Kentucky Accounts Receivable Write-Off Approval Form

Description

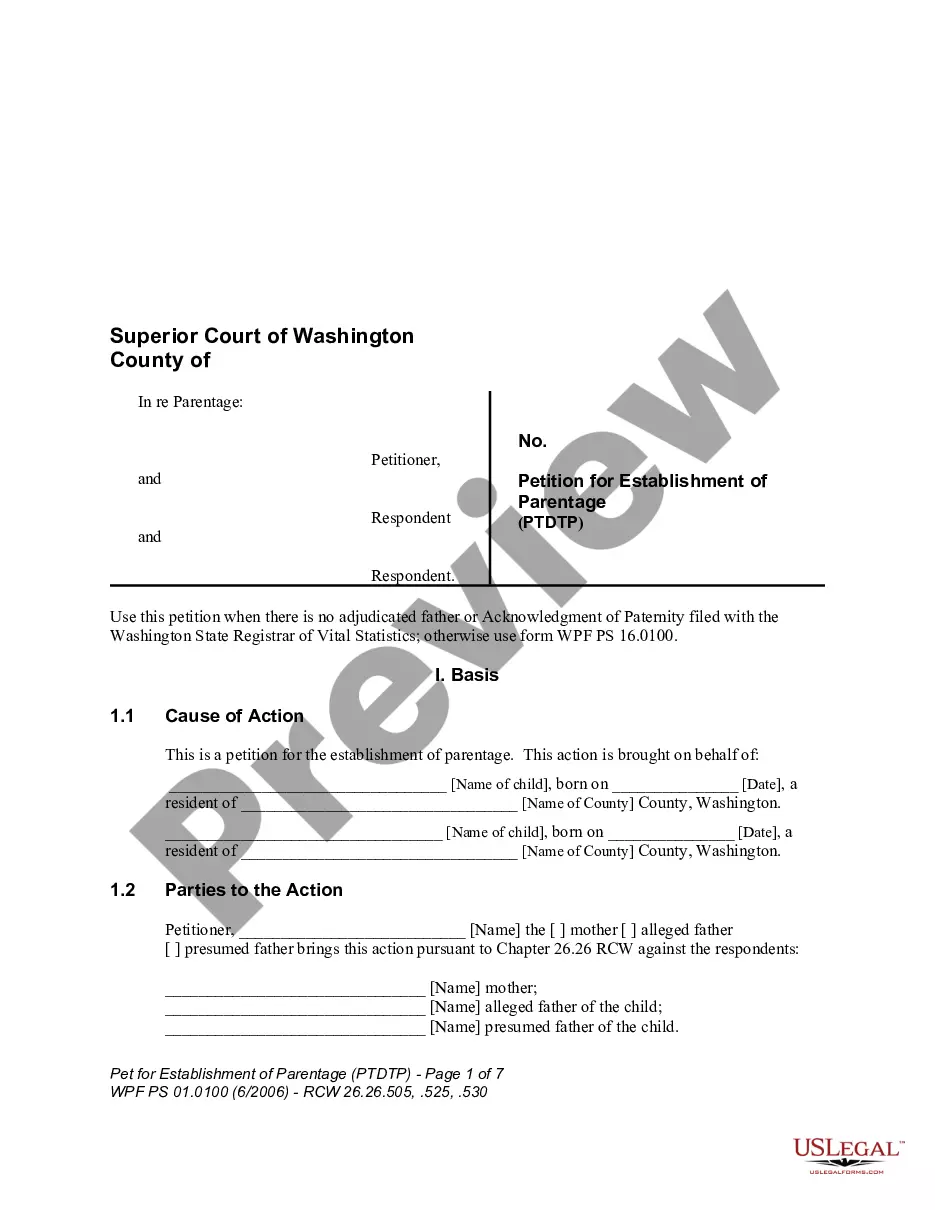

How to fill out Accounts Receivable Write-Off Approval Form?

