Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor

Description

How to fill out Assignment Of Personal Property Lease With Acceptance And Assumption Of Obligations Of Lessee And Consent Of Lessor?

If you wish to finalize, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to obtain the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to access the Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor in just a few clicks.

Every legal document template you acquire is yours indefinitely. You will have access to each form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Complete, download, and print the Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the appropriate city/state.

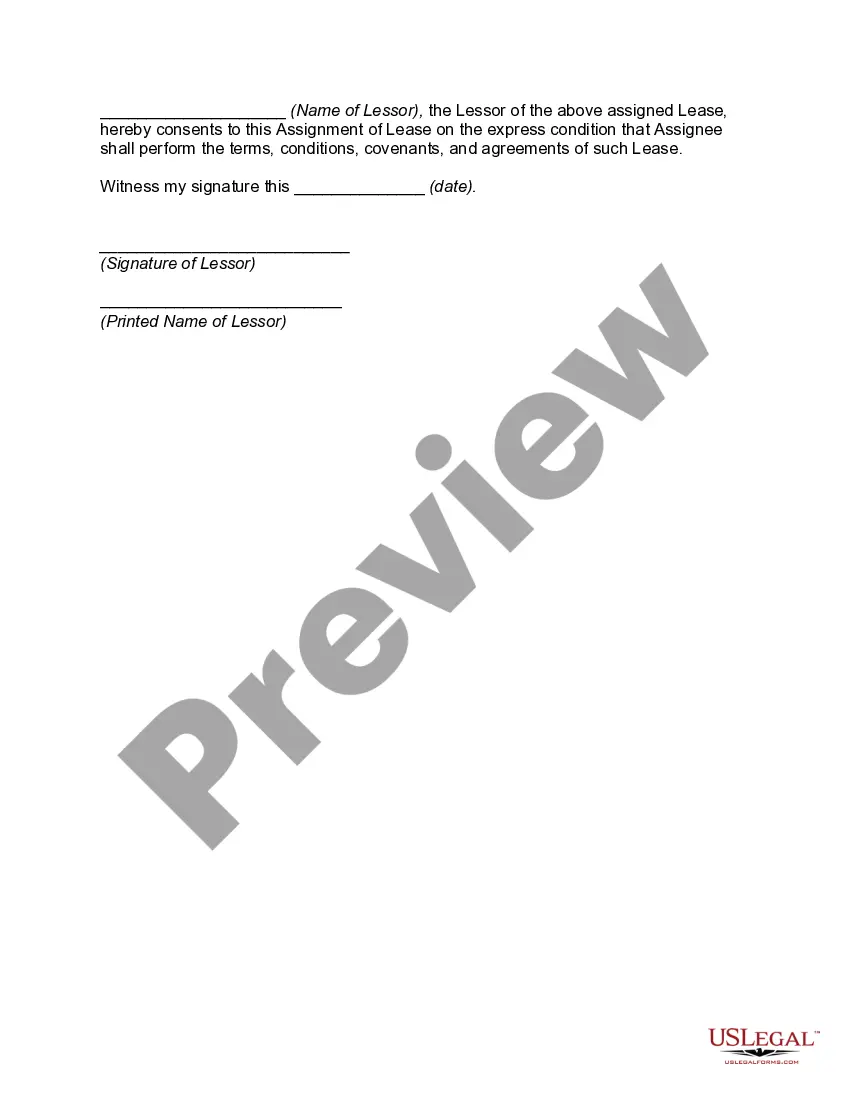

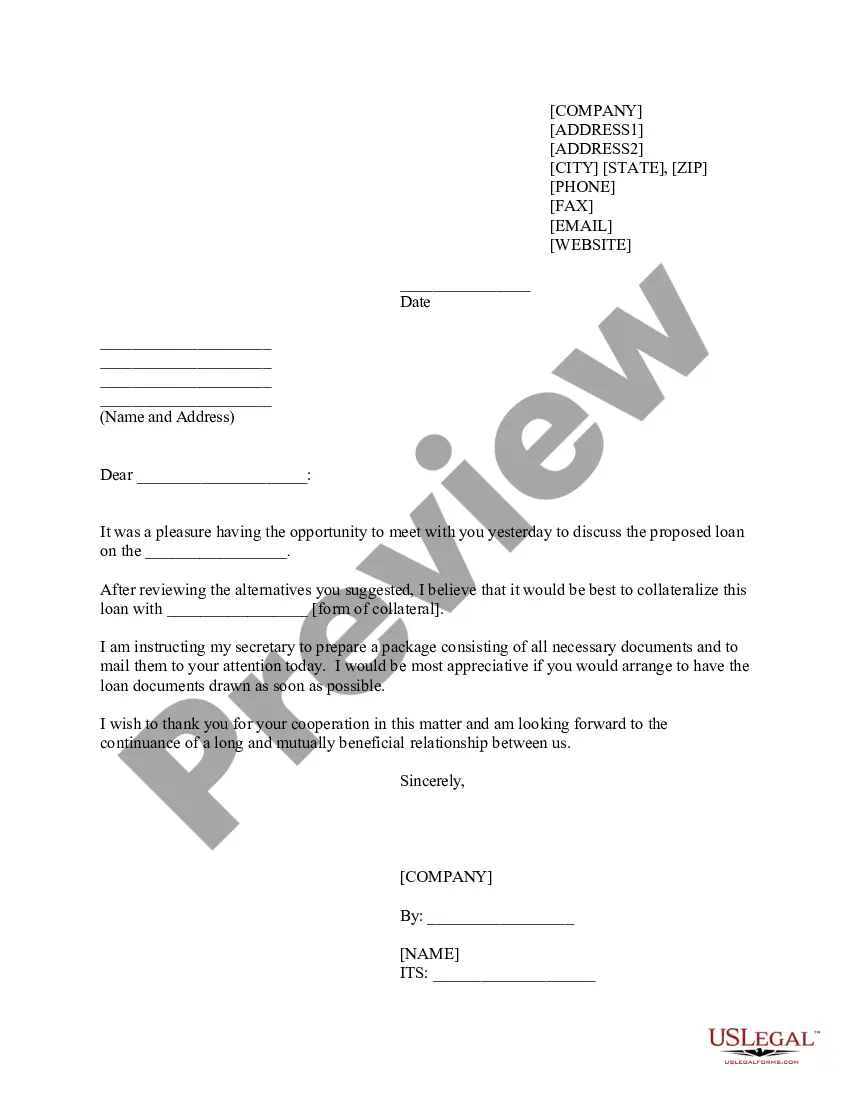

- Step 2. Use the Preview option to review the form's content. Don't forget to read through the description.

- Step 3. If you are not satisfied with the template, utilize the Search field at the top of the screen to find other versions of the legal document format.

- Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, amend, and print or sign the Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor.

Form popularity

FAQ

In Kentucky, leases typically do not require notarization to be legally binding; however, it can provide additional security. While notarization may not be necessary, it can help verify the identities of the parties involved. Utilizing a Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor can help outline the terms clearly, offering peace of mind for all parties, especially in significant transactions.

Yes, most leases include a clause that prohibits assignment without the landlord's consent. This is an important aspect as it ensures the property owner can retain control over who occupies their property. Involving the Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor can provide clarity on how assignments should be handled, ensuring all parties understand their rights and obligations.

Property tax refers to taxes assessed on real estate, while tangible personal property tax is specifically aimed at physical items owned by individuals or businesses. In Kentucky, it's important to recognize these differences to effectively manage your tax liabilities. When involved in the Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor, understanding both tax categories can minimize complications.

