Have you been in the placement where you require files for either organization or individual reasons almost every day time? There are a lot of lawful papers templates accessible on the Internet, but getting types you can rely is not straightforward. US Legal Forms offers thousands of form templates, such as the Kentucky Motion to Discharge or Quash Writ of Garnishment, that are published in order to meet state and federal requirements.

When you are previously knowledgeable about US Legal Forms website and possess a free account, merely log in. After that, you may down load the Kentucky Motion to Discharge or Quash Writ of Garnishment web template.

If you do not offer an accounts and wish to begin using US Legal Forms, adopt these measures:

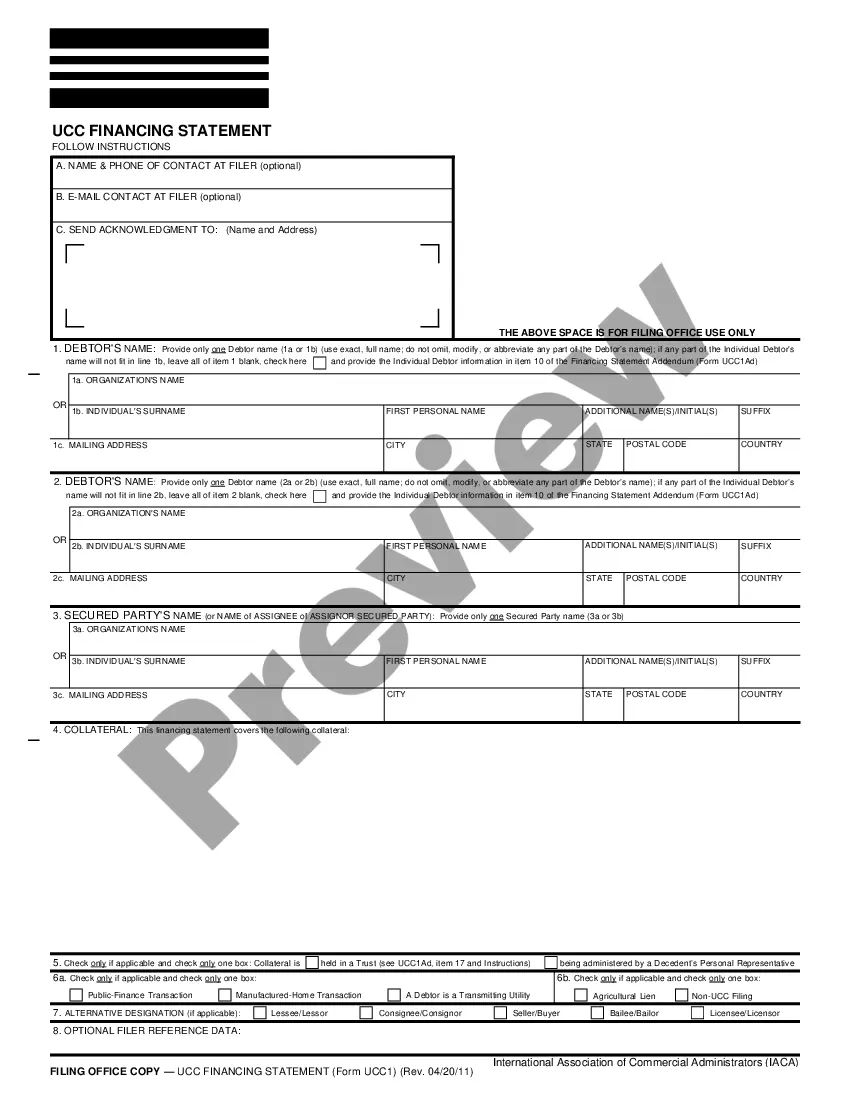

- Obtain the form you want and ensure it is for your correct city/state.

- Use the Preview key to analyze the form.

- Browse the explanation to ensure that you have chosen the appropriate form.

- If the form is not what you are searching for, use the Look for industry to obtain the form that fits your needs and requirements.

- When you find the correct form, just click Purchase now.

- Pick the prices prepare you desire, complete the desired details to make your bank account, and buy an order utilizing your PayPal or charge card.

- Select a convenient file formatting and down load your duplicate.

Get all the papers templates you have purchased in the My Forms menu. You may get a further duplicate of Kentucky Motion to Discharge or Quash Writ of Garnishment at any time, if needed. Just click on the needed form to down load or print the papers web template.

Use US Legal Forms, the most substantial variety of lawful varieties, in order to save time and stay away from faults. The support offers appropriately produced lawful papers templates which you can use for an array of reasons. Make a free account on US Legal Forms and initiate generating your way of life a little easier.