Kentucky Self-Employed Lighting Services Contract

Description

How to fill out Self-Employed Lighting Services Contract?

If you want to be thorough, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the website's simple and convenient search to find the documents you need. Various templates for business and personal use are organized by categories and states, or keywords. Use US Legal Forms to obtain the Kentucky Self-Employed Lighting Services Contract with just a few clicks.

If you are currently a US Legal Forms user, Log In to your account and click the Obtain button to receive the Kentucky Self-Employed Lighting Services Contract. You can also access forms you have previously purchased from the My documents section of your account.

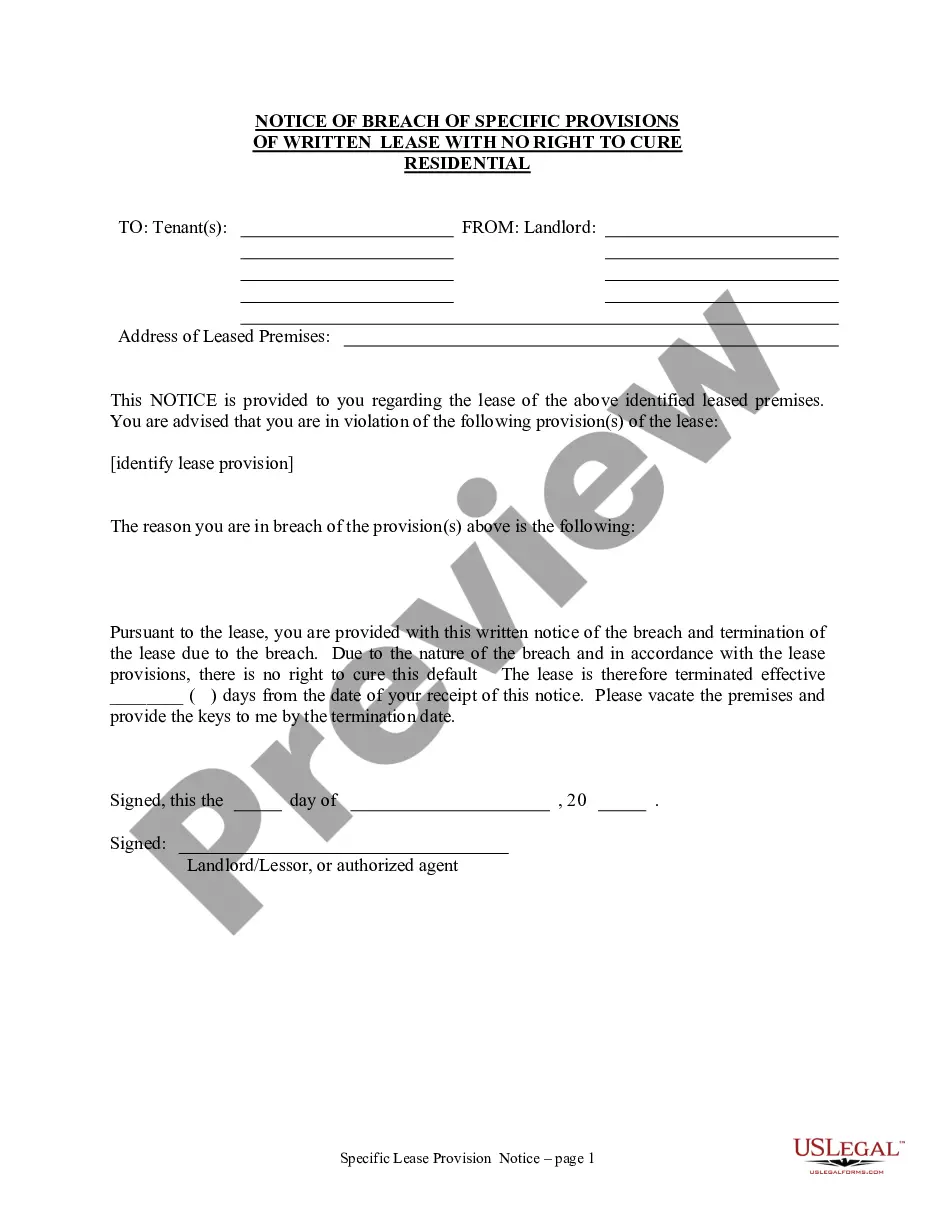

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Utilize the Preview feature to review the form's details. Always remember to read the summary. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template. Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and provide your information to register for an account. Step 5. Complete the transaction. You may use your Visa or Mastercard or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Kentucky Self-Employed Lighting Services Contract.

- Each legal document template you buy is yours permanently.

- You will have access to every form you have purchased in your account.

- Select the My documents section and choose a form to print or download again.

- Acquire and download, and print the Kentucky Self-Employed Lighting Services Contract with US Legal Forms.

- There are numerous professional and state-specific templates you can utilize for your business or personal needs.

Form popularity

FAQ

A breach of contract in Kentucky occurs when one party fails to fulfill their obligations as outlined in the agreement, such as a Kentucky Self-Employed Lighting Services Contract. The key elements include the existence of a valid contract, the plaintiff's performance or willingness to perform, a breach by the defendant, and resulting damages. If you believe a breach has occurred, it's essential to gather documentation and consult legal resources or platforms like uslegalforms for guidance on how to proceed.

In Kentucky, a contract, including a Kentucky Self-Employed Lighting Services Contract, becomes legally binding when it contains an offer, acceptance, and consideration. Both parties must clearly understand the terms and willingly agree to them. Furthermore, the contract must comply with state laws and regulations. If these conditions are met, the contract can be enforced in a court of law.

