Kentucky Assignment of LLC Company Interest to Living Trust

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

Are you currently in a situation where you require paperwork for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones is challenging.

US Legal Forms offers a multitude of template options, including the Kentucky Assignment of LLC Company Interest to Living Trust, specifically designed to comply with federal and state regulations.

Once you find the correct template, click Get now.

Choose the payment plan that suits you, enter the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Kentucky Assignment of LLC Company Interest to Living Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is suitable for your specific city/state.

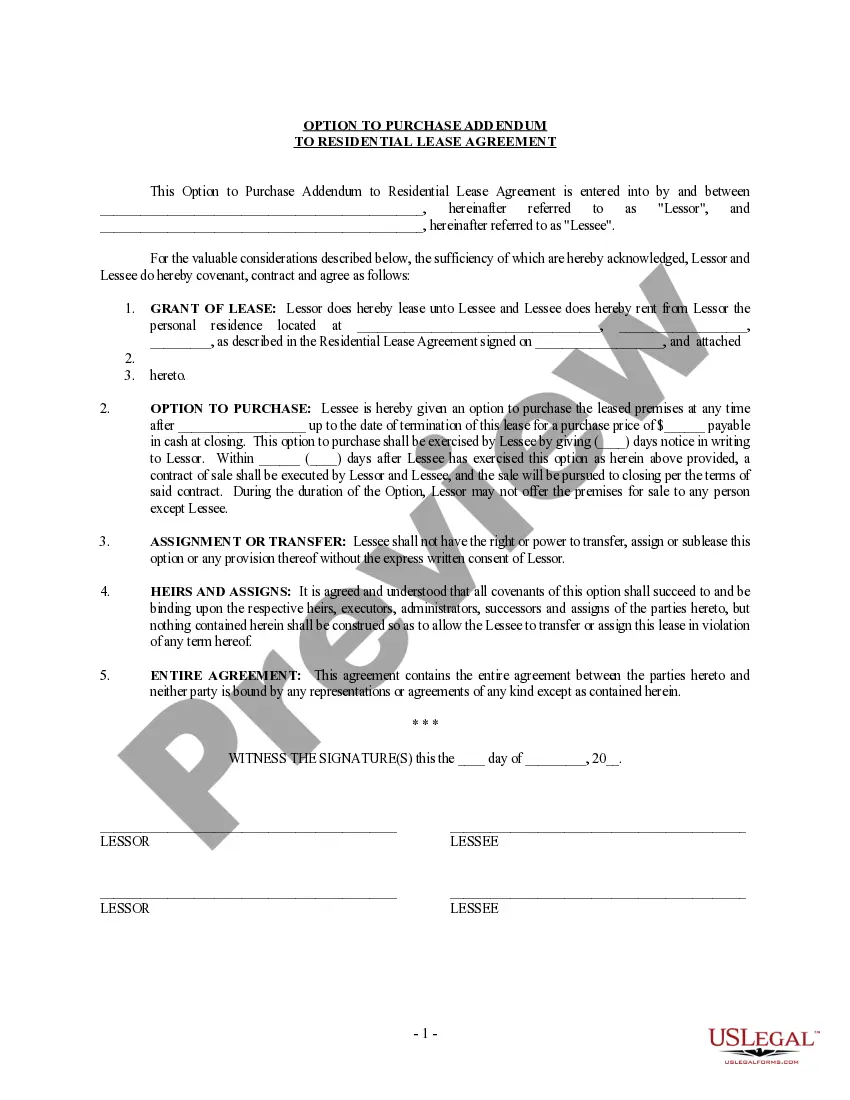

- Utilize the Preview feature to examine the document.

- Check the description to confirm that you have selected the appropriate template.

- If the template isn't what you're looking for, use the Search function to locate the document that fits your criteria.

Form popularity

FAQ

When it comes to owning and operating a business one of the most tax effective and flexible business structures is a discretionary family trust. It is not uncommon for a business to be started as a sole operator or a partnership of individuals, and then transfer the business to a family trust.

Most LLC agreements have a rule that members cannot sell or otherwise transfer their LLC interests unless approved in advance (typically by the manager or some percentage of the members) or allowed under another provision of the transfer section, such as an ROFR or ROFO.

If an LLC member's interest is held in a trust, then the administrator, sometimes called a "trustee," will vote and otherwise exercise the duties and rights of the LLC member. Transferring the membership interest to the trust could require an official transfer document, which is similar to a bill of sale.

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.

The answer is yes, a trust can own an LLC, either as the sole owner or as one of many owners.

If an LLC member's interest is held in a trust, then the administrator, sometimes called a "trustee," will vote and otherwise exercise the duties and rights of the LLC member. Transferring the membership interest to the trust could require an official transfer document, which is similar to a bill of sale.