Kentucky Employee Payroll Records Checklist

Description

How to fill out Employee Payroll Records Checklist?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a vast assortment of legal form templates that you can obtain or print.

Through the website, you can access countless forms for business and personal purposes, organized by categories, states, or keywords. You can swiftly obtain the latest forms like the Kentucky Employee Payroll Records Checklist.

If you have an active subscription, Log In to retrieve the Kentucky Employee Payroll Records Checklist from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Complete the payment process. Use a Visa or Mastercard or PayPal account to finalize the payment.

Choose the format and download the form to your device. Make changes. Fill out, modify, and print or sign the downloaded Kentucky Employee Payroll Records Checklist. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply return to the My documents section and select the desired form. Access the Kentucky Employee Payroll Records Checklist with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that address your business or personal needs.

- Ensure you select the correct form for your locality/region.

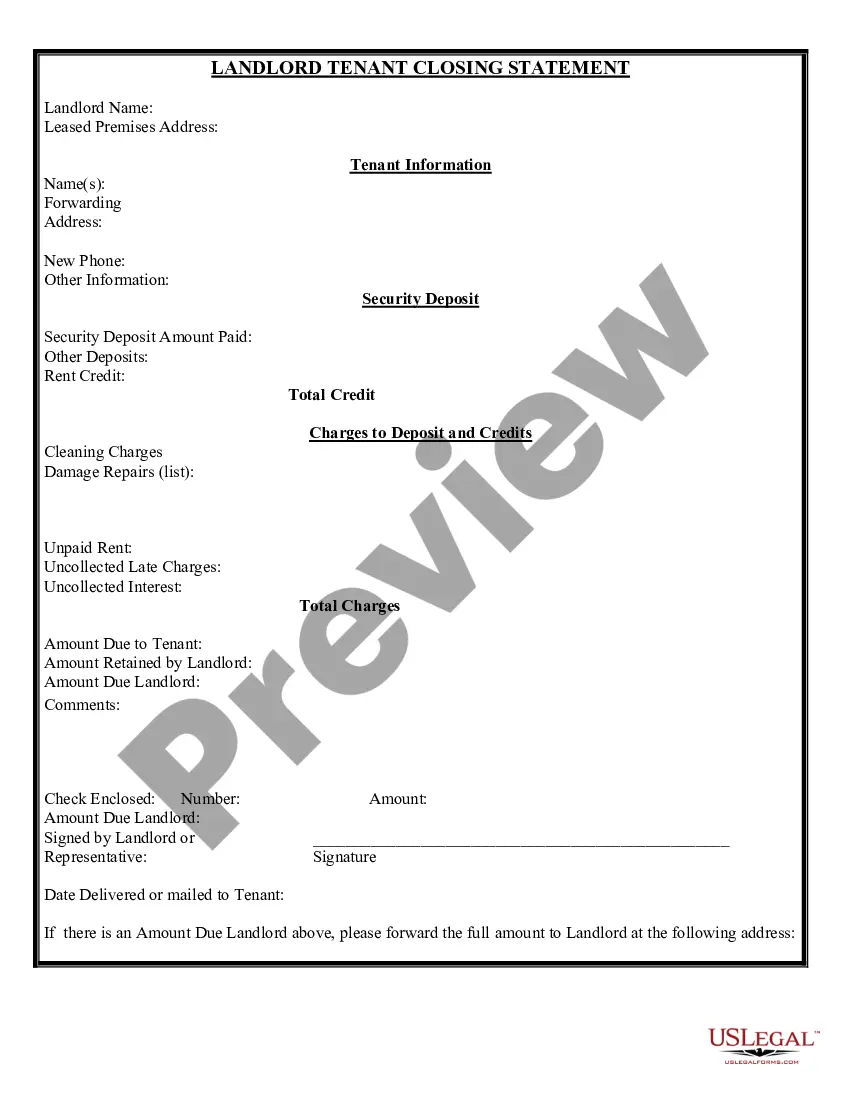

- Click the Preview button to review the contents of the form.

- Check the form description to confirm you have chosen the appropriate document.

- If the form does not meet your requirements, use the Lookup feature at the top of the screen to find one that does.

- Once satisfied with the form, verify your choice by clicking the Get now button.

- Then, select your preferred pricing plan and provide your credentials to create an account.

Form popularity

FAQ

For effective payroll processing, you will need several important documents. These include employee tax forms, timesheets, payroll policies, and documentation of wage rates. Use the Kentucky Employee Payroll Records Checklist to verify that you have all required paperwork to ensure smooth and compliant payroll operations.

To file Kentucky Form K-5, you need to complete the form with accurate financial data. Make sure to include all pertinent information, and then submit it either electronically or by mail to the specified department. Following the Kentucky Employee Payroll Records Checklist can help streamline this process and ensure all necessary information is provided.

Maintaining employee records involves keeping various essential documents. Some critical documents include hiring forms, tax withholding forms, payroll records, and performance evaluations. Consult the Kentucky Employee Payroll Records Checklist to ensure you stay compliant and retain all necessary documentation for your workforce.

Filing a K-1 in Kentucky requires specific steps. First, you need to gather all necessary information from the entity with which you are associated. Once you have the required data, fill out the appropriate forms accurately, and submit them to the Kentucky Department of Revenue, ensuring you comply with the Kentucky Employee Payroll Records Checklist for accurate documentation.

Every employee's payroll file should contain essential documents to ensure compliance and accuracy. Key items include the employee's W-4 form, tax identification documents, wage agreements, and any benefit enrollment forms. These elements help maintain thorough records and can simplify the auditing process, making your Kentucky Employee Payroll Records Checklist more effective.

To accurately manage payroll, you need specific information for each employee. Typically, this includes the employee's name, address, Social Security number, and tax withholding details. Additionally, you should keep track of their salary or hourly wage and any deductions. This information forms the basis of your Kentucky Employee Payroll Records Checklist.

Yes, Kentucky is classified as a public record state, meaning that many types of records, including court and property records, are accessible to the public. This transparency allows residents to obtain information easily, which can be especially important in employee management. For comprehensive guidance on navigating public records, the Kentucky Employee Payroll Records Checklist offers a structured approach to ensuring compliance.

An employee file should include various critical documents such as a completed job application, tax withholding forms, and signed company policies. Additionally, performance evaluations and records of disciplinary actions are important for maintaining compliance. For employers aiming to ensure they have all necessary documentation, the Kentucky Employee Payroll Records Checklist can serve as a valuable tool.

Yes, Kentucky divorce records are generally considered public documents. Anyone can request access to these records, which provide important information about the dissolution of marriages in the state. For those managing employee records, understanding public access to documents like divorce records can be vital. You can navigate these requirements effectively with our Kentucky Employee Payroll Records Checklist.

You can get a Kentucky withholding account number by applying through the Kentucky Department of Revenue. This number is linked to your business and its payroll obligations. Keeping this number handy is essential for your Kentucky Employee Payroll Records Checklist; it simplifies your calculations and tax submissions.