This form is used when an Assignor assigns, transfers, and conveys to Assignee an overriding royalty interest in the Lease and all of the oil and gas produced, saved and marketed from the Lease, out of the interest owned by Assignor, with proportionate reduction (the Override ).

Kentucky Assignment of Overriding Royalty Interest for Single Lease - Proportionate reduction

Description

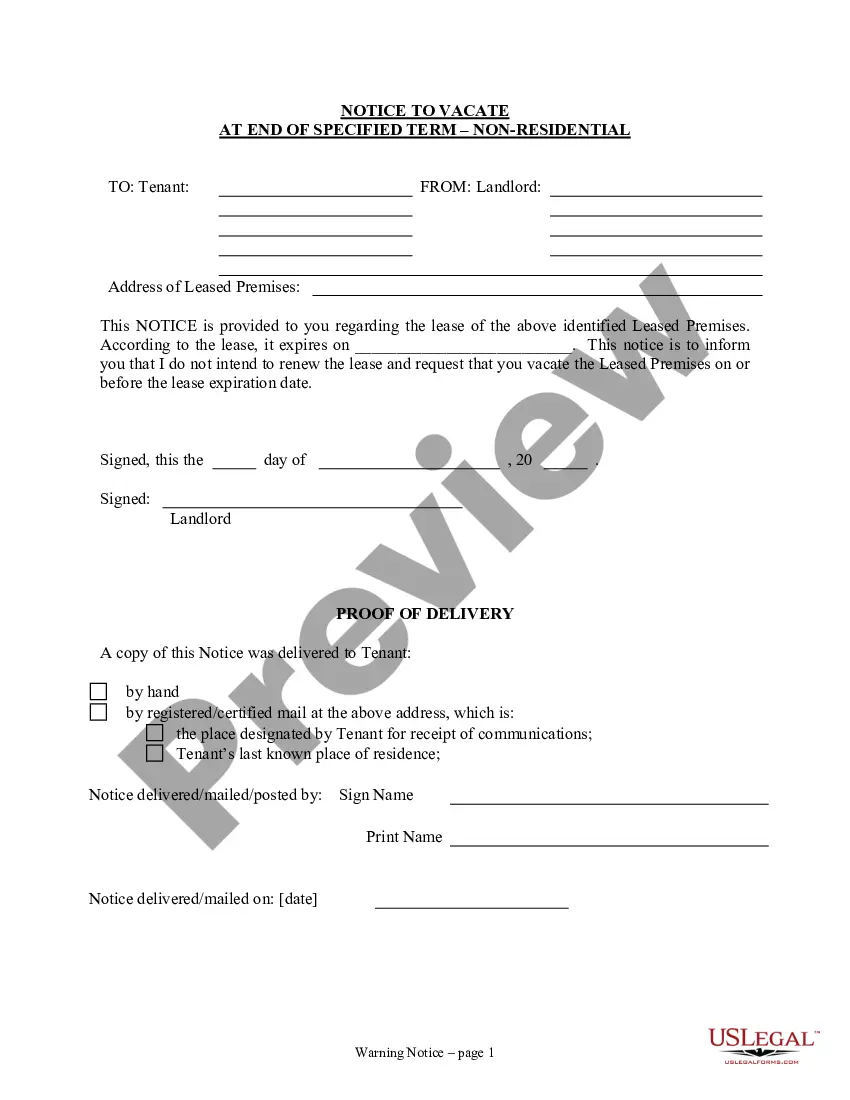

How to fill out Assignment Of Overriding Royalty Interest For Single Lease - Proportionate Reduction?

Discovering the right legal document design can be quite a battle. Naturally, there are plenty of web templates available on the Internet, but how would you discover the legal develop you require? Make use of the US Legal Forms site. The services gives a huge number of web templates, including the Kentucky Assignment of Overriding Royalty Interest for Single Lease - Proportionate reduction, that can be used for business and private needs. Every one of the types are inspected by specialists and satisfy state and federal needs.

Should you be presently registered, log in in your accounts and click on the Obtain switch to find the Kentucky Assignment of Overriding Royalty Interest for Single Lease - Proportionate reduction. Make use of your accounts to look with the legal types you possess bought earlier. Go to the My Forms tab of your accounts and have yet another copy in the document you require.

Should you be a fresh consumer of US Legal Forms, allow me to share straightforward directions so that you can adhere to:

- Initial, be sure you have chosen the right develop to your area/state. You may look over the shape utilizing the Preview switch and browse the shape description to make sure this is basically the right one for you.

- If the develop is not going to satisfy your expectations, make use of the Seach area to find the proper develop.

- When you are certain that the shape is suitable, select the Acquire now switch to find the develop.

- Opt for the rates strategy you would like and enter in the required information. Create your accounts and pay for the transaction making use of your PayPal accounts or Visa or Mastercard.

- Select the document file format and download the legal document design in your gadget.

- Comprehensive, change and printing and indication the attained Kentucky Assignment of Overriding Royalty Interest for Single Lease - Proportionate reduction.

US Legal Forms is the greatest library of legal types that you can find different document web templates. Make use of the service to download skillfully-created files that adhere to express needs.

Form popularity

FAQ

The owner of a royalty interest receives a portion of the income generated from oil and gas production. Unlike an ORRI, a royalty-interest owner does not have the right to execute leases or collect bonus payments. The RI owner does not bear any operating costs or expenses related to the well. what are oil & gas mineral, royalty & overriding royalty interests? legacyroyalties.com ? oil-gas-mineral-royalty-ove... legacyroyalties.com ? oil-gas-mineral-royalty-ove...

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well. Overriding Royalty Interest (ORRI) (US) - Westlaw westlaw.com ? Glossary ? PracticalLaw westlaw.com ? Glossary ? PracticalLaw

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons. Overriding Royalty Interest (ORRI) - Sell Your Oil and Gas Royalties bluemesaminerals.com ? overriding-royalty-intere... bluemesaminerals.com ? overriding-royalty-intere...

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease. What is Overriding Royalty Interest and How to Value it? pheasantenergy.com ? overriding-royalty-in... pheasantenergy.com ? overriding-royalty-in...