Kentucky Occupational Therapist Agreement - Self-Employed Independent Contractor

Description

How to fill out Occupational Therapist Agreement - Self-Employed Independent Contractor?

Finding the appropriate legal document template can be quite a challenge.

Clearly, there are numerous templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Kentucky Occupational Therapist Agreement - Self-Employed Independent Contractor, which can be utilized for both business and personal purposes.

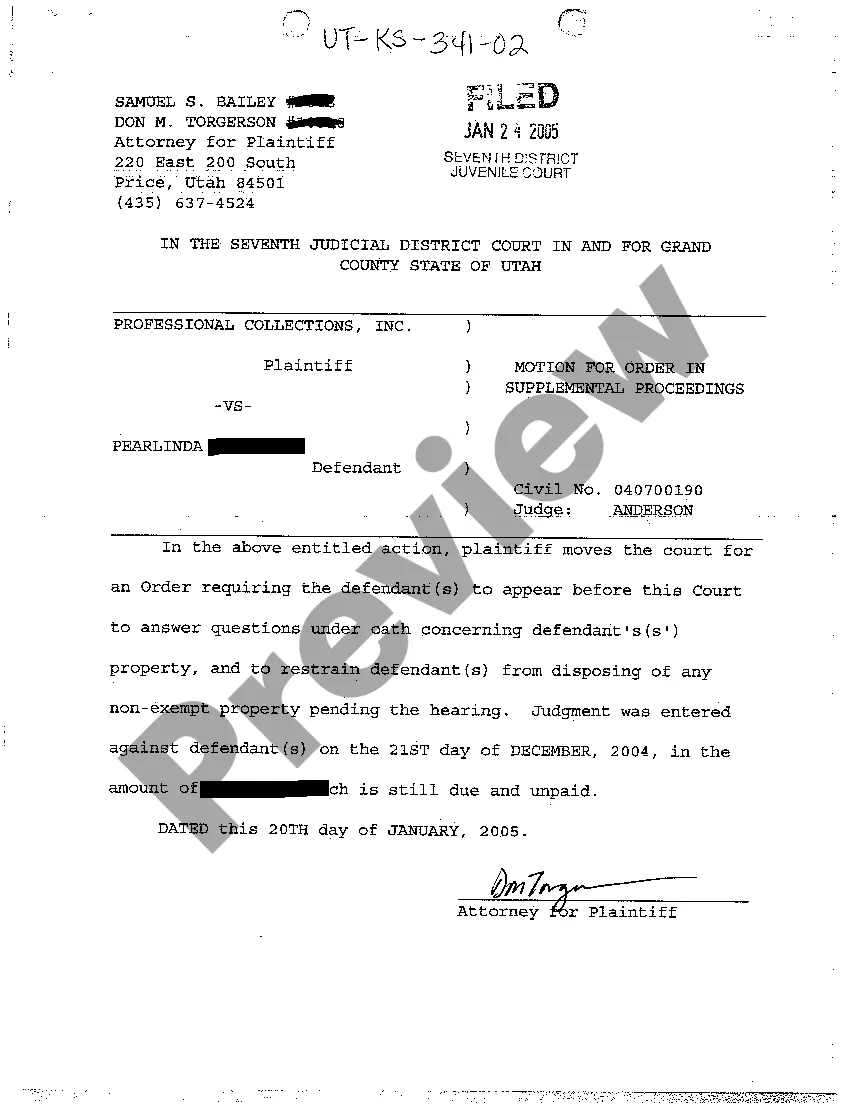

You can preview the form using the Preview button and check the form outline to ensure that it fits your needs.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Kentucky Occupational Therapist Agreement - Self-Employed Independent Contractor.

- Use your account to navigate through the legal forms you have previously purchased.

- Visit the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

Independent contractors must adhere to specific regulations that govern their work, including tax obligations and business licenses. These rules can vary by state, and it is crucial for Kentucky Occupational Therapist Agreement - Self-Employed Independent Contractor to outline compliance requirements. Familiarizing yourself with these regulations can prevent issues down the line and help maintain a successful practice.

The basic independent contractor agreement outlines the essential terms and conditions under which services are performed. It includes elements such as service description, compensation, and termination clauses. A well-crafted Kentucky Occupational Therapist Agreement - Self-Employed Independent Contractor can help ensure a professional and clear understanding between the therapist and their clients.

Yes, Kentucky is a direct access state for occupational therapy, meaning clients can seek therapy services without a physician’s referral. This regulation enhances patient convenience and access to care. However, it is still important for independent contractors to work within the guidelines established in their Kentucky Occupational Therapist Agreement - Self-Employed Independent Contractor.

In Kentucky, the independent contractor agreement is a legal document that outlines the terms of service between an occupational therapist and their clients or employers. This Kentucky Occupational Therapist Agreement - Self-Employed Independent Contractor includes details about payment, work scope, and responsibilities. It serves to protect both parties by clearly defining their rights and obligations.

An independent contractor in occupational therapy operates independently rather than as a direct employee of a facility. They provide therapy services to clients under a specific Kentucky Occupational Therapist Agreement - Self-Employed Independent Contractor. This relationship allows flexibility and autonomy in work schedules, enabling contractors to set their own fees and manage their businesses.

To fill out an independent contractor agreement, start by entering the names and contact information of both parties involved. Clearly define the scope of work, payment terms, and deadlines to avoid confusion later. It's important to reference the Kentucky Occupational Therapist Agreement - Self-Employed Independent Contractor for specific requirements. You may also consider using resources from USLegalForms, which offer guidance and templates to streamline the completion of your agreement.

Writing an independent contractor agreement begins with outlining the terms you and the contractor agree upon. You should include details about the services provided, payment terms, and duration of the agreement. Remember to specify that this is a Kentucky Occupational Therapist Agreement - Self-Employed Independent Contractor, as it helps clarify the responsibilities and expectations for both parties. Additionally, using platforms such as USLegalForms can simplify the process by providing templates that ensure compliance with state laws.