Kentucky Short Form of Agreement to Form a Partnership in the Future

Description

How to fill out Short Form Of Agreement To Form A Partnership In The Future?

Are you presently in a role where you require documents for both business and personal reasons on a nearly daily basis.

There is a wide array of legal document templates available online, but finding reliable ones isn't straightforward.

US Legal Forms provides thousands of form templates, including the Kentucky Short Form of Agreement to Form a Partnership in the Future, designed to comply with state and federal regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can download another copy of the Kentucky Short Form of Agreement to Form a Partnership in the Future at any time if needed. Just select the form you wish to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- Then, you can download the Kentucky Short Form of Agreement to Form a Partnership in the Future template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it's for your specific city/region.

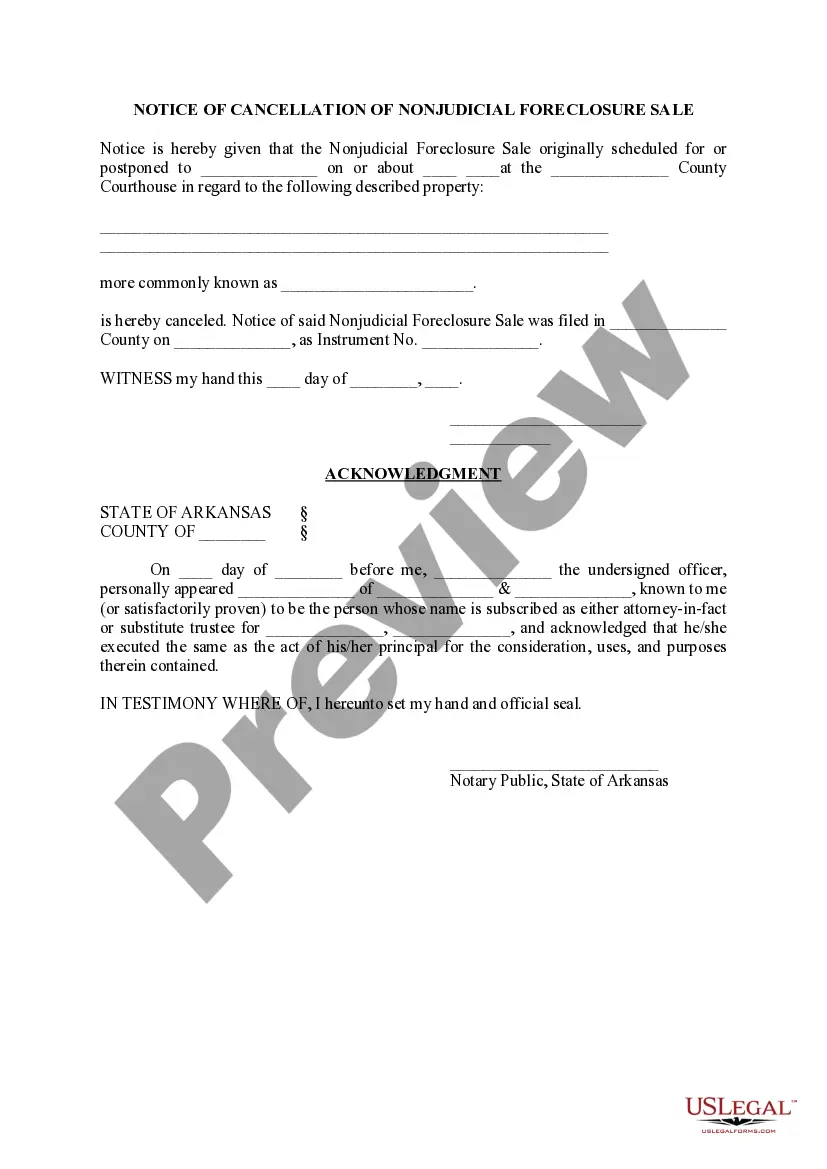

- Utilize the Preview button to check the form.

- Review the description to confirm that you've selected the correct form.

- If the form isn't what you're searching for, use the Search field to locate the form that meets your needs and requirements.

- Once you identify the correct form, click Purchase now.

- Select the payment plan you desire, complete the necessary information to create your account, and place your order using your PayPal or credit card.

Form popularity

FAQ

To form a partnership, you need at least two individuals who agree to operate a business together. Essential elements include defining each partner's contributions, responsibilities, and how profits will be shared. The Kentucky Short Form of Agreement to Form a Partnership in the Future can provide a solid foundation for the partnership structure and help clarify these critical points.

Filing requirements for a partnership often include submitting the partnership agreement and any state-specific forms. It's crucial to check your jurisdiction's regulations regarding local business licenses as well. Using the Kentucky Short Form of Agreement to Form a Partnership in the Future can streamline the filing process and ensure compliance with local laws.

Partnerships typically need to fill out a partnership agreement form that outlines the mutual responsibilities and expectations. In your case, consider the Kentucky Short Form of Agreement to Form a Partnership in the Future to efficiently address the needed elements. This form helps ensure that all partners are on the same page from the start.

Filling out a partnership agreement involves detailing the terms of the partnership, such as duration, contributions, and responsibilities. Use clear and straightforward language to avoid misunderstandings between partners. The Kentucky Short Form of Agreement to Form a Partnership in the Future can guide you through these essential components, making the process more accessible and efficient.

To fill out a partnership form, start by gathering necessary information about each partner, including names, addresses, and roles. Next, clearly state the purpose of the partnership and outline how profits and losses will be shared. You may want to use the Kentucky Short Form of Agreement to Form a Partnership in the Future as it can simplify this process and ensure all key details are included.

The primary purpose of Form 720 is to report the income and expenses of partnerships in Kentucky. This reporting enables the state to assess the tax liability appropriately. Familiarizing yourself with this form is essential, especially when planning your Kentucky Short Form of Agreement to Form a Partnership in the Future, to ensure compliance and avoid penalties.

If your business operates as a partnership and earns income, you will likely need to file Form 720. Additionally, if your partnership has specific taxable transactions, that will necessitate this filing. Understanding your obligation to file Form 720 is vital in navigating taxes, especially when considering a Kentucky Short Form of Agreement to Form a Partnership in the Future.

A partnership return form is utilized to report the income, deductions, gains, and losses of a partnership. This form effectively communicates to both partners and the state how the partnership is performing financially. Comprehending this form is important, particularly if you are drafting a Kentucky Short Form of Agreement to Form a Partnership in the Future.

Any partnership, limited liability company, or other pass-through entities that conduct business in Kentucky must file Form PTE. This includes both resident and non-resident entities. Filing this form is crucial for accurately reporting income earned within the state, especially with regard to your Kentucky Short Form of Agreement to Form a Partnership in the Future.

Form 725 is the Kentucky income tax return for limited liability companies (LLCs) treated as partnerships. This form allows LLCs to report their income, deductions, and credits effectively. If your partnership structure aligns with an LLC, understanding Form 725 can significantly impact how you handle taxation for your Kentucky Short Form of Agreement to Form a Partnership in the Future.