Kentucky FLSA Exempt / Nonexempt Compliance Form

Description

How to fill out FLSA Exempt / Nonexempt Compliance Form?

Are you presently situated in a location where you require documents for both business and personal purposes on a daily basis.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers thousands of form templates, such as the Kentucky FLSA Exempt / Nonexempt Compliance Form, which can be tailored to meet state and federal requirements.

Once you find the correct form, click Purchase now.

Choose the pricing plan you prefer, fill out the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Kentucky FLSA Exempt / Nonexempt Compliance Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct region/area.

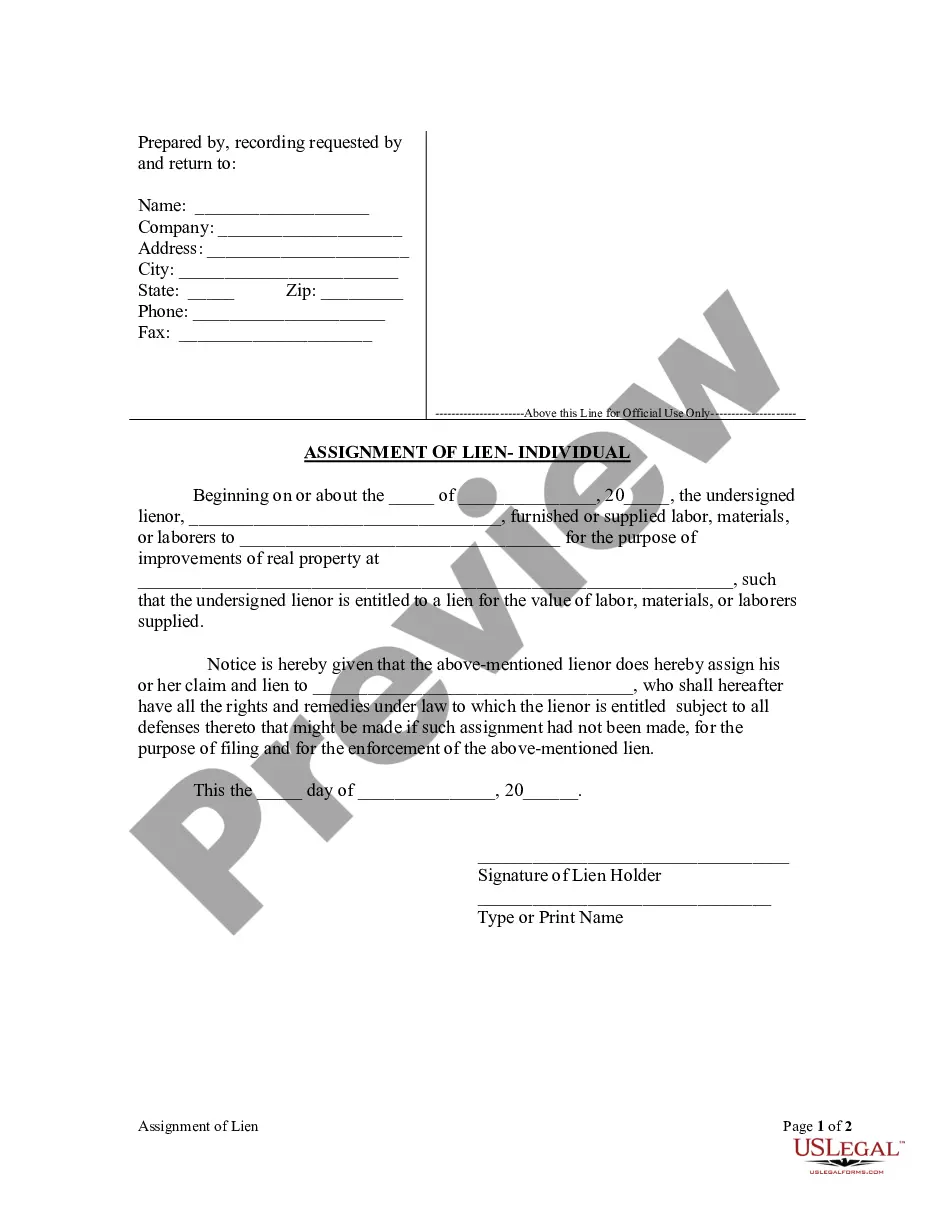

- Use the Preview button to view the form.

- Read the description to ensure you have selected the right form.

- If the form is not what you are seeking, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

An employee's FLSA status is whether that employee is classified as exempt or nonexempt according to the Fair Labor Standards Act (FLSA). An employee who is nonexempt is entitled to receive overtime pay after they work a certain number of hours, while exempt employees are not eligible for overtime.

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in Federal, State, and local governments.

In Kentucky, employers must allow employees to take a short (less than 20 minutes) paid rest period for every four hours worked. Employees are also allowed to take an unpaid lunch break when they work any shift that is longer than five hours.

The FLSA also defines what kind of behavior can be considered working. For example, the FLSA is the reason you do not get paid for your commute to work, but you should get paid for any work you do, no matter what the time or place.

Executive, administrative, professional and outside sales employees: (as defined in Department of Labor regulations) and who are paid on a salary basis are exempt from both the minimum wage and overtime provisions of the FLSA.

Section 7(k) of the FLSA provides that employees engaged in fire protection or law enforcement may be paid overtime on a work period basis. A work period may be from 7 consecutive days to 28 consecutive days in length.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

How to Make Sure You Stay Compliant with FLSA RequirementsAudit Jobs to Understand which are Exempt and Non-Exempt.Check the Minimum Wage Requirement in Your State.Pay for All Time Worked Even if it Is Unauthorized Overtime.Keep Detailed Documentation of All Non-Exempt Employees.

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments.

Standards Act (FLSA) However, Section 13(a)(1) of the FLSA provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive, administrative, professional and outside sales employees.