A bulk sale is a sale of goods by a business which engages in selling items out of inventory (as opposed to manufacturing or service industries), often in liquidating or selling a business, and is governed by the bulk sales law. Article 6 of the Uniform Commercial Code (UCC), which has been adopted at least in part all states, governs bulk sales. The heart of the bulk sales law is the requirement that the transferee provide the transferor's creditors with notice of the pending bulk transfer. This notice is the essential protection provided to creditors; once notified, the creditor must take the necessary steps to adequately protect his or her interest.

Kentucky Bulk Sale Notice

Description

How to fill out Bulk Sale Notice?

You are capable of spending hours online searching for the valid document template that meets the federal and state requirements you need.

US Legal Forms offers a multitude of legal forms that can be reviewed by professionals.

It is easy to download or print the Kentucky Bulk Sale Notice from our service.

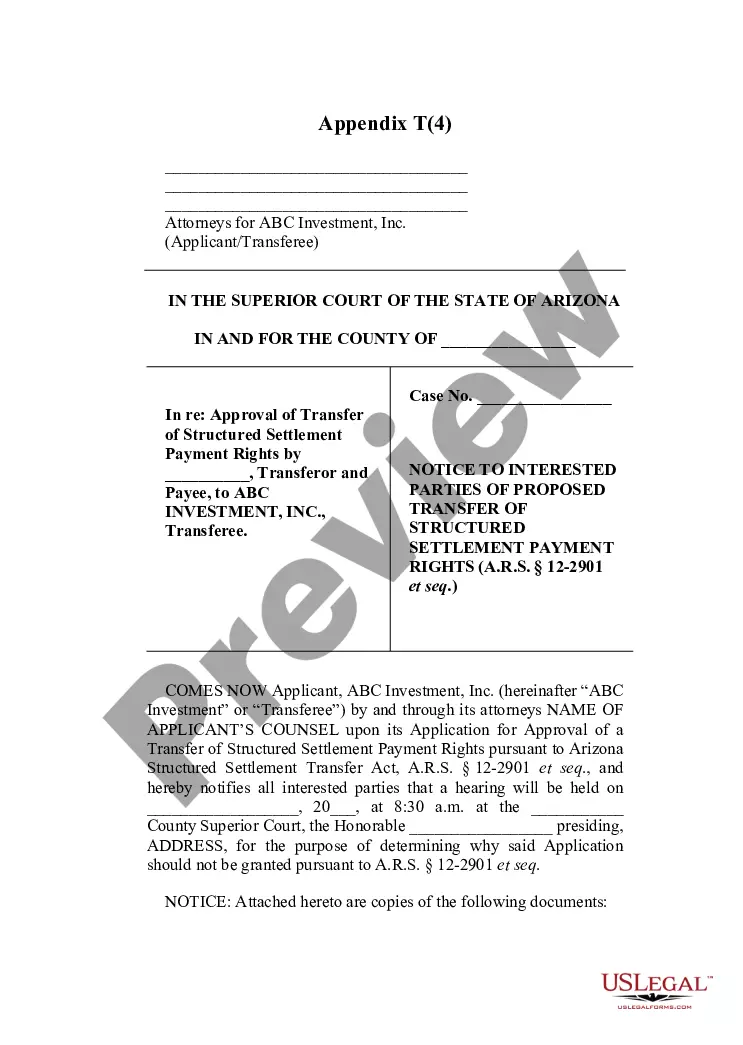

If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Obtain button.

- After that, you may fill out, edit, print, or sign the Kentucky Bulk Sale Notice.

- Each legal document template you receive is yours to keep indefinitely.

- To obtain another copy of any acquired form, navigate to the My documents tab and click on the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the region/city of your choice.

- Review the form description to ensure you have selected the right form.

Form popularity

FAQ

Getting a Kentucky tax account ID involves completing the state’s tax registration application, which can be found on the Kentucky Department of Revenue's website. Ensure that you provide all required information accurately to avoid delays. Once approved, your Kentucky Bulk Sale Notice ID will facilitate your tax obligations in Kentucky.

THE BULK SALES LAW (as amended) AN ACT TO REGULATE THE SALE, TRANSFER, MORTGAGE OR ASSIGNMENT OF GOODS, WARES, MERCHANDISE, PROVISIONS OR MATERIALS, IN BULK, AND PRESCRIBING PENALTIES FOR THE VIOLATION OF THE PROVISIONS THEREOF. Section 1. This Act shall be known as "The Bulk Sales Law." Sec.

On the other hand, Kentucky does offer vendor compensation. The discount is 1.75% of the first $1,000 of one's tax liability. After the first $1,000, the discount percentage is lowered to 1.5% of the remaining tax liability. However, the vendor compensation is capped at $50.

You can register for your Kentucky sales tax license online at the Kentucky Business One Stop Portal. Or file by paper using the Kentucky 10A100 form. You can also register for a sales tax permit when you register your business.

Certain goods are exempt from sales and use tax including coal and other energy-producing fuels, certain medical items, locomotives or rolling stock, certain farm machinery and livestock, certain seeds and farm chemicals, machinery for new and expanded industry, tombstones, textbooks, property certified as an alcohol

The Kentucky Bulk Sales Act is constitutional, and not an unreasonable interference with property rightsY A sale in viola- tion of the Bulk Sales Act is merely voidable at the option of the creditor who pursues his remedy within the statutory period, and a seller may validate a sale made without notice by paying or

A Kentucky Resale Certificate is a document that allows a business to purchase goods and services tax-free from suppliers for the purpose of reselling those goods and services. In order to use one, the retailer will need to provide a Kentucky Resale Certificate to their vendor.

DEFINITIONS1. bought or sold in large quantities. large companies that buy and sell in bulk.

There are several formalities required by the Bulk Sales Law: The sale in bulk to be accompanied by sworn statement of the vendor/mortgagor listing the names and addresses of, and amounts owing to, creditors; The sworn statement shall be furnished to the buyer, the seller is required to prepare an inventory of stocks

The sale of an entire inventory is not a bulk sale if it is sold to buyers in a manner that ensures adequate consideration. For example, if a merchant holds an auction sale for the entire contents of the business and the sale is in good faith, the buyer in not required to comply with bulk sales legislation.