Kentucky Adoption of Stock Option Plan of WSFS Financial Corporation

Description

How to fill out Adoption Of Stock Option Plan Of WSFS Financial Corporation?

You are able to spend time online searching for the authorized file template that suits the federal and state demands you will need. US Legal Forms supplies a huge number of authorized kinds which are analyzed by pros. It is possible to acquire or print out the Kentucky Adoption of Stock Option Plan of WSFS Financial Corporation from the assistance.

If you already have a US Legal Forms account, you can log in and click on the Download switch. After that, you can full, edit, print out, or sign the Kentucky Adoption of Stock Option Plan of WSFS Financial Corporation. Every single authorized file template you get is the one you have eternally. To have another copy for any bought form, visit the My Forms tab and click on the related switch.

If you work with the US Legal Forms website for the first time, follow the easy guidelines beneath:

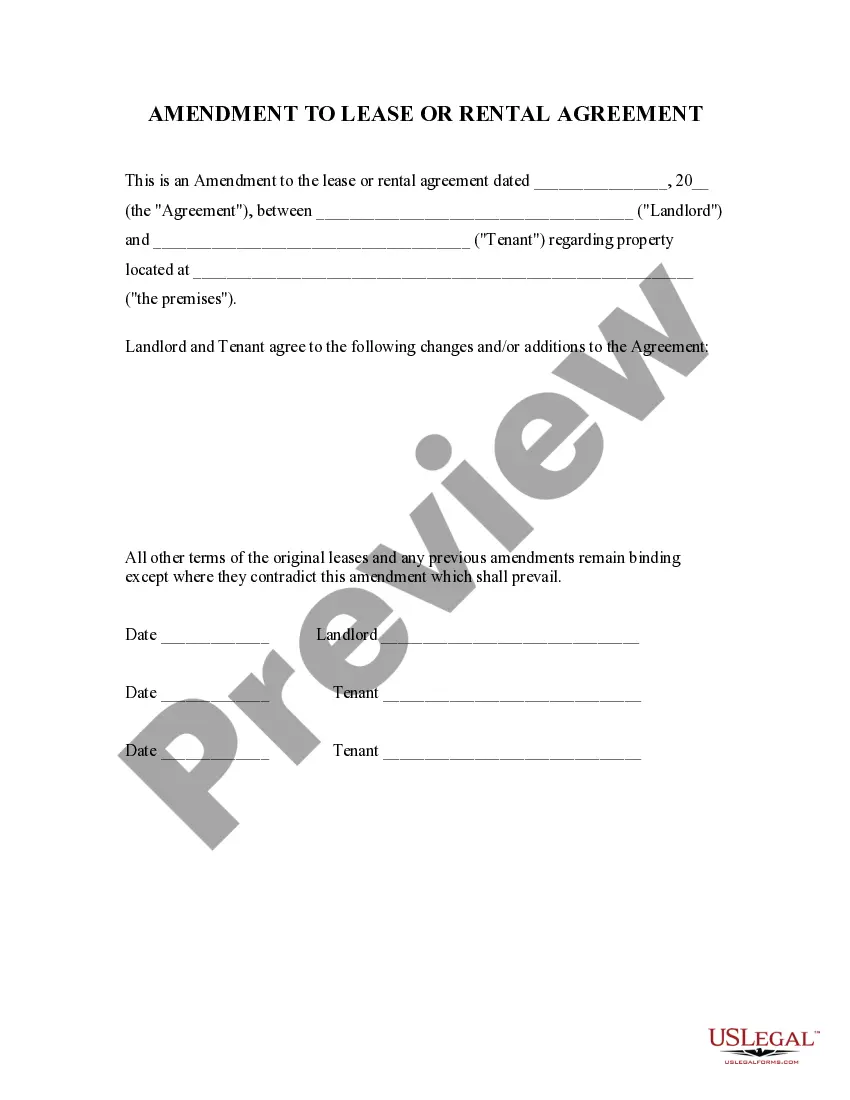

- Initially, be sure that you have selected the right file template for that state/city of your liking. Read the form information to make sure you have picked the appropriate form. If offered, take advantage of the Review switch to check through the file template as well.

- If you wish to locate another model from the form, take advantage of the Research industry to discover the template that fits your needs and demands.

- After you have discovered the template you want, click on Purchase now to move forward.

- Pick the costs program you want, enter your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your credit card or PayPal account to pay for the authorized form.

- Pick the format from the file and acquire it in your device.

- Make alterations in your file if possible. You are able to full, edit and sign and print out Kentucky Adoption of Stock Option Plan of WSFS Financial Corporation.

Download and print out a huge number of file themes utilizing the US Legal Forms website, which offers the largest variety of authorized kinds. Use skilled and express-specific themes to deal with your organization or person requires.

Form popularity

FAQ

In an employee share scheme, you get shares or can buy shares in the company you work for. This is also known as an employee share purchase plan, share options or equity scheme. Companies use share schemes to attract, retain and motivate employees. They also align employee interests with those of shareholders.

Key Takeaways. An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company in the form of shares of stock. ESOPs encourage employees to give their all as the company's success translates into financial rewards.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

Although stock option plans offer many advantages, the tax implications for employees can be complicated. Dilution can be very costly to shareholder over the long run. Stock options are difficult to value. Stock options can result in high levels of compensation of executives for mediocre business results.