Kentucky Application for Employment or Work

Description

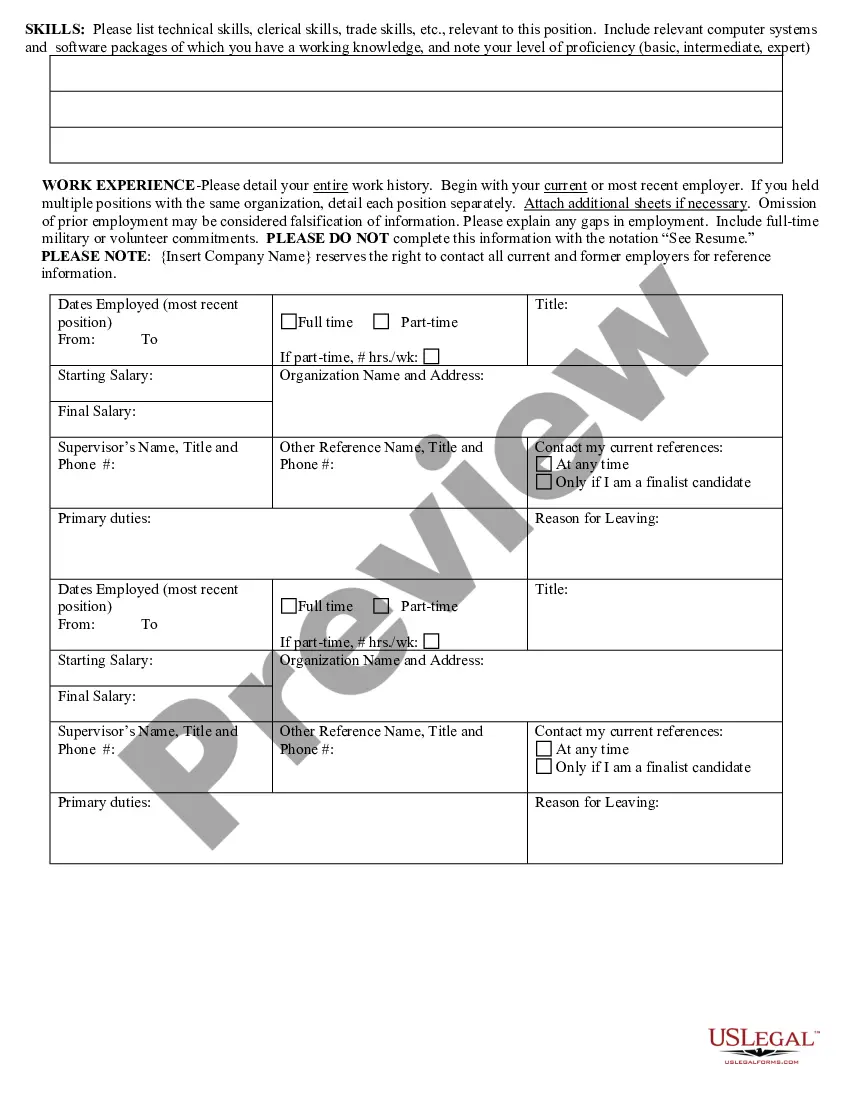

How to fill out Application For Employment Or Work?

It is feasible to spend hours online searching for the official document format that satisfies the federal and state requirements you will need.

US Legal Forms provides thousands of official templates that have been evaluated by experts.

You can easily acquire or print the Kentucky Application for Employment or Work from our service.

If you wish to locate another version of the form, utilize the Search field to find the format that suits your needs and requirements. Once you have found the format you want, click Buy now to continue. Select the pricing plan you desire, enter your information, and register for an account on US Legal Forms. Complete the purchase. You can use your credit card or PayPal account to buy the official form. Choose the format of the document and download it to your device. Make changes to your document if applicable. You can complete, alter, sign, and print the Kentucky Application for Employment or Work. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of official forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Kentucky Application for Employment or Work.

- Each official document format you download is yours permanently.

- To retrieve an additional copy of any purchased form, visit the My documents section and click the appropriate button.

- If you are accessing the US Legal Forms site for the first time, follow the straightforward steps below.

- First, ensure you have selected the correct document format for your state/region of choice. Check the form description to confirm you have chosen the accurate form.

- If available, utilize the Preview button to browse the document format as well.

Form popularity

FAQ

Each state sets its own unemployment insurance benefits eligibility guidelines, but you usually qualify if you: Are unemployed through no fault of your own. In most states, this means you have to have separated from your last job due to a lack of available work. Meet work and wage requirements.

1. You must have worked for at least two calendar quarters. A calendar quarter is three months of the year. In other words, you cannot claim unemployment benefits unless you have worked for at least six months.

To be eligible for benefits you must: (1) Be unemployed or working less than full-time (2) Have earned enough money to establish a valid claim (3) Be unemployed through no fault of your own (4) Be able to work, available for work, and looking for work.

Quit a job as a direct result of COVID-19; Place of employment closed as a direct result of COVID-19; Had insufficient work history and affected by COVID-19; Otherwise not qualified for regular or extended UI benefits and affected by COVID-19.

Retroactive benefits (or back pay) is legally required to be made by state unemployment departments for all eligible weeks under the PUA and PEUC programs. Weeks where claimants got at least $1 of unemployment would also qualify them for the extra $300 FPUC program payment.

Effective July 1, 2020 the minimum rate is $39 and the maximum rate is $569 per week regardless of how high the wages are. There must be at least $1500 in one of the 4 quarters or the claim will be invalid. The total wages outside of the highest quarter must be at least $1,500.

Kentucky unemployment benefits are only for those who are unemployed but actively seeking work. You are required to look for work the entire time you collect benefits without limiting your search to one source. Keep accurate records of your job search.

You may work part-time and still collect unemployment. You may also file a claim when your employer has significantly reduced your wages (through no fault of your own). However, the wages you earn will be deducted from your WBR. The state will deduct 80% of your gross pay during the week you earned wages.

Appointments are available for in-person and phone appointments at select Kentucky Career Center locations. These appointments are for individuals who need unemployment insurance or job seeker assistance. You must provide a valid phone number where you can be reached when scheduling your appointment.

Q: How do I apply? A: Apply by visiting kcc.ky.gov or by calling 502-875-0442.