Kentucky Work for Hire Addendum - Self-Employed

Description

How to fill out Work For Hire Addendum - Self-Employed?

You might spend hours online searching for the official document template that fulfills the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can effortlessly obtain or print the Kentucky Work for Hire Addendum - Self-Employed from your services.

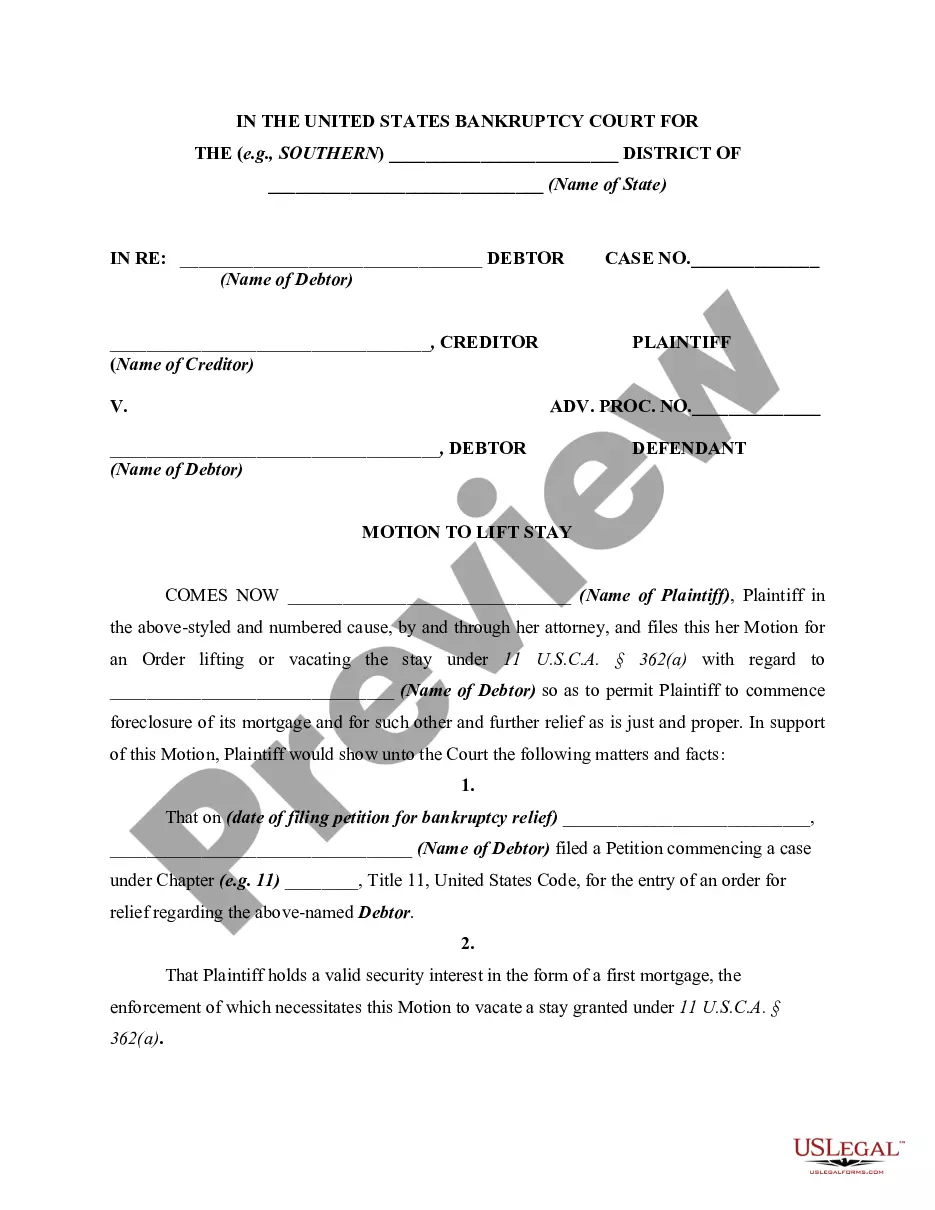

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, edit, print, or sign the Kentucky Work for Hire Addendum - Self-Employed.

- Every legal document template you receive is yours permanently.

- To obtain another copy of the purchased template, navigate to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions below.

- First, make sure you have selected the correct document template for the state/city of your choice.

- Review the template description to ensure you have selected the correct document.

Form popularity

FAQ

No new PUA claims will be accepted after March 13, 2021. As before, people will continue to request their benefits every two weeks. PEUC recipients who ran out of benefit weeks before the week ending Dec. 26, 2020, will also need to file a new claim.

Steps to Hiring your First Employee in KentuckyStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Pandemic Unemployment Assistance (PUA) provides payment to workers not traditionally eligible for unemployment benefits (self-employed, independent contractors, workers with limited work history, and others) who are unable to work as a direct result of the coronavirus public health emergency.

9 Mistakes to Avoid When Hiring & Managing 1099 ContractorsHiring an independent contractor without consulting your human resources department.Not putting an independent contractor agreement in place.Not having an independent contractor policy in place.Moving forward without setting goals or schedules.More items...?

Eligibility Requirements for Kentucky Unemployment BenefitsYou must have earned at least a minimum amount in wages before you were unemployed.You must be unemployed through no fault of your own, as defined by Kentucky law.You must be able and available to work, and you must be actively seeking employment.

To be eligible for benefits you must: (1) Be unemployed or working less than full-time (2) Have earned enough money to establish a valid claim (3) Be unemployed through no fault of your own (4) Be able to work, available for work, and looking for work.

PUA is a federally funded program providing 39 weeks of unemployment benefits for workers not otherwise eligible for regular UI benefits, self-employed individuals, contract workers and business owners who have become unemployed directly due to the COVID-19 pandemic.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.