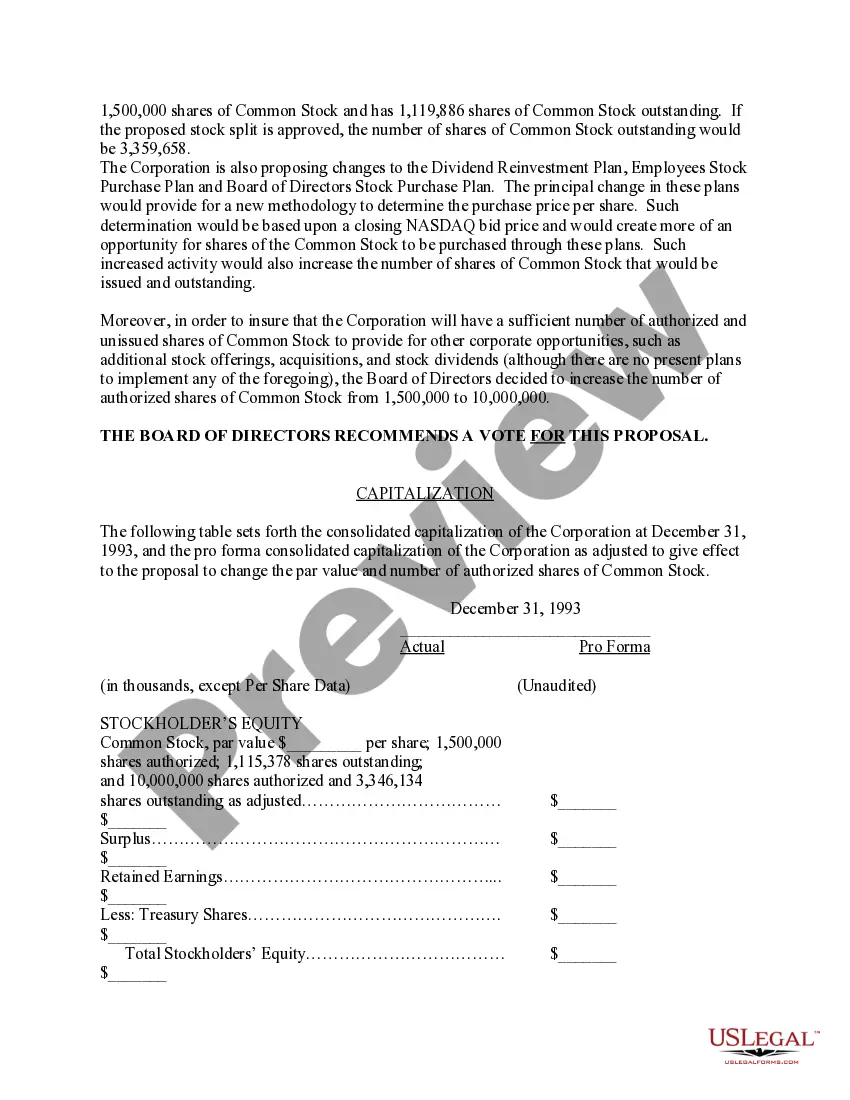

Kentucky Proposal for the Stock Split and Increase in the Authorized Number of Shares

Description

How to fill out Proposal For The Stock Split And Increase In The Authorized Number Of Shares?

Finding the right lawful file format could be a have a problem. Obviously, there are a lot of layouts available on the Internet, but how can you get the lawful develop you will need? Make use of the US Legal Forms internet site. The service delivers a large number of layouts, including the Kentucky Proposal for the Stock Split and Increase in the Authorized Number of Shares, that you can use for enterprise and private demands. Every one of the varieties are checked by experts and meet up with state and federal requirements.

When you are currently signed up, log in to the bank account and then click the Down load option to get the Kentucky Proposal for the Stock Split and Increase in the Authorized Number of Shares. Utilize your bank account to look with the lawful varieties you have bought previously. Check out the My Forms tab of your bank account and have another copy from the file you will need.

When you are a fresh end user of US Legal Forms, here are basic directions for you to follow:

- Very first, ensure you have chosen the appropriate develop for the town/area. You may look over the form making use of the Preview option and browse the form explanation to make certain it will be the right one for you.

- If the develop fails to meet up with your expectations, make use of the Seach discipline to discover the right develop.

- When you are certain the form is acceptable, click on the Buy now option to get the develop.

- Select the prices strategy you desire and enter in the essential details. Create your bank account and purchase the order using your PayPal bank account or bank card.

- Pick the document file format and obtain the lawful file format to the gadget.

- Complete, edit and print and signal the attained Kentucky Proposal for the Stock Split and Increase in the Authorized Number of Shares.

US Legal Forms is definitely the biggest catalogue of lawful varieties that you can find different file layouts. Make use of the company to obtain appropriately-produced documents that follow state requirements.

Form popularity

FAQ

After a stock split, a current stockholder holds more shares, but each share is proportionately worth less. As a result, stock splits do not change the aggregate value of what the stockholder owns or the overall market capitalization of the company.

However, the price per share and the number of shares will change. Although stock splits are fairly insignificant in the long run, they do require approval* from stockholders.

Only those investors who hold shares of a company in their Demat account on the record date are eligible for the stock split.

In a 2-for-1 stock split, the number of outstanding shares is doubled and the price is reduced by half. The total market value (market cap) of the issuer's stock remains the same.

In the example of a 2-for-1 split, the share price will be halved. Thus, while a stock split increases the number of outstanding shares and proportionally lowers the share price, the company's market capitalization remains unchanged.

FINRA does not approve reverse splits, but it does process reverse stock splits as part of its functions related to company corporate actions in the OTC market. OTC companies must submit notice to FINRA 10 days prior to the record/effective date of the corporate action.

The most common split ratios are 2-for-1 or 3-for-1 (sometimes denoted as or ). This means for every share held before the split, each stockholder will have two or three shares, respectively, after the split.

While a stock split is the most common, any other ratio may be used so long as it is approved by the company's board of directors and, in some cases, by shareholders.