To create a legally binding Kentucky Self-Employed Lighting Services Contract, you need five essential elements: mutual agreement, consideration, capacity, legality, and intention to create legal relations. Mutual agreement means both parties must agree on the terms. Consideration refers to what each party will gain from the contract. Additionally, both parties must have the legal capacity to enter into the agreement, and the contract's subject matter must be legal. Lastly, both parties should intend for their agreement to be enforceable by law.

Doing business in Kentucky typically means engaging in regular activities for profit within the state. This can include having a physical presence, employing staff, or providing services like a Kentucky Self-Employed Lighting Services Contract. Understanding these criteria is important to ensure compliance with state regulations.

KY Form 725 must be filed by individuals who operate as self-employed or have income from a business in Kentucky. This includes those managing a Kentucky Self-Employed Lighting Services Contract. Ensuring you file this form accurately is essential to meeting state tax requirements.

In most cases, an LLC does not need to file its own tax return if it is a single-member LLC. Instead, the income is reported on the owner's personal tax return. However, if your LLC operates under a Kentucky Self-Employed Lighting Services Contract, it’s best to consult with a tax professional to ensure compliance with all tax obligations.

Starting a contracting business in Kentucky involves several steps, including choosing a business structure, registering your business name, and obtaining necessary licenses. Additionally, you should create a solid business plan outlining your services, such as those offered in a Kentucky Self-Employed Lighting Services Contract. Consider using platforms like uslegalforms to simplify the document creation process.

Yes, professional services are generally taxable in Kentucky. This includes services provided by contractors and other professionals. If you operate under a Kentucky Self-Employed Lighting Services Contract, understanding the tax implications of your services will help you navigate your financial responsibilities.

Yes, you can file KY Form 725 electronically through the Kentucky Department of Revenue's online services. This option simplifies the filing process for many self-employed individuals. If you’re engaged in a Kentucky Self-Employed Lighting Services Contract, using electronic filing can save you time and reduce paperwork.

Yes, in Kentucky, LLCs must file an annual report to maintain good standing. This report ensures that your business information remains current with the state. If you manage a Kentucky Self-Employed Lighting Services Contract, keeping your LLC compliant is crucial for your business operations.