Kentucky Application for Military Leave Bank

Description

How to fill out Application For Military Leave Bank?

You can spend several hours online attempting to locate the valid document template that satisfies the state and federal stipulations you will require.

US Legal Forms offers thousands of valid forms that can be inspected by professionals.

You can easily acquire or print the Kentucky Application for Military Leave Bank from your services.

If you wish to find another version of the form, use the Search area to locate the template that meets your needs and specifications. Once you have found the template desired, click Acquire now to proceed. Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the transaction using your Visa or Mastercard or PayPal account to purchase the valid form. Choose the format of the document and download it to your device. Make adjustments to your document if possible. You can complete, edit, and sign and print the Kentucky Application for Military Leave Bank. Download and print thousands of document templates through the US Legal Forms website, which provides the largest collection of valid forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you already possess a US Legal Forms account, you may Log In and select the Download option.

- Then, you can complete, edit, print, or sign the Kentucky Application for Military Leave Bank.

- Each valid document template you obtain is yours indefinitely.

- To get another copy of a purchased form, navigate to the My documents section and click on the relevant option.

- When using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, confirm that you have selected the correct document template for your chosen county/town.

- Review the form summary to ensure you have chosen the right form.

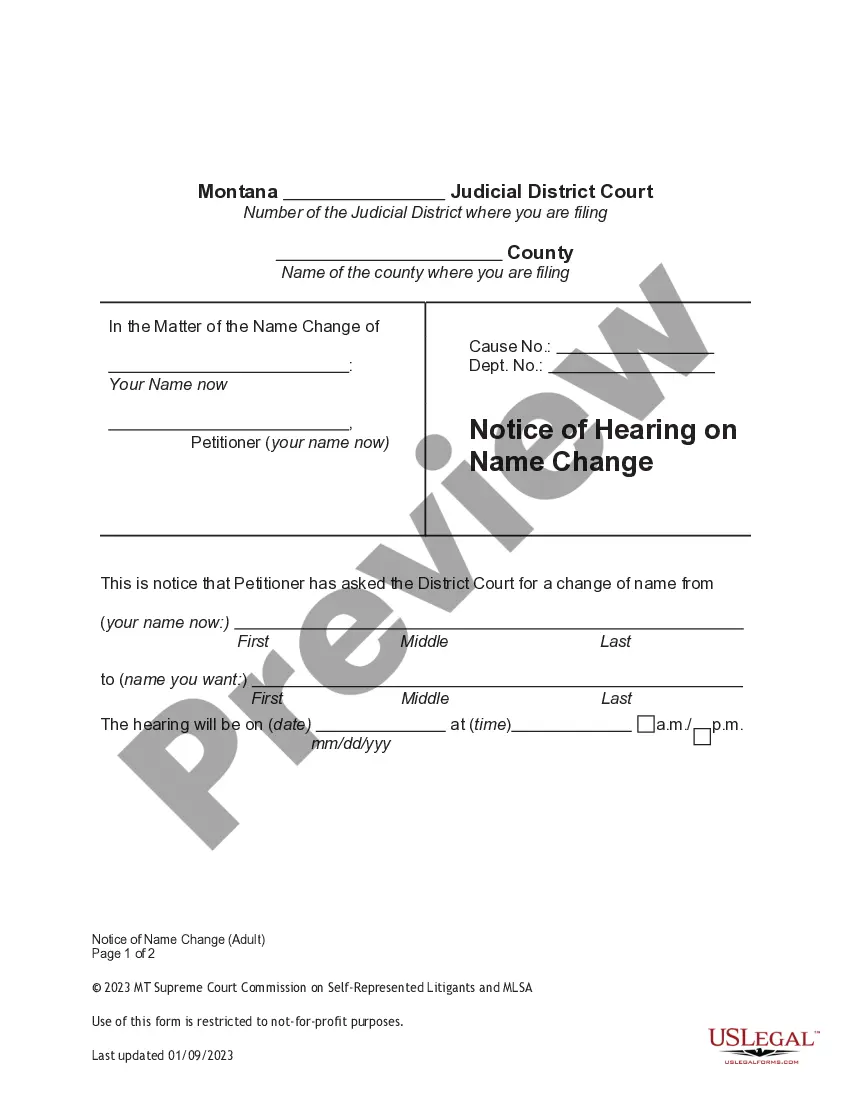

- If available, utilize the Preview option to view the document template as well.

Form popularity

FAQ

Taxes. In general, unless earned in a designated combat zone, all military pay items are taxable. Military allowances (such as housing allowance, overseas housing allowance, family separation allowance, basic allowance for subsistence) are not taxable by either the federal or state governments.

Leave is valued at 1/30 of base pay per day cashed in. No other allowances, such as BAH or BAS, are included in the value of leave. 37 U.S. Code § 501(b)(1). For enlisted members only, discharge includes the expiration of an enlistment term, even if the member reenlists.

Military income: Military pay is taxable if stationed in California.

Generally, only public employers are required to pay for any part of military leave. Private employers may grant annual leave with or without pay and may pay for all or part of the leave. In the case of active duty leave, the employer may adopt a policy of paying the difference between civilian pay and military pay.

Does Kentucky tax active duty military pay? No. Beginning with tax year 2010, Kentucky does not tax active duty military pay.

As part of the military pay and benefits package, military service members earn 30 days of paid leave per year. You start at zero and for every month of military service, 2.5 days of leave get added to your leave account.

No. As stated previously, an employer may not require documentation for notification prior to military duty. Further, an employer does not have a"right of refusal" for military leave of absence, so long as the employee has not exceeded the 5 years of cumulative service provided under USERRA.

Submit your Military Leave of absence through HR/Pay »:Navigate to Self Service > Time Reporting > Report Time > Absence Request.Select Military Leave in the absence name field.Select either Training or Deployment in the reason name field.

How to request leave. Every command will have its own procedures for requesting leave. It may involve a paper or electronic leave request form, sometimes called a leave chit. The command will then approve or deny the leave request.

In the military, the federal government generally only taxes base pay, and many states waive income taxes. Other military paythings like housing allowances, combat pay or cost-of-living adjustmentsisn't taxed.