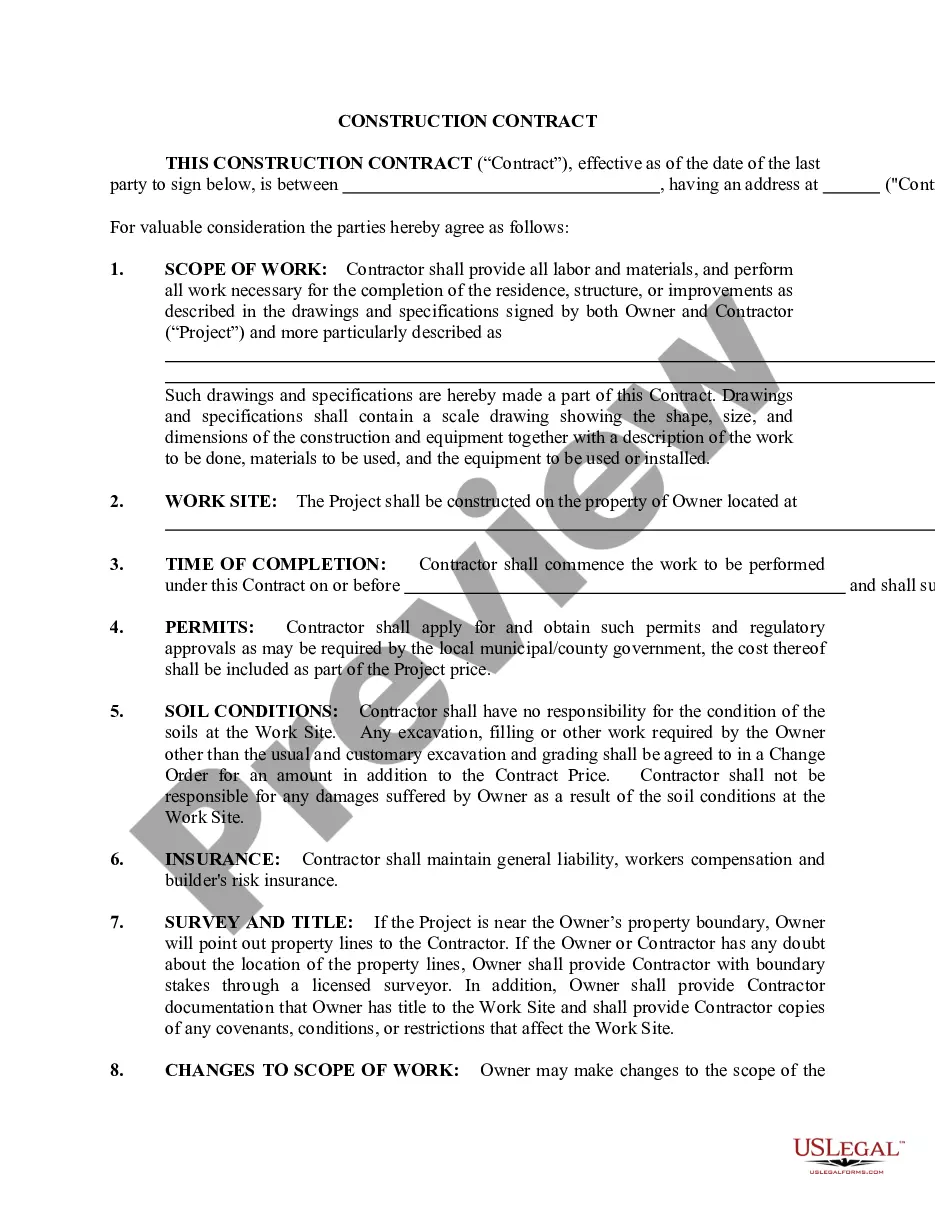

First, you need to be sure to include the legal name of your company. Second, your articles of dissolution should state the date when your company will be dissolved. Finally, there should be a statement that your corporation's board of directors or your LLC's members approved the dissolution.

If your Kentucky LLC was administratively dissolved by the Kentucky Secretary of State (SOS), you can reinstate at any time. You just have to complete and submit the Reinstatement Application.

To dissolve your Kentucky LLC, you file the Articles of Dissolution and one exact copy with the Kentucky Secretary of State (SOS) by mail or in person. If the forms provided by the SOS do not meet your needs, you can't just attach additional documentation, but you can create your own custom forms.

The filing fee for Articles of Dissolution is $40.00. Your check should be made payable to the "Kentucky State Treasurer."