Kentucky Form - Large Quantity Sales Distribution Agreement

Description

How to fill out Form - Large Quantity Sales Distribution Agreement?

Have you been inside a situation in which you need paperwork for sometimes company or individual reasons almost every working day? There are plenty of authorized file layouts available on the Internet, but discovering kinds you can rely on isn`t simple. US Legal Forms delivers 1000s of develop layouts, like the Kentucky Form - Large Quantity Sales Distribution Agreement, which can be written to meet state and federal requirements.

In case you are already acquainted with US Legal Forms website and possess an account, basically log in. Afterward, you may download the Kentucky Form - Large Quantity Sales Distribution Agreement design.

Should you not offer an account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the develop you want and make sure it is to the correct city/state.

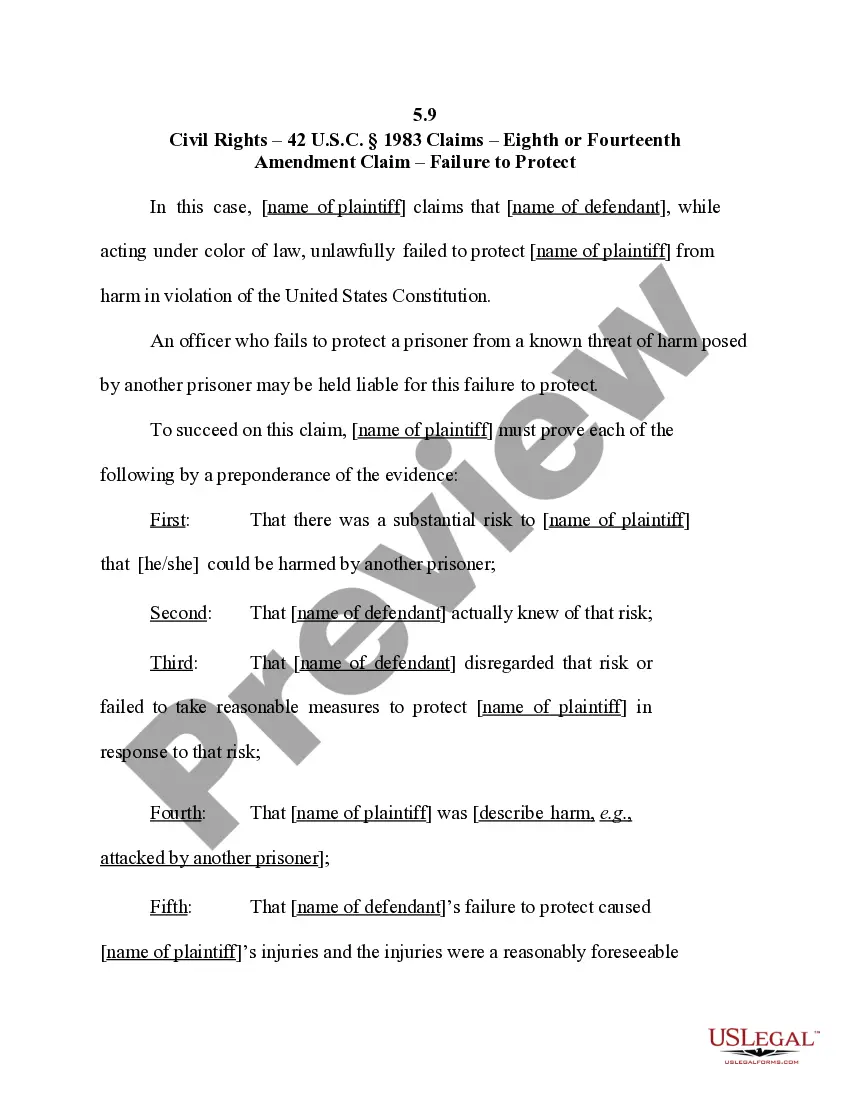

- Utilize the Preview switch to examine the form.

- See the explanation to actually have selected the appropriate develop.

- When the develop isn`t what you are looking for, use the Look for discipline to find the develop that meets your requirements and requirements.

- When you discover the correct develop, click on Purchase now.

- Pick the prices prepare you want, fill in the required details to generate your money, and buy an order making use of your PayPal or charge card.

- Choose a convenient document structure and download your duplicate.

Get all the file layouts you might have bought in the My Forms food selection. You can obtain a extra duplicate of Kentucky Form - Large Quantity Sales Distribution Agreement whenever, if possible. Just click the essential develop to download or produce the file design.

Use US Legal Forms, by far the most comprehensive collection of authorized kinds, to save time as well as prevent errors. The services delivers professionally produced authorized file layouts that can be used for a variety of reasons. Generate an account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

The Basics of Kentucky's PTE Tax For taxable years beginning on or after January 1, 2022, an ?authorized person? may elect annually, on behalf of an ?electing entity,? to pay Kentucky income tax at the entity-level.

Kentucky Tax Registration (10A100) - Basic Kentucky tax registration can be completed online or via the Kentucky Tax Registration Application (10A100). Additional tax registrations may be required based on your industry, for more information visit the Kentucky Department of Revenue.

Sole proprietorships and pass-through entities are exempt from state corporate income taxes. Instead, owners pay state individual income taxes on their share of earnings from the business, regardless of whether the income is used for personal use or reinvested in the business.

Form 740-PTET is used to make the election, file the return, and pay the income tax due at the entity-level. Form PTET-CR is used to report the tax paid on each owner's behalf to each owner of the PTE. Additional guidance on the tax and credit is expected.

PURPOSE OF THE INSTRUCTIONS These instructions have been designed for pass-through entities: S-corporations, partnerships, and general partnerships , which are required by law to file a Kentucky income tax and LLET return. Form PTE is complementary to the federal forms 1120S and 1065.

For purposes of this subsection, a "qualified investment partnership" means a pass-through entity that, during the taxable year, holds only investments that produce income that would not be taxable to a nonresident individual if held or owned individually.

Nonresidents who answered ?No? to any of the statements above must file Form 740-NP to report Kentucky income. INSTRUCTIONS This form may be used by qualifying full-year nonresidents to claim a refund of Kentucky income taxes withheld during 2022.

Every pass-through entity doing business in Kentucky must file a pass-through entity income and limited liability entity tax (LLET) return using Form PTE.