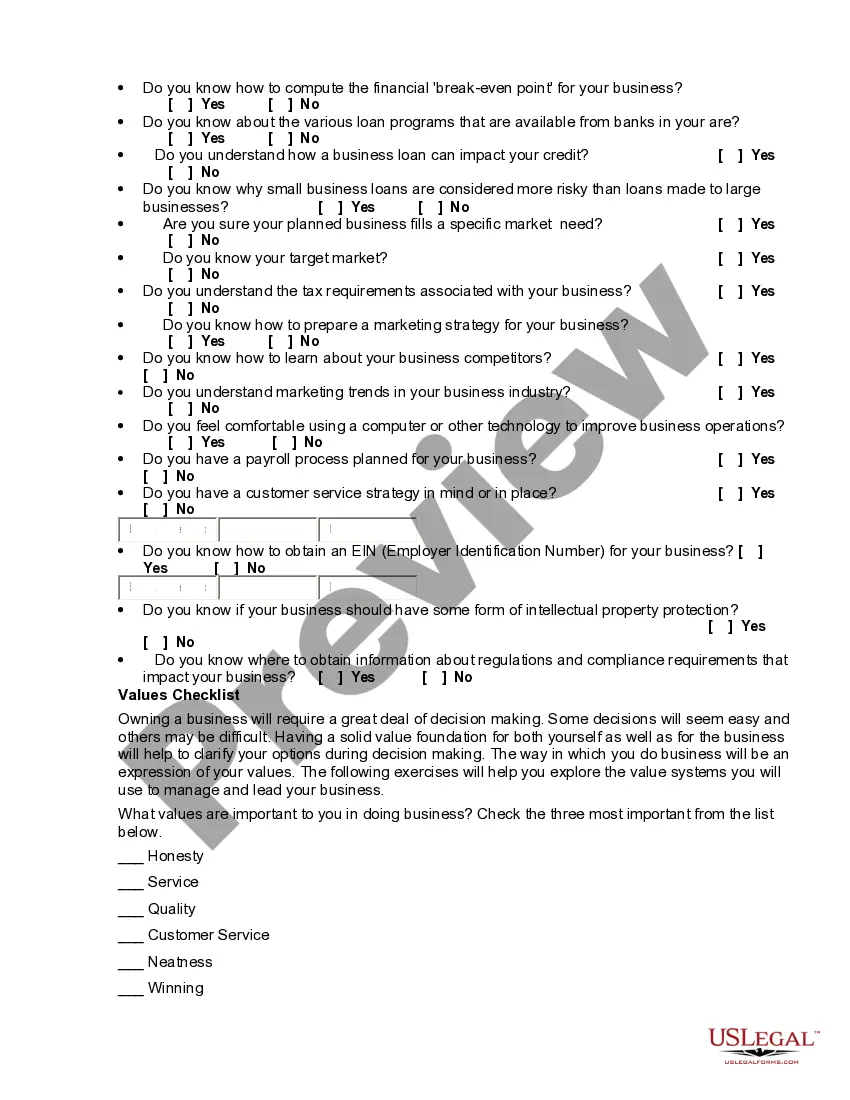

Are you ready to start a business? This assessment tool is designed to help you better understand your readiness for starting a small business. It will prompt you with questions and assist you in evaluating skills, characteristics and experience, as they relate to your being prepared for starting a business.

Kentucky Personal Strengths and Weaknesses - Owning a Small Business

Description

How to fill out Personal Strengths And Weaknesses - Owning A Small Business?

US Legal Forms - one of the most extensive collections of legal documents in the USA - provides a range of legal template options that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal uses, organized by categories, titles, or keywords. You can find the newest versions of forms such as the Kentucky Personal Strengths and Weaknesses - Owning a Small Business within minutes.

If you already have a subscription, Log In and download Kentucky Personal Strengths and Weaknesses - Owning a Small Business from the US Legal Forms collection. The Download button will appear on each form you view. You have access to all previously saved forms under the My documents tab of your account.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Make edits. Fill out, adjust, and print and sign the downloaded Kentucky Personal Strengths and Weaknesses - Owning a Small Business.

Every template you add to your account does not have an expiration date and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's details.

- Check the form information to verify that you have selected the accurate form.

- If the form does not fit your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

How to Start a Business in KentuckyChoose a Business Idea. Take some time to explore and research ideas for your business.Decide on a Legal Structure.Choose a Name.Create Your Business Entity.Apply for Licenses and Permits.Pick a Business Location and Check Zoning.File and Report Taxes.Obtain Insurance.More items...

The initial license fee is $100 and the annual minimum license fee is also $100. Due dates: The initial license fee is due at the time of registration. The annual minimum fee is due on the same filing due date as the net profit license fee return (Form No.

Kentucky does not have a statewide business license that applies to all businesses, but certain types of businesses are required to have a special license or permit to legally operate their business. In some cases, more than one license may be required.

How much does it cost to form an LLC in Kentucky? The Kentucky Secretary of State charges $40 to file the Articles of Organization. You can reserve your LLC name with the Kentucky Secretary of State for $15.

Starting an LLC in Kentucky is EasySTEP 1: Name your Kentucky LLC.STEP 2: Choose a Registered Agent in Kentucky.STEP 3: File Your Kentucky LLC Articles of Organization.STEP 4: Create Your Kentucky LLC Operating Agreement.STEP 5: Get an EIN.

Business Plan. Almost every business needs a little funding to get started.Partnership Agreement.LLC Operating Agreement.Buy/Sell Agreement.Employment Agreement.Employee Handbook.Non-Disclosure Agreement.Non-Compete Agreement.More items...

To Start a Business in Kentucky, Follow These StepsChoose the Right Business Idea.Plan Your Kentucky Business.Get Funding.Choose a Business Structure.Register Your Kentucky Business.Set up Banking, Credit Cards, & Accounting.Get Insured.Obtain Permits & Licenses.More items...?

Business. Business Kentucky is a great place to locate or expand your business, offering a positive economic environment and a quality workforce. Get information on licenses/permits, taxes, environmental concerns, farming & agriculture, and other business resources.

Start a Corporation in Kentucky To file the Articles of Incorporation for a corporation in Kentucky, you must submit formation documents to the Secretary of State online, by mail, or in person, along with a minimum $50 filing fee.

How to Start a Business in KentuckyChoose a Business Idea. Take some time to explore and research ideas for your business.Decide on a Legal Structure.Choose a Name.Create Your Business Entity.Apply for Licenses and Permits.Pick a Business Location and Check Zoning.File and Report Taxes.Obtain Insurance.More items...