Kentucky Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.

Description

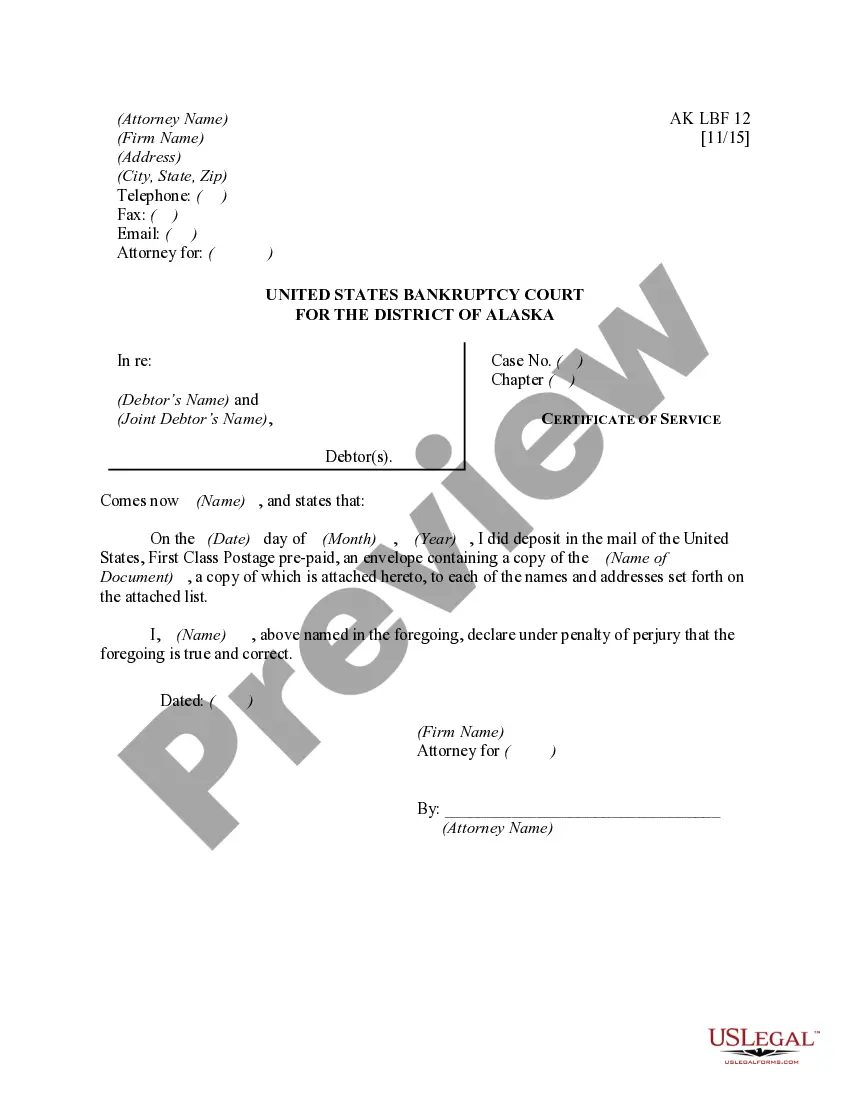

How to fill out Quickstart Loan And Security Agreement Between Silicon Valley Bank And IPrint, Inc.?

Discovering the right authorized record template can be quite a struggle. Naturally, there are a lot of layouts available on the Internet, but how do you obtain the authorized develop you will need? Use the US Legal Forms web site. The service gives a large number of layouts, like the Kentucky Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc., which can be used for business and private requires. Every one of the forms are checked out by experts and meet federal and state needs.

Should you be presently registered, log in for your account and click the Download key to get the Kentucky Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.. Make use of account to search through the authorized forms you might have ordered formerly. Visit the My Forms tab of your respective account and acquire yet another copy in the record you will need.

Should you be a new end user of US Legal Forms, listed below are simple recommendations that you can comply with:

- Initially, make certain you have chosen the correct develop for the town/area. You are able to examine the shape utilizing the Preview key and study the shape explanation to make certain this is basically the best for you.

- When the develop fails to meet your needs, take advantage of the Seach discipline to find the proper develop.

- Once you are positive that the shape is proper, go through the Buy now key to get the develop.

- Opt for the pricing prepare you want and type in the necessary information and facts. Build your account and pay money for an order using your PayPal account or Visa or Mastercard.

- Choose the data file format and download the authorized record template for your device.

- Total, modify and print and signal the acquired Kentucky Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc..

US Legal Forms is definitely the biggest collection of authorized forms where you can discover different record layouts. Use the company to download expertly-created papers that comply with condition needs.

Form popularity

FAQ

If a creditor has security interest in your property, it will likely be outlined in a security agreement. This important contract should not be entered into without careful consideration, as a default could lead to harsh consequences.

Each Borrower grants and pledges to Bank a continuing security interest in the Collateral to secure prompt repayment of any and all Obligations and to secure prompt performance by Borrowers of each of its covenants and duties under the Loan Documents.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Secured loans are business or personal loans that require some type of collateral as a condition of borrowing. A bank or lender can request collateral for large loans for which the money is being used to purchase a specific asset or in cases where your credit scores aren't sufficient to qualify for an unsecured loan.

Loans and credits are different finance mechanisms. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.

The purpose of a loan agreement is to detail what is being loaned and when the borrower has to pay it back as well as how. The loan agreement has specific terms that detail exactly what is given and what is expected in return.