Kentucky Demand Letter - Repayment of Promissory Note

Description

How to fill out Demand Letter - Repayment Of Promissory Note?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal form templates that you can download or produce.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms like the Kentucky Demand Letter - Repayment of Promissory Note in just a few seconds.

If you have an account, Log In and download the Kentucky Demand Letter - Repayment of Promissory Note from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Make modifications. Complete, edit, and print and sign the downloaded Kentucky Demand Letter - Repayment of Promissory Note.

Each form you added to your account does not have an expiration date and is yours for a long time. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Kentucky Demand Letter - Repayment of Promissory Note with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- To use US Legal Forms for the first time, here are simple instructions to get you started.

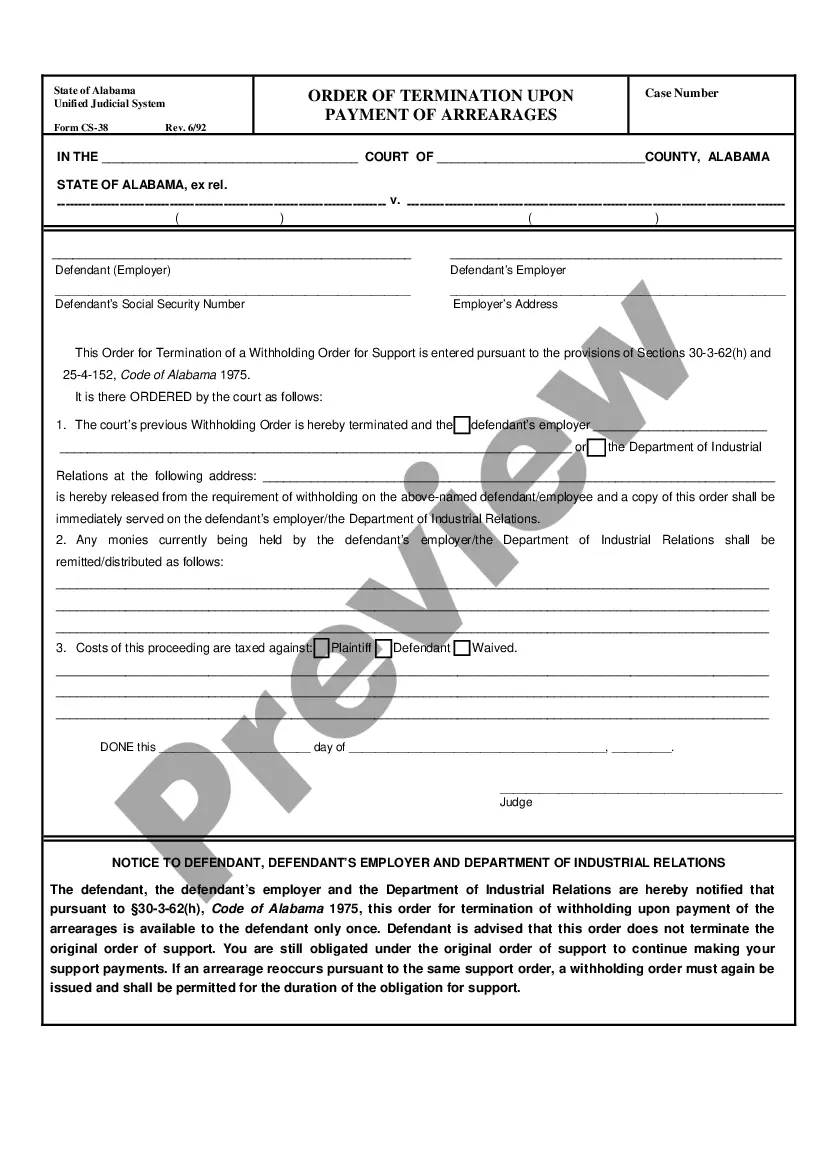

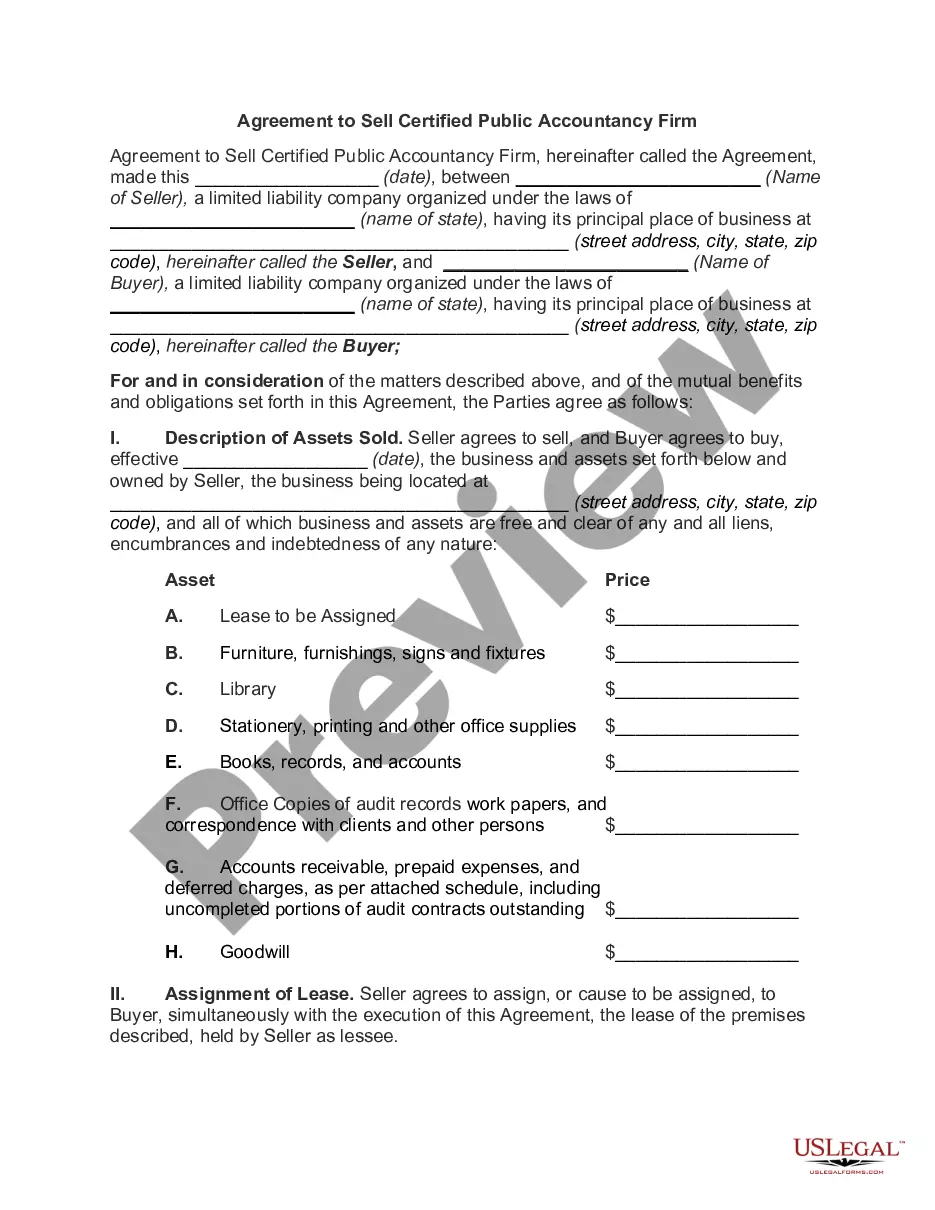

- Ensure you have chosen the correct form for your city/state. Click the Preview button to review the form's details. Check the form information to make sure you have selected the right form.

- If the form doesn't meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose your preferred payment plan and provide your information to create an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

'On demand' in a promissory note indicates that the borrower must repay the debt immediately upon request by the lender. This condition provides flexibility for the lender to reclaim funds. When drafting a Kentucky Demand Letter - Repayment of Promissory Note, it is essential to clearly state this provision.

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

Once a note has been paid off, it's time to wrap up any loose ends and release the parties from their duties. A clean break will provide peace of mind, discharge all obligations, and lead to an amicable conclusion. A release is the definitive end of the parties' commitments under a note.

