Kentucky Assignment of Equipment Lease by Dealer to Manufacturer

Description

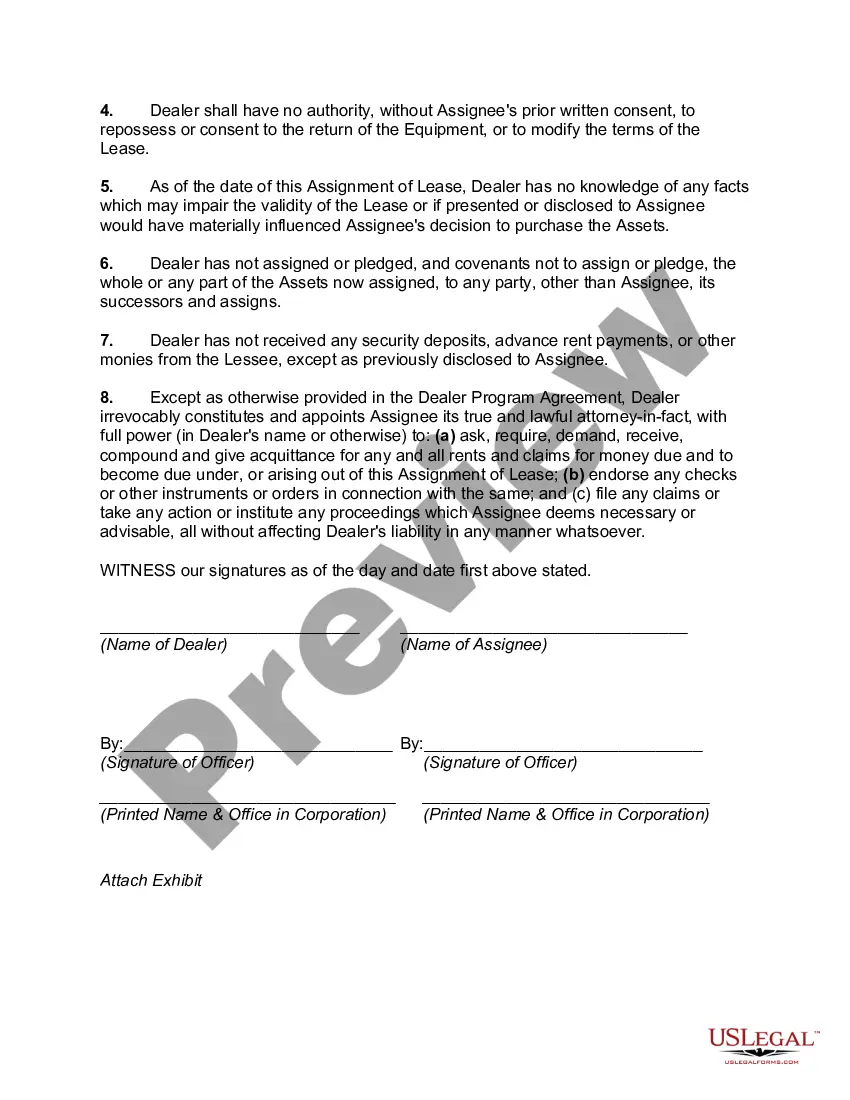

How to fill out Assignment Of Equipment Lease By Dealer To Manufacturer?

If you have to complete, download, or printing authorized record templates, use US Legal Forms, the greatest variety of authorized varieties, which can be found on the web. Use the site`s simple and practical lookup to obtain the papers you want. Numerous templates for enterprise and personal purposes are sorted by types and suggests, or search phrases. Use US Legal Forms to obtain the Kentucky Assignment of Equipment Lease by Dealer to Manufacturer in a couple of clicks.

When you are presently a US Legal Forms client, log in to your account and click on the Obtain switch to obtain the Kentucky Assignment of Equipment Lease by Dealer to Manufacturer. You may also access varieties you previously saved from the My Forms tab of your respective account.

If you are using US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for the appropriate metropolis/land.

- Step 2. Make use of the Preview solution to look through the form`s articles. Never neglect to read the outline.

- Step 3. When you are unsatisfied together with the type, use the Lookup discipline at the top of the display screen to discover other types of your authorized type template.

- Step 4. When you have located the form you want, select the Purchase now switch. Opt for the prices plan you choose and include your accreditations to sign up on an account.

- Step 5. Process the financial transaction. You can use your bank card or PayPal account to perform the financial transaction.

- Step 6. Choose the format of your authorized type and download it on your system.

- Step 7. Full, revise and printing or signal the Kentucky Assignment of Equipment Lease by Dealer to Manufacturer.

Every single authorized record template you buy is yours for a long time. You may have acces to every type you saved within your acccount. Go through the My Forms segment and select a type to printing or download again.

Contend and download, and printing the Kentucky Assignment of Equipment Lease by Dealer to Manufacturer with US Legal Forms. There are millions of professional and state-particular varieties you can use for the enterprise or personal requires.

Form popularity

FAQ

The three main types of leasing are finance leasing, operating leasing and contract hire.

How to Record "Lease to Own" Computer assetCreate Other Current Liability account for the loan/lease payable.Create Fixed Asset account for Computer Equipment.You must use a General Journal Entry, as taxes cannot be entered from the register.

Various Types of Lease: Finance, Operating, Direct, LeveragedVarious Types of Lease.(1) Finance lease :(2) Operating lease :(3) Sale and lease back :(4) Direct lease :(5) Single investor lease :(6) Leveraged lease :(7) Domestic Lease :More items...

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

Leasing works like a rental agreement. You pay the equipment's owner a set fee every agreed period and you can use the asset as though it was your own. Under a lease, nobody else can use the equipment without your permission and for all intents and purposes, it's as though you own the piece of equipment.

Because they are both a form of lease, they have one thing in common. That is, the owner of the equipment (the lessor) provides to the user (the lessee) the authority to use the equipment and then returns it at the end of a set period.

It is retained by the lessor during and after the lease term and cannot contain a bargain purchase option. The term is less than 75% of the asset's estimated economic life and the present value (PV) of lease payments is less than 90% of the asset's fair market value.

Key takeaway: With an operating lease, you have access to the equipment for a time but don't own it. The lease period tends to be shorter than the life of the equipment. With a finance lease, you own the equipment at the end of the term. Big companies typically use this type of lease.

A lease will always have at least two parties: the lessor and the lessee. The lessor is the person or business that owns the equipment. The lessee is the person or business renting the equipment. The lessee will make payments to the lessor throughout the contract.