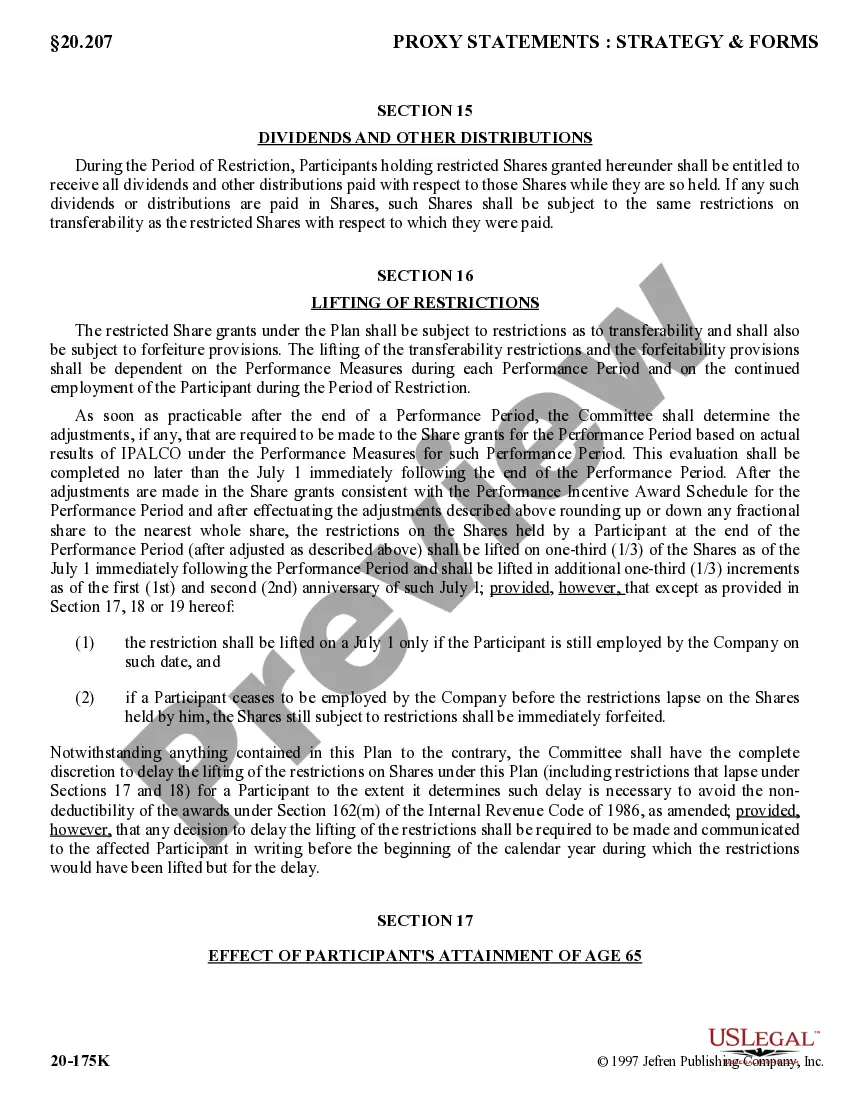

Kentucky Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc.

Description

How to fill out Long Term Performance And Restricted Stock Incentive Plan Of Ipalco Enterprises, Inc.?

