Kentucky Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp.

Description

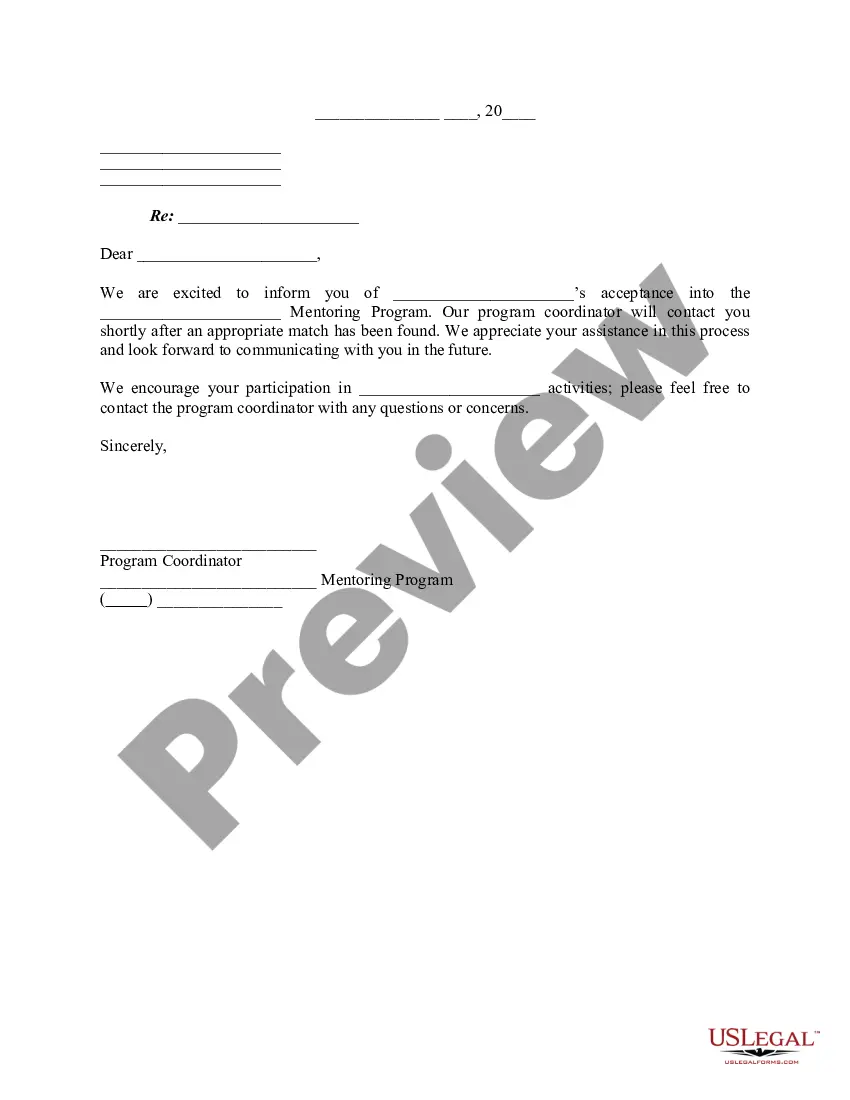

How to fill out Stock Option And Dividend Equivalent Plan With Exhibits Of UGI Corp.?

Have you been in the place the place you will need documents for sometimes company or specific uses virtually every working day? There are tons of legal document web templates available on the Internet, but discovering ones you can depend on is not easy. US Legal Forms provides thousands of develop web templates, just like the Kentucky Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp., that happen to be written to meet state and federal demands.

When you are already informed about US Legal Forms website and have a free account, merely log in. Following that, you may acquire the Kentucky Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp. web template.

Unless you provide an profile and would like to start using US Legal Forms, adopt these measures:

- Find the develop you will need and make sure it is for the correct city/state.

- Take advantage of the Review button to analyze the form.

- See the description to actually have selected the right develop.

- In case the develop is not what you`re searching for, utilize the Search area to find the develop that meets your needs and demands.

- When you discover the correct develop, simply click Buy now.

- Opt for the prices strategy you desire, fill in the required details to produce your account, and pay for an order utilizing your PayPal or bank card.

- Choose a handy document file format and acquire your duplicate.

Discover all of the document web templates you have purchased in the My Forms food selection. You may get a additional duplicate of Kentucky Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp. anytime, if necessary. Just click on the necessary develop to acquire or print out the document web template.

Use US Legal Forms, by far the most extensive collection of legal types, to save lots of efforts and steer clear of blunders. The services provides skillfully created legal document web templates which can be used for a selection of uses. Create a free account on US Legal Forms and commence producing your daily life a little easier.

Form popularity

FAQ

A dividend equivalent payment is treated as a dividend from sources within the United States. ingly, the dividend is subject to the flat 30-percent withholding tax (or lower withholding tax rate, if provided for by a treaty) if received by a nonresident alien or foreign corporation (IRC § 871(m); Reg. §1.881-2). Dividend Equivalent Payments - Income Taxes - Explanations CCH Answer Connect ? irc ? explanation ? di... CCH Answer Connect ? irc ? explanation ? di...

UGI's transfer agent, Computershare Trust Company, N.A., sponsors and administers the direct stock purchase of UGI Corporation stock.

A dividend equivalent payment is treated as a dividend from sources within the United States. ingly, the dividend is subject to the flat 30-percent withholding tax (or lower withholding tax rate, if provided for by a treaty) if received by a nonresident alien or foreign corporation (IRC § 871(m); Reg. §1.881-2).

A dividend equivalent right entitles the recipient to receive credits equal to the cash or stock dividends or other distributions that would have been received on shares of stock had the shares been issued and outstanding on the dividend record date.