Kentucky Bill of Sale of Personal Property - Reservation of Life Estate in Seller

Description

How to fill out Bill Of Sale Of Personal Property - Reservation Of Life Estate In Seller?

Have you ever been in a situation where you require documents for either business or personal purposes almost constantly.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms provides a vast selection of form templates, including the Kentucky Bill of Sale of Personal Property - Reservation of Life Estate in Seller, designed to meet state and federal regulations.

Select a suitable file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Kentucky Bill of Sale of Personal Property - Reservation of Life Estate in Seller at any time, if needed. Just click on the desired form to download or print the template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create your account at US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Kentucky Bill of Sale of Personal Property - Reservation of Life Estate in Seller template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/region.

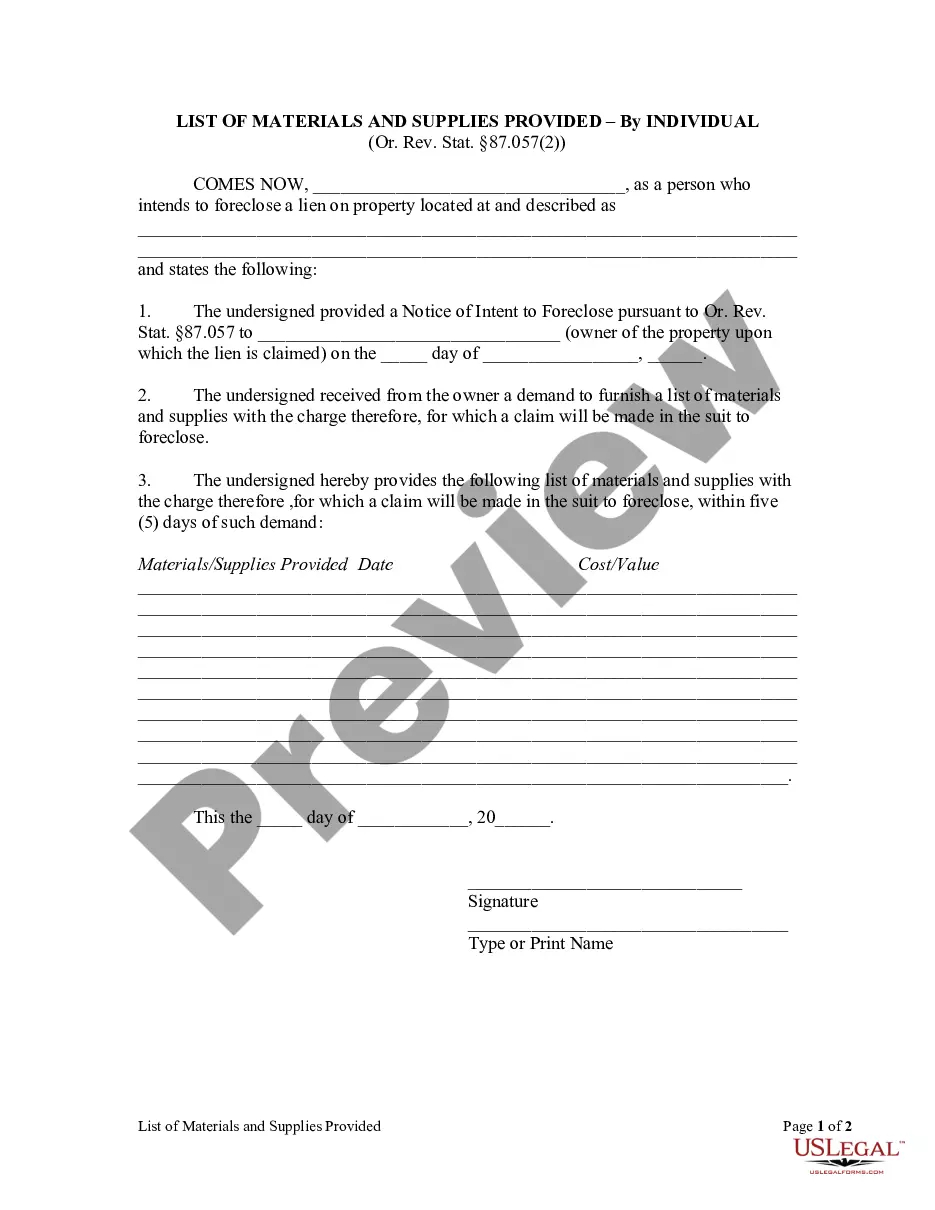

- Use the Preview feature to review the form.

- Check the summary to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Research field to find the form that suits your needs and requirements.

- When you find the correct form, click Purchase now.

- Choose the pricing plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

When you create a life estate, a gift is automatically made to your children. The gift is known as the remainder interest. This gift disqualifies you for medical assistance (help with nursing home bills) for the then applicable "look back" period.

Estate and gift taxes are a linked set of federal taxes that apply to transfers of wealth. In 2021, estates face a 40 percent tax rate on their value above $11.7 million, although various deductions reduce the value subject to the tax. The same threshold and tax rate apply to gift taxes.

Key Takeaways. A life estate is a type of joint property ownership. Under a life estate, the owners have the right to use the property for life. Typically, the life estate process is adopted to streamline inheritance while avoiding probate.

The transfer by deed of the residence with a retained life estate will therefore be taxed for gift tax purposes at the fair market value of the entire residence, without reduction for the value of the retained life estate and without the annual $10,000 exclusion.

In a nutshell, real property is anything that's immovable and attached to the house - walls, windows, blinds, light fixtures, doors, and (most) appliances. Personal property is anything that can be moved or taken from the house - furniture, artwork, above-ground hot tubs, and more.

Personal property may not be included as additional security for any mortgage on a one-unit property unless otherwise specified by Fannie Mae. For example, certain personal property is pledged when the Multistate Rider and Addenda (Form 3170) is used.

Everything you own, aside from real property, is considered personal property. This includes material goods such as all of your clothing, any jewelry, all of your household goods and furnishings, and anything else that is movable and not permanently attached to a fixed location such as your home.

If an object is physically and permanently attached or fastened to the property, it's considered a fixture. This includes items that have been bolted, screwed, nailed, glued or cemented onto the walls, floors, ceilings or any other part of the home. A classic example of this is a window treatment.

Life estate consThe life tenant cannot change the remainder beneficiary without their consent.If the life tenant applies for any loans, they cannot use the life estate property as collateral.There's no creditor protection for the remainderman.You can't minimize estate tax.More items...

Legally, the items you listed are personal property because they are not permanently attached to the house. Unless specifically itemized, such personal property is not included in the home sale.