Kentucky Self-Employed Lifeguard Services Contract

Description

How to fill out Self-Employed Lifeguard Services Contract?

If you require to fully download or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s convenient and efficient search to find the documents you need.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to acquire the Kentucky Self-Employed Lifeguard Services Contract with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Kentucky Self-Employed Lifeguard Services Contract.

- You can also access forms you previously downloaded in the My documents section of your account.

- If it’s your first time using US Legal Forms, follow the steps below.

- Step 1. Make sure you have selected the form for your appropriate area/region.

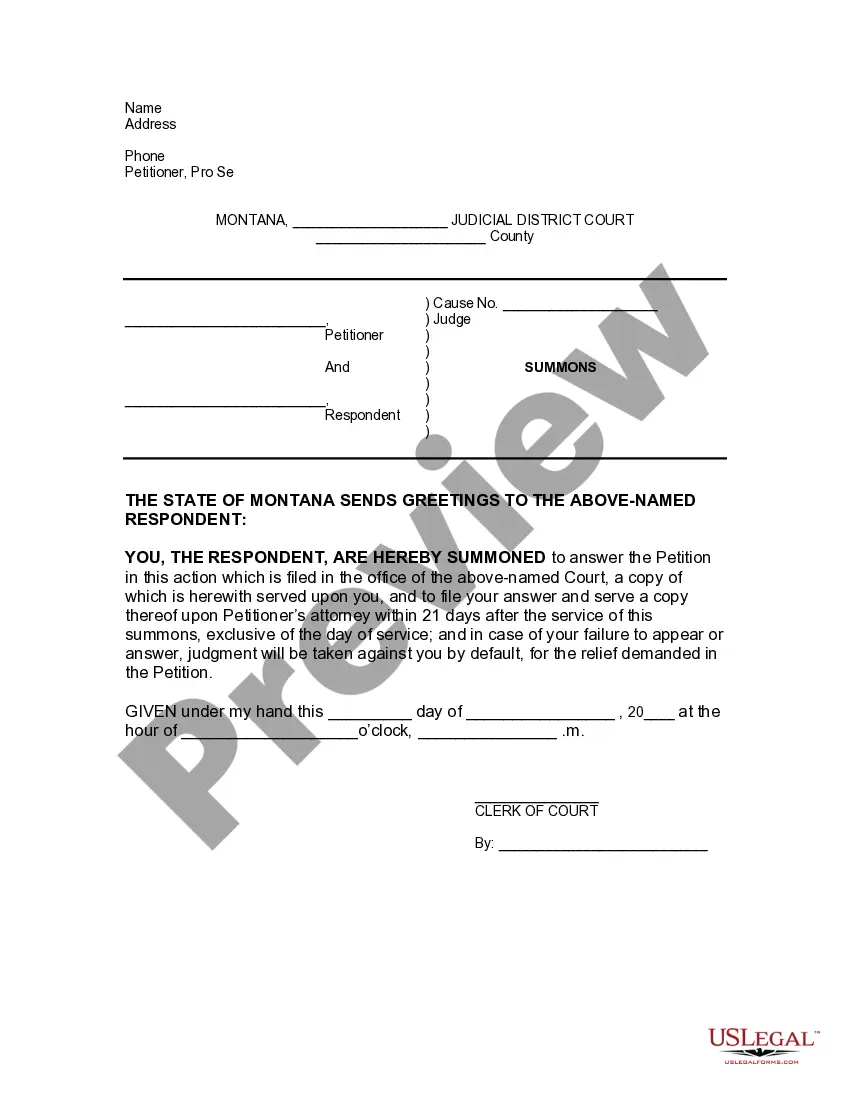

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

This agreement should clearly state what tasks the contractor is to perform. The agreement will also include what tasks will be performed and how much the contractor will be paid for his or her work. A contractor agreement can also help demonstrate that the person is truly an independent contractor and not an employee.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

A 'self-employed contractor' is a person who is genuinely in business for themselves (ie s/he takes responsibility for the success or failure of the business) and is neither an employee nor a worker.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

The 5 personality traits that make a successful contractorConfidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.

First up: Get your tax forms in orderStep 1: Ask your independent contractor to fill out Form W-9.Step 2: Fill out two 1099-NEC forms (Copy A and B)Ask your independent contractor for invoices.Add your freelancer to payroll.Keep records like a boss.Tools to check out:

Independent contractors are not classified as employees by the Internal Revenue Service (IRS), so instead of being paid through your payroll system, they're paid separately as a business expense.

It seems obvious, but make sure that you include in the contract the contractor's name, physical address, phone number, insurance company and account and license numbers.