Kentucky Renunciation of Legacy

Description

How to fill out Renunciation Of Legacy?

You can devote hrs on the web trying to find the lawful file format that meets the state and federal requirements you want. US Legal Forms provides a huge number of lawful varieties that happen to be reviewed by pros. You can easily down load or print the Kentucky Renunciation of Legacy from my support.

If you already possess a US Legal Forms bank account, it is possible to log in and then click the Down load option. Next, it is possible to full, edit, print, or signal the Kentucky Renunciation of Legacy. Every single lawful file format you buy is your own for a long time. To obtain yet another version associated with a obtained kind, go to the My Forms tab and then click the related option.

If you are using the US Legal Forms web site the first time, follow the easy recommendations below:

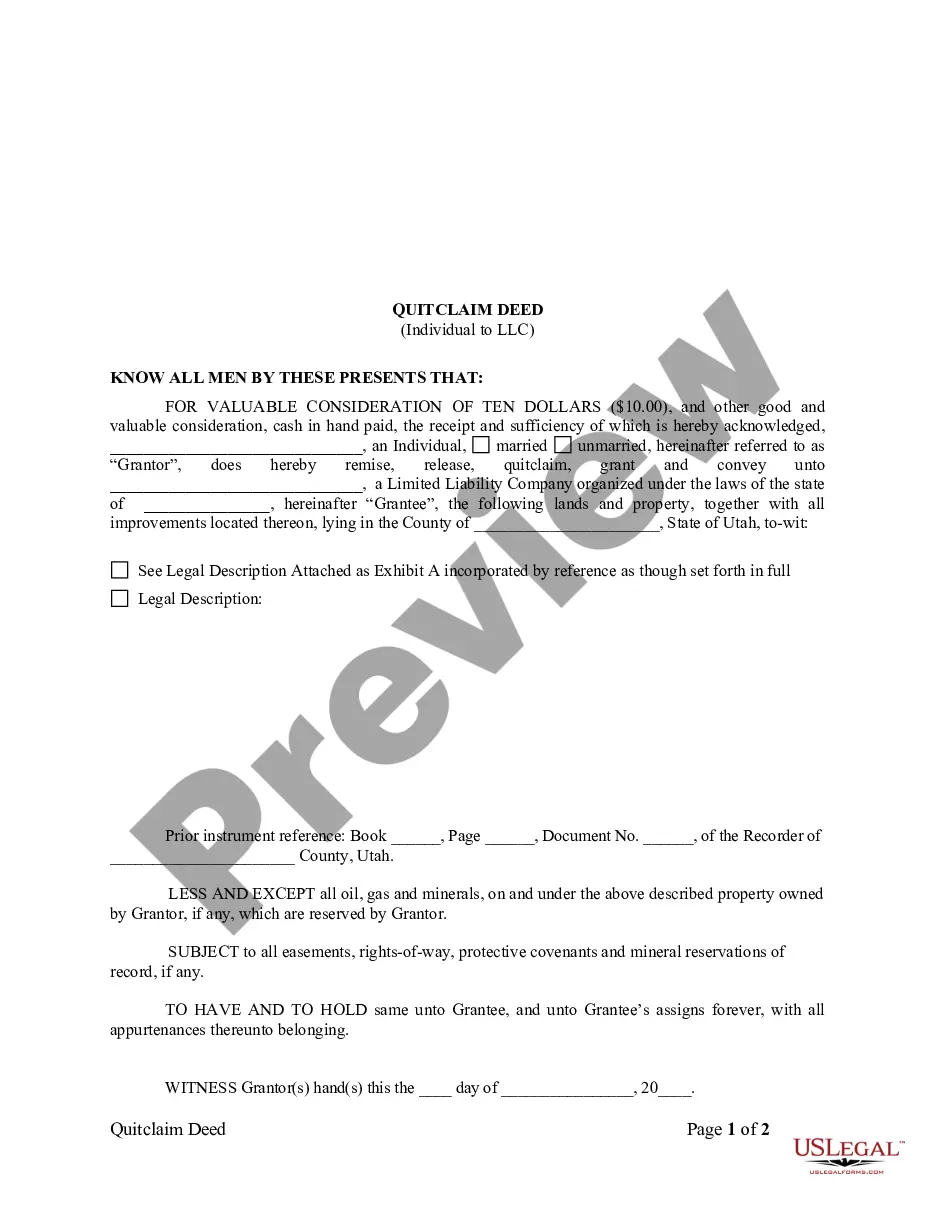

- Initially, be sure that you have selected the proper file format for the region/city that you pick. Look at the kind explanation to ensure you have chosen the appropriate kind. If available, utilize the Review option to search with the file format as well.

- If you wish to locate yet another model of the kind, utilize the Lookup area to find the format that meets your requirements and requirements.

- Upon having located the format you would like, click on Buy now to carry on.

- Find the prices program you would like, type your qualifications, and sign up for an account on US Legal Forms.

- Complete the financial transaction. You can use your bank card or PayPal bank account to pay for the lawful kind.

- Find the formatting of the file and down load it to the product.

- Make adjustments to the file if possible. You can full, edit and signal and print Kentucky Renunciation of Legacy.

Down load and print a huge number of file templates making use of the US Legal Forms site, which offers the biggest assortment of lawful varieties. Use skilled and state-certain templates to handle your business or personal requirements.

Form popularity

FAQ

Settling the Estate The settlement may not be filed until at least six months from the date the personal representative was appointed. KRS §395.190. If settling the estate takes more than two years, a periodic settlement may be required.

In Kentucky, real estate can be transferred via a TOD deed, also known as a beneficiary deed. This deed permits a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

Survivorship property and property payable on death passes to the surviving co-owner shown on the deed or instrument, unless a disclaimer was filed, and not by the terms of the will or by the laws of intestate succession.

After the death of the husband or wife intestate, the survivor shall have an estate in fee of one-half (1/2) of the surplus real estate of which the other spouse or anyone for the use of the other spouse, was seized of an estate in fee simple at the time of death, and shall have an estate for his or her life in one- ...

Pursuant to the anti-lapse statutes, where a will beneficiary predeceases the testator and leaves issue who survives the testator, the statutes create ?a rebuttable presumption that the surviving issue was meant to be substituted in the will for its ancestor.? Blevins, 12 S.W. 3d at 702.

In Kentucky, if you die without a will, your spouse will inherit property from you under a law called "dower and curtesy." Usually, this means that your spouse inherits 1/2 of your intestate property. The rest of your property passes to your descendants, parents, or siblings.

Kentucky has a lenient time requirement for probate. ing to the Kentucky Revised Statutes 395.010, it must be completed within 10 years after the person's death. However, it is better to file soon after the person's death and to complete the probate process as quickly as possible.

The Living Trust If you have a larger estate, you can avoid a long and expensive probate process by using a technique of asset transfer called a Living Trust. A document called a ?trust document?, which is similar to a Will, is created which names a person who will control the trust.