Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor

Description

How to fill out Physical Therapist Agreement - Self-Employed Independent Contractor?

If you desire to be thorough, obtain, or produce legal document online templates, utilize US Legal Forms, the largest collection of legal forms, which can be accessed on the web.

Take advantage of the site's straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to locate the Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor in just a few clicks of the mouse.

Every legal document template you acquire is yours permanently. You have access to every form you downloaded within your account. Visit the My documents section and choose a form to print or download again.

Stay competitive and download, and print the Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms user, sign in to your account and click the Download button to obtain the Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

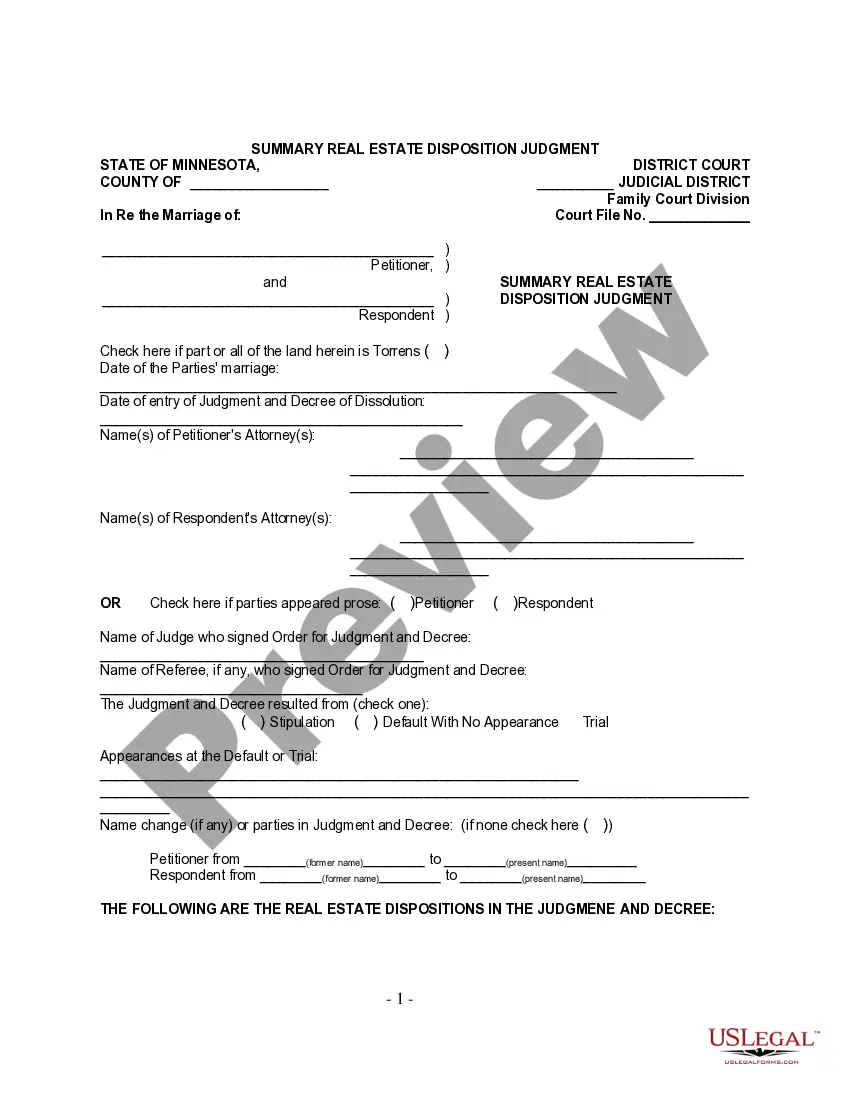

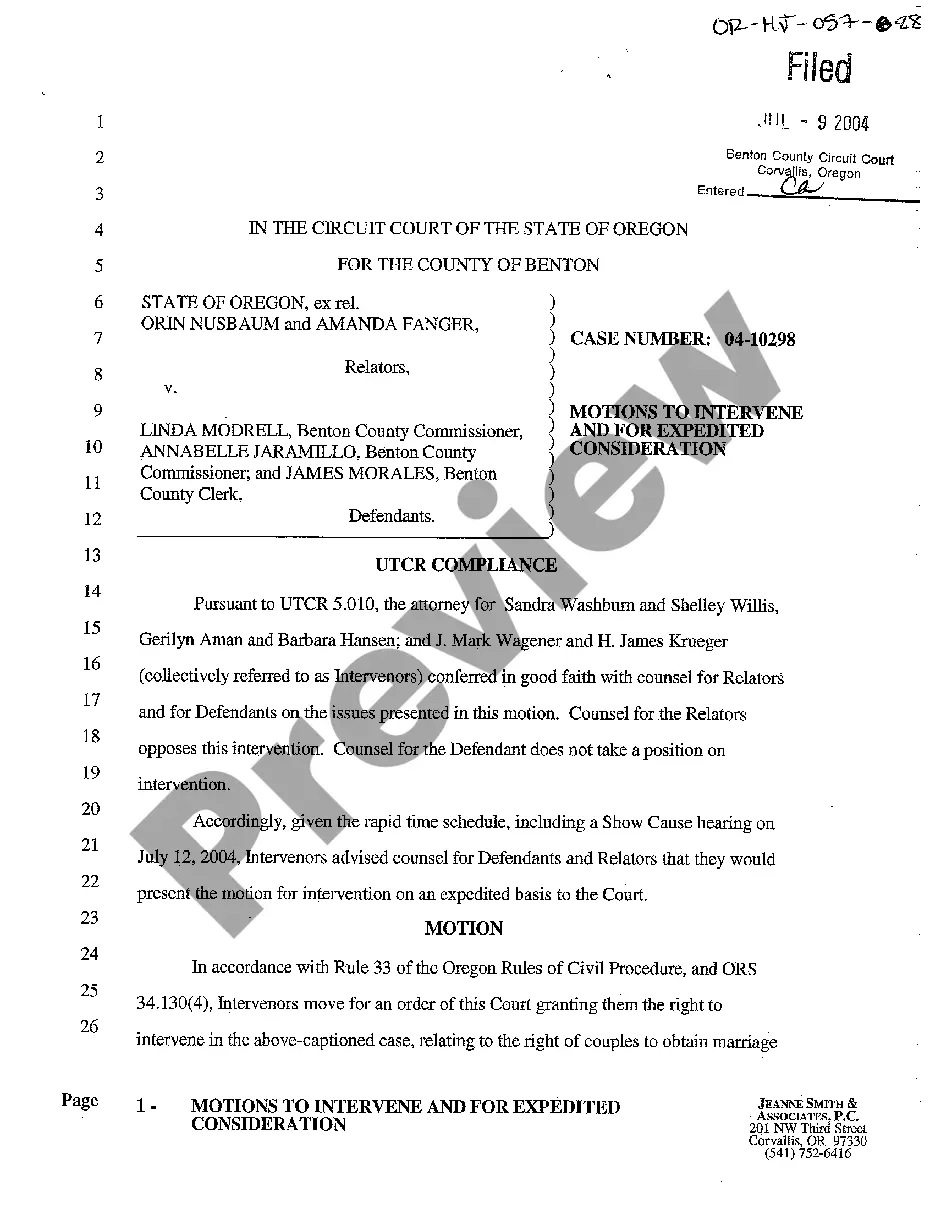

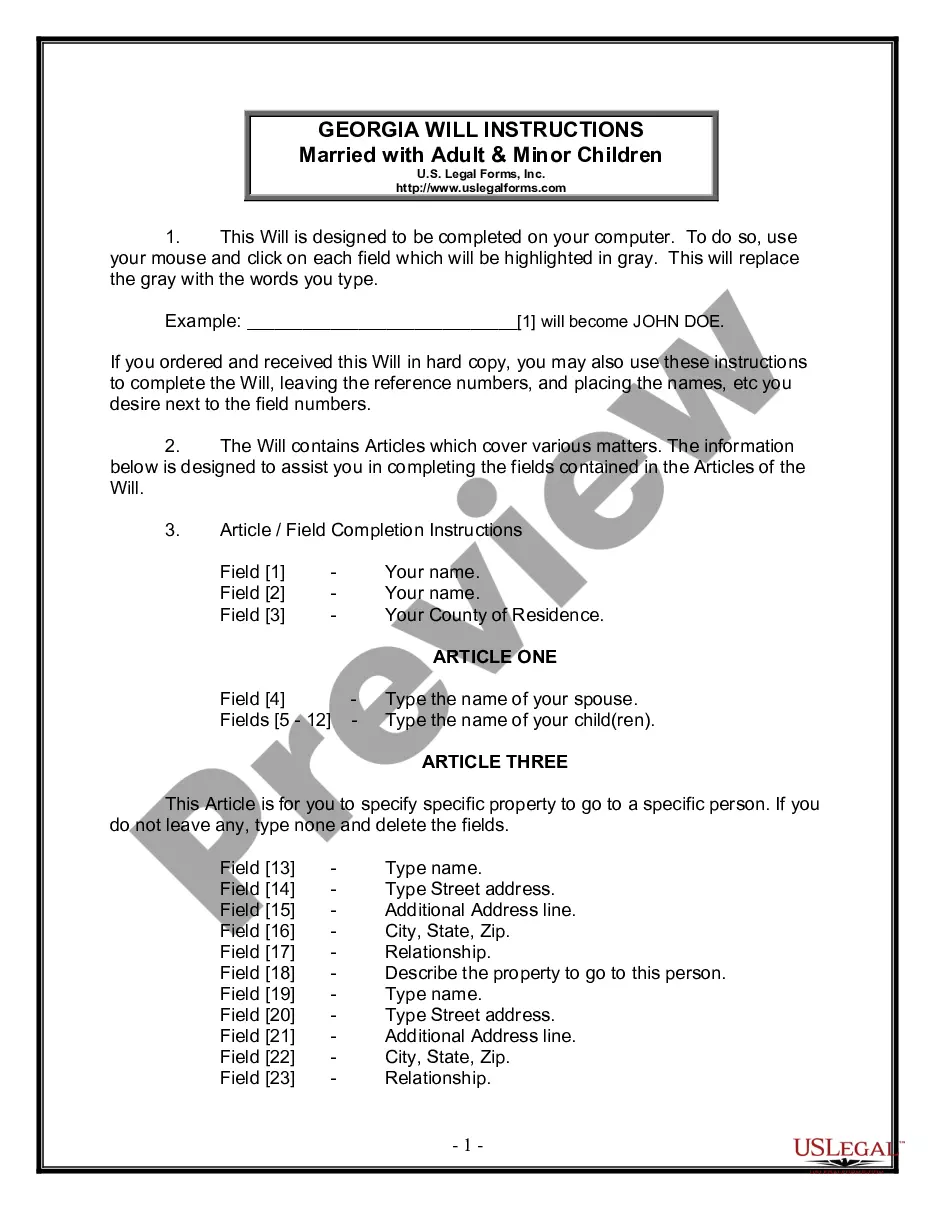

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Process the payment. You can utilize your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, edit and print or sign the Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Filling out a declaration of independent contractor status form involves stating your role and confirming that you operate independently. Include essential information such as your business structure and payment methods. If you're working under a Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor, make sure this form reflects your specific status to comply with relevant regulations.

