Kentucky Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

It is possible to devote several hours on the web searching for the legitimate papers web template which fits the federal and state specifications you want. US Legal Forms offers thousands of legitimate varieties that are reviewed by pros. You can actually download or print out the Kentucky Term Sheet - Convertible Debt Financing from our service.

If you currently have a US Legal Forms bank account, you are able to log in and then click the Acquire button. Afterward, you are able to full, modify, print out, or signal the Kentucky Term Sheet - Convertible Debt Financing. Every legitimate papers web template you acquire is the one you have permanently. To acquire yet another backup for any bought kind, go to the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms web site initially, follow the easy directions under:

- First, ensure that you have selected the correct papers web template for the state/city of your choosing. Look at the kind explanation to make sure you have selected the proper kind. If readily available, make use of the Review button to search throughout the papers web template as well.

- If you would like locate yet another edition from the kind, make use of the Search area to find the web template that meets your requirements and specifications.

- When you have discovered the web template you desire, simply click Purchase now to carry on.

- Find the rates prepare you desire, type in your references, and sign up for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your charge card or PayPal bank account to pay for the legitimate kind.

- Find the structure from the papers and download it to your product.

- Make changes to your papers if possible. It is possible to full, modify and signal and print out Kentucky Term Sheet - Convertible Debt Financing.

Acquire and print out thousands of papers templates using the US Legal Forms site, that provides the biggest assortment of legitimate varieties. Use professional and express-specific templates to tackle your company or person needs.

Form popularity

FAQ

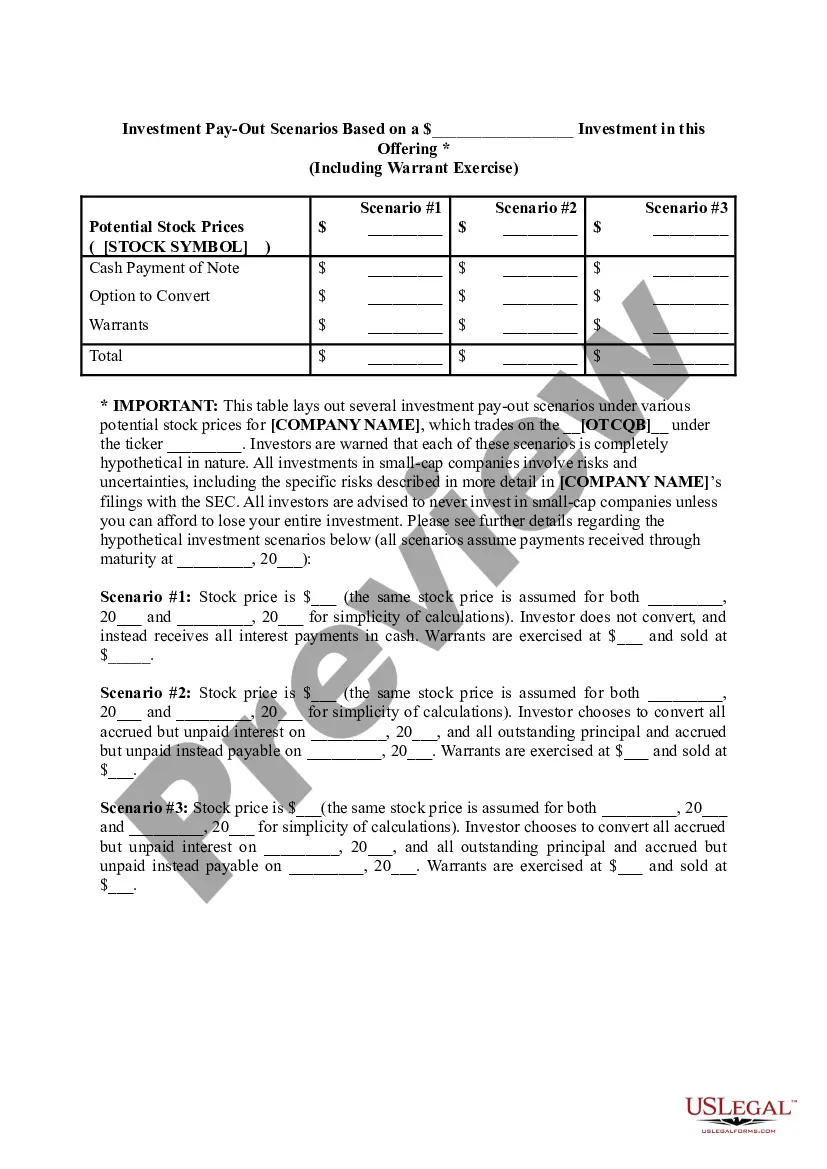

Convertible debt issued at a substantial premium could result in the instrument being treated entirely as an equity instrument for tax purposes, with no tax consequences during its term or upon redemption.

Conversion to Equity - Accounting for Convertible Debt When the note converts, usually during a new funding round, the liability moves to the equity section of the balance sheet. At this stage, the convertible note is settled, and new equity instruments, typically preferred shares, are issued to the investor.

Typically, the result is that the amount will convert to shares. If the convertible notes convert into shares, the company will need to determine how many shares to issue to the noteholder. To do so, the company will usually divide the loan amount, plus any accrued interest, by a certain share price.

Convertible debt is a debt hybrid product with an embedded option that allows the holder to convert the debt into equity in the future. The ratio is calculated by dividing the convertible security's par value by the conversion price of equity.

For tax purposes, the tax basis of the convertible debt is the entire proceeds received at issuance of the debt. Thus, the book and tax bases of the convertible debt are different. ASC 740-10-55-51 addresses whether a deferred tax liability should be recognized for that basis difference.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

The convertible debt that was listed as a non-current liability before the conversion now gets get treated as shareholder's equity.