Yes, Kentucky does levy a personal property tax on both tangible and intangible assets owned by individuals and businesses. This tax is assessed annually through local tax authorities. To properly address personal property tax obligations, one might consider utilizing services from USLegalForms, especially when dealing with the Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor.

Property tax typically refers to the tax levied on real estate, while personal tax can encompass taxes on wages, income, and certain asset holdings. In Kentucky, understanding these distinctions is vital for proper tax planning. The Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor may involve navigating both types of taxes, depending on the nature of the agreement.

In Kentucky, tangible personal property includes items such as cars, electronics, furniture, and machinery, as opposed to real estate or intangible assets. This classification is important for tax purposes and financial planning. Understanding what constitutes tangible personal property can benefit those managing leases under the Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor.

In Kentucky, the form for declaring personal property typically includes a personal property tax return, detailing the assets owned. This form must be submitted annually to the local property valuation administrator. It is crucial to accurately complete this form to facilitate the appropriate valuation in cases involving the Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor.

Yes, tangible property is a subset of personal property, specifically referring to physical items that can be touched or moved. Personal property encompasses both tangible items, like cars and jewelry, as well as intangible items, such as stocks and bonds. The understanding of these definitions can greatly impact the execution of the Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor.

An example of tangible property includes vehicles, computers, and office furniture. These items have physical presence and measurable value, which differentiate them from intangible assets like trademarks or patents. In the context of the Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor, tangible properties often form the core of lease agreements.

Tangible personal property taxes refer to taxes assessed on physical items owned by the taxpayer. In Kentucky, this includes assets like machinery, equipment, and furniture. The Kentucky Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor requires the proper assessment of such taxes to ensure compliance with local regulations.