Promissory notes can also vary depending on how the loan is to be repaid: Lump sum: The entire loan amount is to be repaid in one payment. Due on demand: The borrower must repay the loan when the lender asks for repayment. Installment: A specified schedule of payments determines how the loan is to be paid back.

All Promissory Notes are valid only for a period of 3 years starting from the date of execution, after which they will be invalid. There is no maximum limit in terms of the amount which can be lent or borrowed. The issuer / lender of the funds is normally the one who will hold the Promissory Note.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note.Accept full payment of the loan.Mark paid in full on the promissory note.Place a signature beside the paid in full notation.Mail the original promissory note to the borrower.

When the promissory note is discounted, the interest is taken off the principal amount at the beginning of the loan. The borrower pays back the entire amount, even though he only received the principal minus the interest.

Types of Promissory NotesSimple Promissory Note.Student Loan Promissory Note.Real Estate Promissory Note.Personal Loan Promissory Notes.Car Promissory Note.Commercial Promissory note.Investment Promissory Note.

Write a "Cancellation of Promissory Note" letter or have the attorney write one for you. The note should include details of the original promissory note and also indicate that the original promissory note is canceled at the request of both parties. Have the promisee sign the document in the presence of a notary.

Such an early release of a promissory note without full payment may be considered by the Internal Revenue Service ( IRS) to be a taxable event. The value of the amount of debt forgiven may be deemed either taxable income, or a gift subject to the federal estate and gift tax.