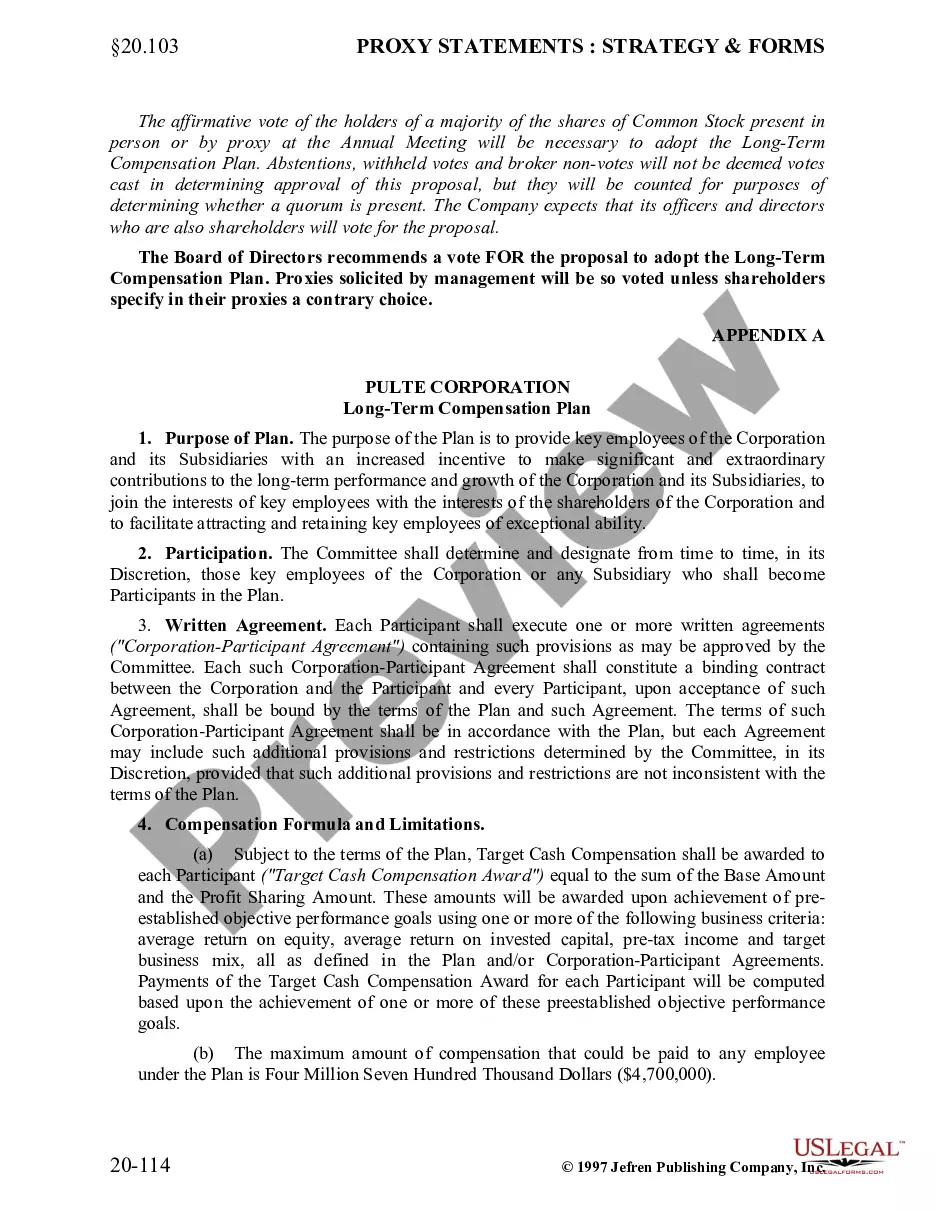

If you need to total, obtain, or produce authorized papers templates, use US Legal Forms, the largest variety of authorized forms, that can be found on the Internet. Use the site`s simple and easy convenient research to get the documents you will need. Various templates for organization and specific uses are sorted by classes and states, or key phrases. Use US Legal Forms to get the Kentucky Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc. in a few mouse clicks.

Should you be presently a US Legal Forms consumer, log in in your profile and click on the Acquire switch to find the Kentucky Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc.. You can also access forms you earlier downloaded within the My Forms tab of your profile.

Should you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for your correct metropolis/nation.

- Step 2. Use the Review solution to look over the form`s articles. Don`t forget to read through the information.

- Step 3. Should you be unsatisfied with all the kind, take advantage of the Lookup industry towards the top of the monitor to find other models of your authorized kind design.

- Step 4. When you have found the form you will need, select the Acquire now switch. Choose the costs prepare you like and add your references to register for an profile.

- Step 5. Approach the transaction. You may use your credit card or PayPal profile to finish the transaction.

- Step 6. Find the format of your authorized kind and obtain it on your own product.

- Step 7. Total, edit and produce or indication the Kentucky Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc..

Each and every authorized papers design you purchase is your own permanently. You possess acces to each and every kind you downloaded with your acccount. Click on the My Forms section and select a kind to produce or obtain again.

Be competitive and obtain, and produce the Kentucky Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc. with US Legal Forms. There are many professional and state-certain forms you can utilize for the organization or specific requires.

Form popularity

FAQ

In summary, RSUs in public companies offer more immediate liquidity, allowing employees to sell their shares as soon as they vest. On the other hand, private company RSUs involve waiting for specific events or finding a willing buyer to access the value of the shares.

RSUs are considered a form of compensation and are included in your taxable income when they vest. Because RSU income is considered supplemental, the withholding rate can vary between 22% and 37%. Usually, your employer will liquidate a percentage of the shares to cover the withholding requirement.

RSUs are a type of restricted stock (which may also be known as ?letter stock? or ?restricted securities?). Restricted stock is company stock that cannot be fully transferable until certain restrictions have been met. These can be performance or timing restrictions, similar to restrictions for options.

Accurately Report RSU Sales When you sell your RSUs, you must report the RSU income. Your income is the difference between the cost basis on which you already paid taxes and the stock price when you sell it. Accurately reporting the sales will ensure you pay the correct capital gains tax rate.

Some investors opt to sell their RSUs right away, before they have an opportunity to gain or lose value. It is a savvy way to minimize these capital gains taxes and avoid RSUs being taxed twice.

The main difference between restricted stock and performance shares is that restricted stock is typically awarded to employees with the condition that they remain with the company for a certain period of time, while performance shares are awarded to employees based on the company's performance.

Stock options are typically taxed at two points in time: first when they are exercised (purchased) and again when they're sold. You can unlock certain tax advantages by learning the differences between ISOs and NSOs.

By paying out profits in the form of salaries rather than dividends, a corporation can avoid double taxation. Tax Treaties: Many countries have tax treaties in place to prevent double taxation. These treaties often provide rules for which country has the right to tax certain types of income.