US Legal Forms - one of the most prominent repositories of legal documents in the United States - provides a diverse selection of legal template formats available for purchase or creation.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, regions, or keywords. You can find the latest versions of forms such as the Kentucky Accounts Receivable Write-Off Approval Form in moments.

If you already have an account, Log In and download the Kentucky Accounts Receivable Write-Off Approval Form from the US Legal Forms collection. The Download button will appear on every form you view. You can access all previously obtained forms from the My documents section of your account.

Make modifications. Complete, edit, print, and sign the downloaded Kentucky Accounts Receivable Write-Off Approval Form.

Every template you add to your account does not have an expiration date and is yours permanently. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire.

- If you wish to use US Legal Forms for the first time, here are simple steps to help you begin.

- Ensure you select the appropriate form for your area/state. Click the Preview button to review the content of the form. Read the form description to confirm that you selected the correct form.

- If the form does not meet your needs, use the Search area at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the payment plan you prefer and provide your details to register for an account.

- Process the payment. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

When you write off an account, you typically debit the bad debt expense and credit accounts receivable. This process reduces your total receivables and acknowledges that you will not collect the amount owed. If you are using a Kentucky Accounts Receivable Write-Off Approval Form, it will help streamline this process and maintain proper documentation. This form also assists in ensuring compliance with accounting standards and internal controls.

Under the allowance method, the entry to write off accounts receivable involves debiting the allowance for doubtful accounts and crediting accounts receivable directly. This maintains the integrity of your financial statements while reflecting the actual collectible amounts. Utilizing the Kentucky Accounts Receivable Write-Off Approval Form helps streamline this process for your accounting records.

An example of an accounts receivable write-off is when you determine that a customer's balance is unlikely to be collected due to bankruptcy. In such a case, you complete the Kentucky Accounts Receivable Write-Off Approval Form and adjust your financial records accordingly. This action helps you maintain accurate financial statements.

To write off receivables, assess the accounts to determine which are uncollectible. Complete the Kentucky Accounts Receivable Write-Off Approval Form to maintain compliance. After that, adjust your financial records by affecting the allowance for doubtful accounts and reducing the accounts receivable balance.

Writing off other receivables involves identifying the uncollectible amounts and completing the necessary documentation. Each write-off requires the Kentucky Accounts Receivable Write-Off Approval Form to ensure compliance with your accounting policy. From there, adjust your financial records by debiting the appropriate expense account.

You offset accounts receivable with the allowance for doubtful accounts. This approach reflects anticipated losses from bad debts on your financial statements. Ensuring you have the Kentucky Accounts Receivable Write-Off Approval Form can streamline this process and maintain accurate records.

To properly record a write-off of accounts receivable, first ensure you have the Kentucky Accounts Receivable Write-Off Approval Form completed. Begin by debiting the allowance for doubtful accounts and crediting accounts receivable. This reduces your accounts receivable balance on your financial statements and accounts for potential losses.

If accounts receivable are uncollectible, it is necessary to write off those amounts to ensure your financial records are accurate. Utilizing the Kentucky Accounts Receivable Write-Off Approval Form helps streamline this process. By officially documenting the write-off, you protect yourself during financial audits. Effective management of uncollectible accounts contributes to clearer financial health.

To write off unpaid accounts receivable, begin by evaluating the debts that are unlikely to be collected. Use the Kentucky Accounts Receivable Write-Off Approval Form to gather the necessary approvals before proceeding. The formal document guides you through the process, ensuring compliance. Lastly, adjust your accounts in the ledger to reflect the bad debt expense.

When you write off an account receivable, it means you have declared that particular debt unrecoverable. With the Kentucky Accounts Receivable Write-Off Approval Form, you ensure that all necessary documentation is in place. This process reduces your accounts receivable balance while increasing your bad debt expense for accuracy in financial statements. Ultimately, this helps maintain a healthier financial position.