Kentucky Electronic Services Form

Description

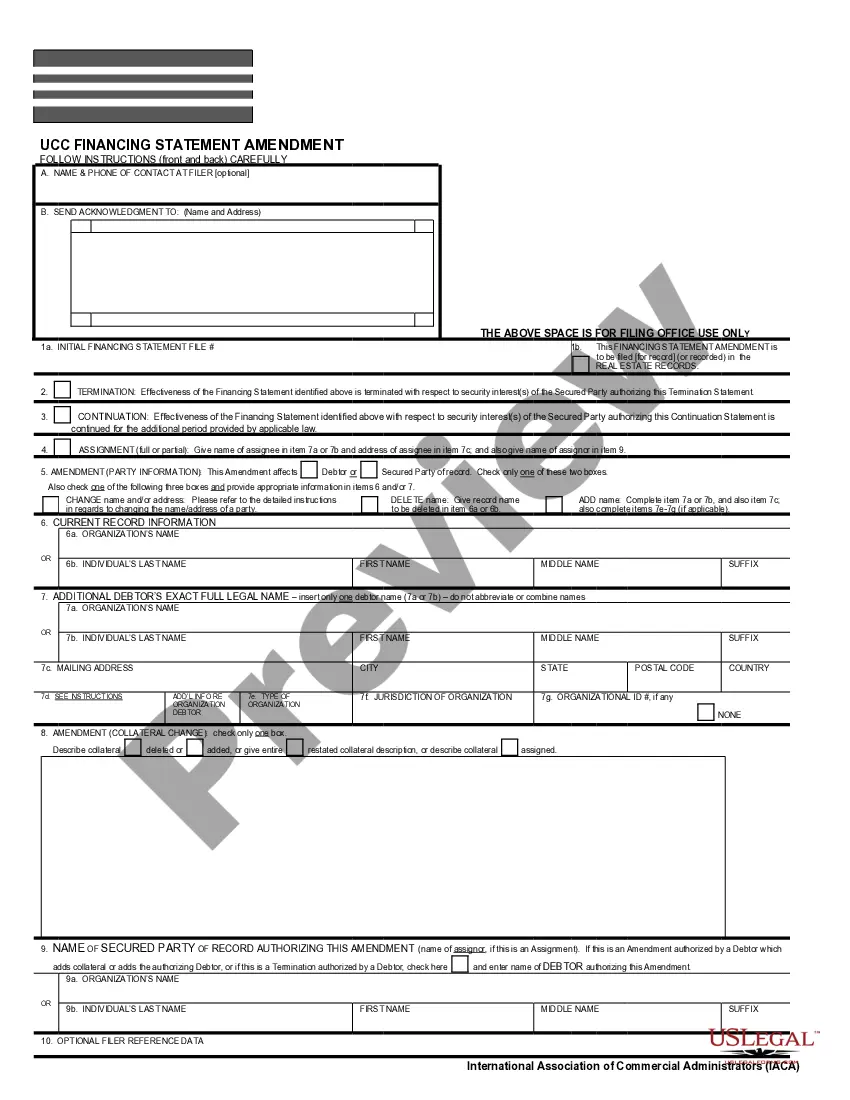

How to fill out Electronic Services Form?

Choosing the best authorized papers format can be a have difficulties. Obviously, there are plenty of templates accessible on the Internet, but how will you discover the authorized type you want? Take advantage of the US Legal Forms website. The services provides thousands of templates, for example the Kentucky Electronic Services Form, which can be used for organization and personal needs. Each of the forms are inspected by specialists and meet state and federal needs.

In case you are already signed up, log in to the accounts and click the Obtain key to have the Kentucky Electronic Services Form. Make use of accounts to look through the authorized forms you have ordered in the past. Check out the My Forms tab of your own accounts and get one more duplicate of your papers you want.

In case you are a whole new consumer of US Legal Forms, allow me to share basic instructions so that you can adhere to:

- First, make sure you have chosen the right type for your personal area/state. You may check out the form utilizing the Review key and read the form description to make sure it will be the right one for you.

- In case the type is not going to meet your requirements, use the Seach field to obtain the appropriate type.

- Once you are positive that the form is acceptable, click on the Get now key to have the type.

- Pick the prices plan you want and type in the required details. Build your accounts and buy an order utilizing your PayPal accounts or credit card.

- Opt for the submit structure and obtain the authorized papers format to the device.

- Total, revise and produce and signal the obtained Kentucky Electronic Services Form.

US Legal Forms will be the greatest collection of authorized forms for which you can discover various papers templates. Take advantage of the company to obtain skillfully-produced paperwork that adhere to state needs.

Form popularity

FAQ

Form K-5 is used to report withholding statement information from Forms W-2, W-2G, and 1099 and is completed online with two filing methods to choose from. It may be filed electronically by clicking the submit button or the completed form may be printed and mailed to the address on the form.

Hear this out loud PauseKentucky Withholding Tax Account Number and Deposit Frequency. If you are a new business, register online with the KY Department of Revenue to retrieve your KY Withholding Tax Account Number and deposit frequency.

??????Register or Reinstate a Business Step 1: Legally Establish Your Business. ... Step 2: Obtain Your Federal Employer Identification Number (FEIN) from the IRS. ... Step 3: Register for Tax Accounts and the Commonwealth Business Identifier (CBI). ... Step 4: If necessary, complete the specialty applications below:

Register online with the KY Dept of Revenue to receive a Withholding Account Number. Registration may also be completed via the Kentucky Registration Application (10A100). Please visit the Kentucky DOR Tax Registration Information page or additional resources or call the KY DOR at (502) 564-4581.

Electronically sign and e-file your Kentucky tax return. Print your tax return for record keeping and filing.

If your debt is currently being handled by the Division of Collections you can set up your own payment plan by going to the following website . You will need your case number from any Division of Collections' letter. Follow the on-line instructions.

Hear this out loud PauseBoth the employer and the employee pay these taxes, each paying 7.65% of the total tax. To ensure accurate payroll reporting, it is important to understand how Kentucky payroll taxes are calculated and relevant laws apply.

Hear this out loud PauseWhere can I get an EIN in Kentucky? All EINs are issued by the federal government through the IRS, regardless of your state. You can apply for a federal employer identification number on the IRS website. Keep in mind that you will also have to get a state tax ID number from the Kentucky Department of Revenue.