To fill out an independent contractor form, start by entering your name and identification details. Then, provide the services you will render in the context of a Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor. Make sure to include payment details and any tax information required, ensuring accuracy to avoid issues later.

Writing an independent contractor agreement requires clarity and precision. Begin by drafting a title that specifies the nature of the agreement, followed by sections detailing the scope of work, compensation, and any applicable deadlines. Since this agreement is for a Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor, include relevant legal guidelines to protect both parties.

Filling out an independent contractor agreement involves several key steps. First, gather all necessary information about the parties involved, including names, addresses, and contact details. Next, clearly outline the terms of work, payment structure, and duration of the contract, ensuring that it's specifically tailored to your Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor needs.

Yes, a physical therapist can start their own business, but they must follow legal guidelines and obtain necessary certifications. Establishing a practice requires a thorough understanding of the Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor. This agreement ensures compliance with state laws and protects the therapist's rights. Our platform offers easy access to pre-drafted agreements to simplify this process.

Physical therapy assistants can work independently under certain conditions. It is essential for them to understand the regulations governing their practice in Kentucky. The Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor outlines the necessary terms for an independent operative framework. Using our platform, you can easily create an agreement tailored to your needs.

Yes, having a contract as an independent contractor is crucial for defining the terms of your work. A well-structured Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor decreases misunderstandings and protects your rights. It ensures that both you and your clients are on the same page regarding services, payment, and responsibilities. Using uslegalforms can help you create an effective contract tailored to your specific needs.

In Kentucky, a physical therapist can supervise up to three physical therapist assistants (PTAs) at one time. This supervision ensures that quality care is consistently provided to patients while adhering to legal regulations. If you're looking to establish a strong supervisory practice, having a Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor is vital for outlining the supervisory structure. This helps maintain compliance and promotes effective patient care.

Yes, you can work as an independent contractor as a therapist in Kentucky. This arrangement offers you the ability to set your own hours and manage your own practice. However, it is essential to have a well-drafted Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor to protect your interests and clarify the working relationship. Working as an independent contractor can provide both freedom and the responsibility of managing your business.

An independent contractor agreement in Kentucky outlines the terms of a working relationship between a physical therapist and their employer. This agreement varies from an employment contract as it allows the therapist more flexibility and autonomy. Typically, it addresses payment structures, responsibilities, and project scope. A clear Kentucky Physical Therapist Agreement - Self-Employed Independent Contractor helps parties understand their rights and obligations.