This due diligence form is a checklist of company records provided for review at meetings regarding business transactions.

Kentucky Company Records Checklist

Description

How to fill out Company Records Checklist?

Are you in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating trustworthy ones isn't simple.

US Legal Forms offers a vast array of form templates, including the Kentucky Business Records Checklist, which can be tailored to comply with state and federal regulations.

Once you find the appropriate form, click on Get now.

Choose the pricing plan you prefer, provide the necessary information to create your account, and complete the transaction using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kentucky Business Records Checklist template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

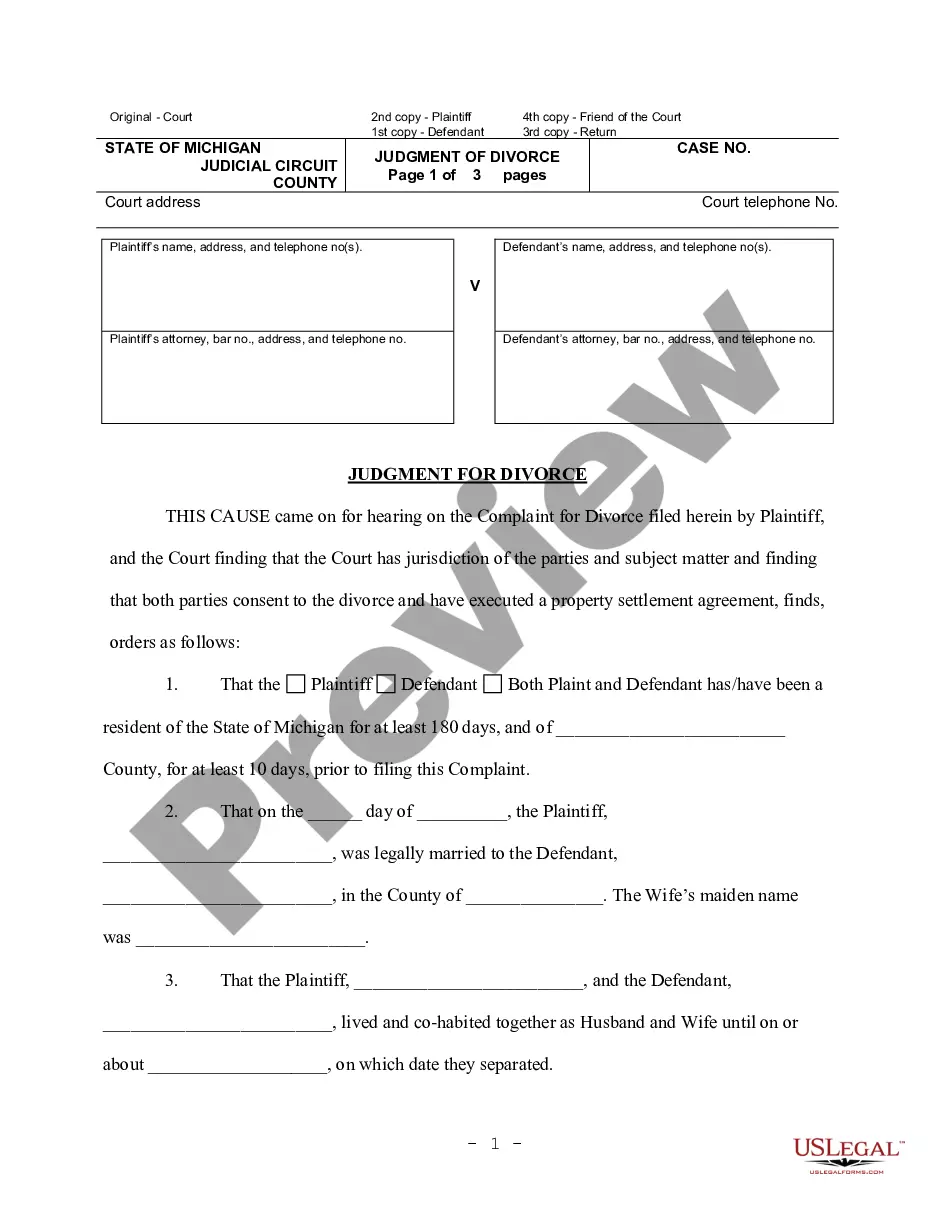

- Utilize the Preview button to review the form.

- Check the description to confirm you have chosen the correct form.

- If the form isn't what you're searching for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Yes, divorce records in Kentucky are generally considered public records. Anyone can access these documents after they are filed, following certain procedures. If you are looking for these records, you can refer to the Kentucky Company Records Checklist for additional guidance on how to obtain them. This resource simplifies the process and connects you with the necessary information.

Verifying a business in Kentucky involves checking its registration status and compliance with state regulations. You can do this through the Secretary of State’s website, where you can refer to the Kentucky Company Records Checklist for a step-by-step guide. This checklist provides valuable details and resources that ensure you verify the business accurately and efficiently.

Yes, Kentucky is a public record state, which means that many documents and records are accessible to the public. This includes business registrations, company filings, and other important documents. Utilizing the Kentucky Company Records Checklist can help you navigate these records effectively. You can easily find and request access to the information you need.

KY Form 725 must be filed by corporations or LLCs that elect to be taxed as corporations. This form is crucial for accurately reporting your company’s income and calculating due taxes. Having a Kentucky Company Records Checklist is beneficial for tracking which entities must file this form and keeping your records organized.

Yes, you must file an annual report to renew your LLC in Kentucky, which is due each year by June 30th. This report keeps your LLC in good standing and maintains compliance with state regulations. Using a Kentucky Company Records Checklist helps ensure that you don't miss this important deadline.

Yes, KY Form 725 can be filed electronically via the Kentucky Department of Revenue's online portal. This option streamlines the process, making it more convenient for you. Incorporating a Kentucky Company Records Checklist can help you keep track of all the necessary documents and forms for electronic filing.

To file an LLC in Kentucky, begin by choosing a unique name and designating a registered agent. You will need to complete the Articles of Organization and file them with the Secretary of State. A Kentucky Company Records Checklist is vital for ensuring you have everything in order, which simplifies the filing process.

In Kentucky, the law requires that public agencies respond to an open records request within three business days. However, the actual time may vary depending on the complexity of the request. For businesses, keeping a Kentucky Company Records Checklist can simplify how you manage and request essential documents.

Form 725 in Kentucky is used for reporting corporate income taxes for entities that have elected to be taxed as corporations. This form helps the state assess the tax obligations of your company accurately. Keeping a Kentucky Company Records Checklist is beneficial for tracking and maintaining your filings and compliance.

To verify a business's validity, start by checking its registration status on the Kentucky Secretary of State's website. Ensure the business matches the information listed in the Kentucky Company Records Checklist. You can also look for any licenses or permits that the business should have based on its industry to ensure it operates legally.