Kentucky Application for Waiver of the Chapter 7 Filing Fee

Description

How to fill out Application For Waiver Of The Chapter 7 Filing Fee?

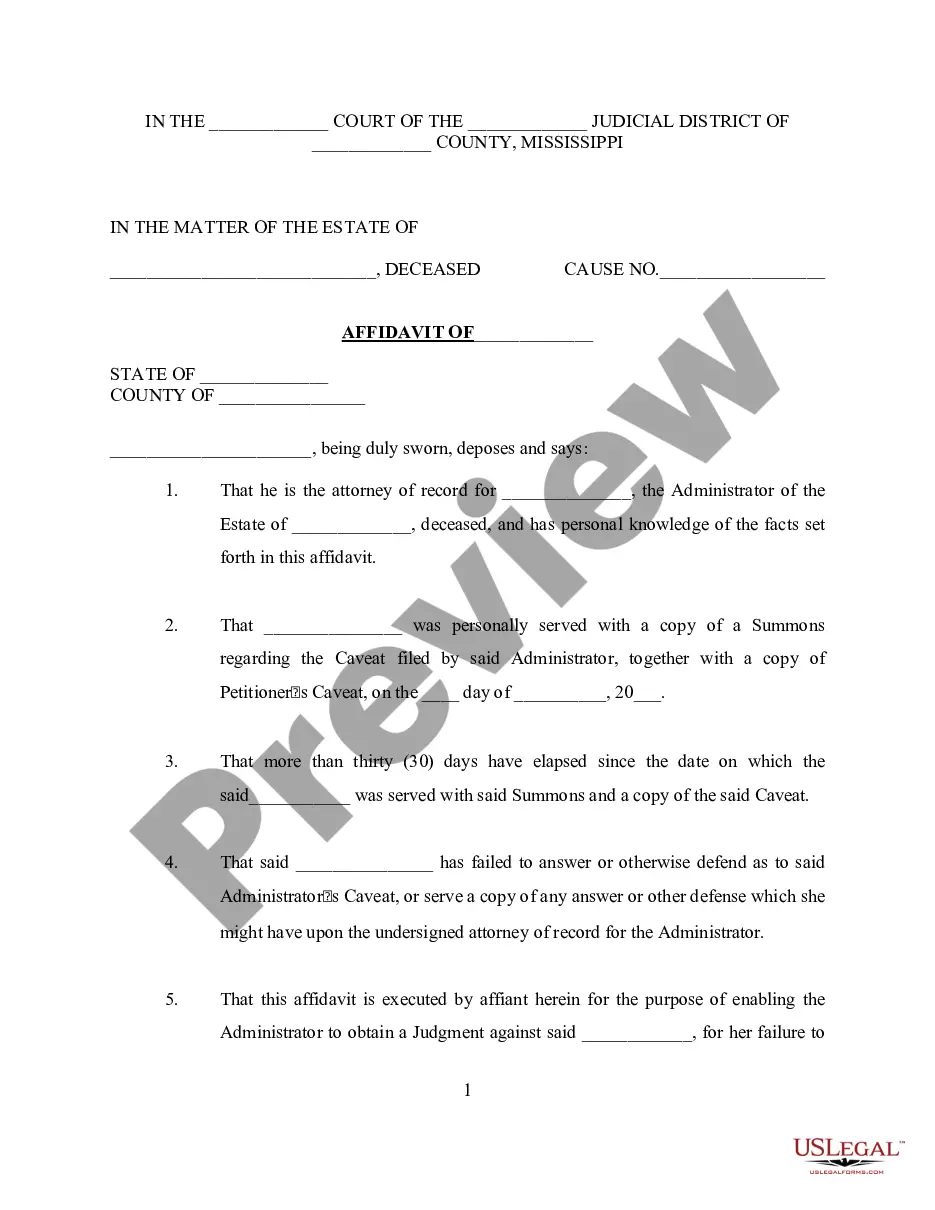

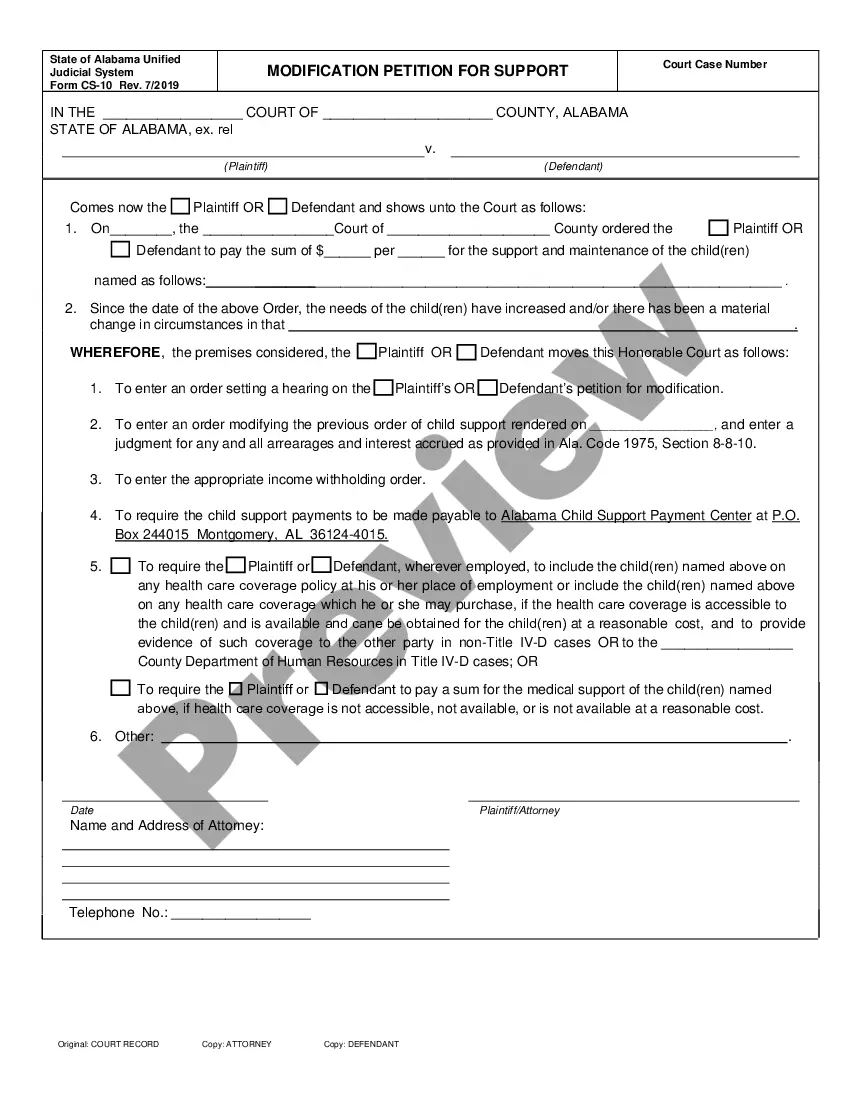

Discovering the right legal file web template can be quite a have difficulties. Of course, there are tons of templates accessible on the Internet, but how do you discover the legal form you want? Use the US Legal Forms web site. The support offers thousands of templates, for example the Kentucky Application for Waiver of the Chapter 7 Filing Fee, which can be used for enterprise and private needs. Each of the varieties are checked out by professionals and satisfy state and federal needs.

Should you be already listed, log in to your profile and then click the Obtain button to get the Kentucky Application for Waiver of the Chapter 7 Filing Fee. Make use of profile to search throughout the legal varieties you possess ordered formerly. Check out the My Forms tab of the profile and acquire an additional version from the file you want.

Should you be a new customer of US Legal Forms, here are straightforward directions for you to adhere to:

- First, ensure you have chosen the appropriate form for your city/area. It is possible to look over the form utilizing the Preview button and read the form information to ensure it is the best for you.

- When the form does not satisfy your expectations, use the Seach area to obtain the correct form.

- When you are positive that the form is suitable, select the Buy now button to get the form.

- Pick the prices program you would like and enter the essential details. Build your profile and pay money for your order making use of your PayPal profile or bank card.

- Pick the file structure and download the legal file web template to your product.

- Comprehensive, change and print out and signal the received Kentucky Application for Waiver of the Chapter 7 Filing Fee.

US Legal Forms is definitely the biggest library of legal varieties for which you can discover various file templates. Use the service to download professionally-created papers that adhere to condition needs.

Form popularity

FAQ

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or your car while also discharging unsecured debt.

Not All Debts Are Discharged Certain debts will remain on your account when you file for Chapter 7 bankruptcy. You will still be responsible for alimony and child support. Tax liens, student loans, and personal injury debts caused by intoxicated drivers are still on the docket, as well.

Of the two options, Chapter 7 is more popular because filers don't have to pay back part of their debts. Chapter 13 may be a better solution if you're in arrears on your mortgage because you can keep your house in Chapter 13 and have time to get caught up on payments.