Kentucky Assignment of Partnership Interest with Consent of Remaining Partners

Description

How to fill out Assignment Of Partnership Interest With Consent Of Remaining Partners?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal form templates that you can either download or create.

By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the Kentucky Assignment of Partnership Interest with Consent of Remaining Partners within moments.

If you have a monthly subscription, Log In to access and download the Kentucky Assignment of Partnership Interest with Consent of Remaining Partners from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finish the payment.

Download the form to your device in your desired format and Edit. Fill in, modify, print, and sign the downloaded Kentucky Assignment of Partnership Interest with Consent of Remaining Partners.

Each template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

Access the Kentucky Assignment of Partnership Interest with Consent of Remaining Partners through US Legal Forms, the most extensive library of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have chosen the correct form for your city/state.

- Click the Preview button to review the content of the form.

- Check the form summary to confirm that you have selected the right document.

- If the form does not meet your needs, use the Search field located at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

This means that a partner wishing to leave the partnership must first offer their interest to the other members in the company before offering it to an outside party. If all of the members refuse this offer, the partner is then allowed to transfer interest to anyone they choose.

Transfer of limited partnership interest is allowed as long as the general partner consents to the arrangement and it is done in concert with the established partnership agreement. A common example of a limited partnership is the family limited partnership, which is often created to administer a family business.

In a normal partnership, when one partner withdraws, or leaves the company, the partnership dissolves.

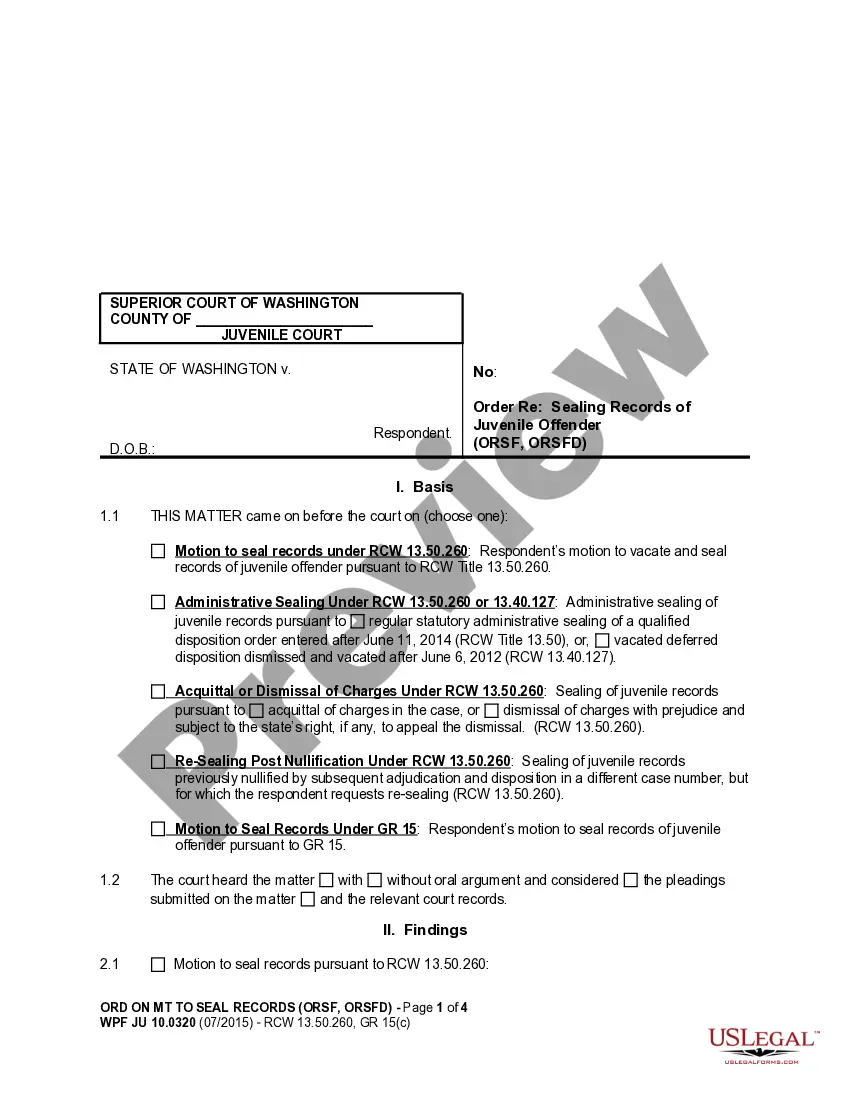

An Assignment of Partnership Interest is a legal document establishing the terms under which stake in a partnership is transferred from an assignor to an assignee. In other words, the new partner (assignee) acquires the right to receive benefits from the partnership per the stake granted.

A partner's interest in the partnership is his share of the profits and surplus and the same is personal property.

The assignment of a limited partnership interest will often be effected by way of a deed of transfer and an accompanying sale and purchase agreement which may contain simple warranties such as those relating to ownership of the limited partnership interests.

An Assignment of Partnership Interest occurs when a partner sells their stake in a partnership to a third party. The assignment document records the details of the transfer to the new partner.

Partners are required to mandatorily obtain the consent of all the partners in case the partner is willing to transfer his/her rights and interest to another person. The partners have to work within his/her assigned authority.

A partner's interest in the partnership may be assigned by the partner. However, the assignee does not become a partner without the consent of the other partners.

In general, as noted earlier, the transferee of a partnership interest must withhold a tax equal to 10% of the amount realized by the transferor on any transfer of a partnership interest unless an applicable exception applies (as discussed below).