Kentucky Conveyance of Deed to Lender in Lieu of Foreclosure

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

If you have to total, download, or print out authorized papers templates, use US Legal Forms, the most important variety of authorized types, which can be found on the web. Take advantage of the site`s simple and easy hassle-free research to discover the files you will need. Different templates for organization and personal purposes are sorted by categories and claims, or keywords and phrases. Use US Legal Forms to discover the Kentucky Conveyance of Deed to Lender in Lieu of Foreclosure in just a handful of click throughs.

When you are currently a US Legal Forms consumer, log in to your account and then click the Down load button to find the Kentucky Conveyance of Deed to Lender in Lieu of Foreclosure. You can also accessibility types you earlier saved in the My Forms tab of your own account.

Should you use US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have selected the shape for your proper metropolis/region.

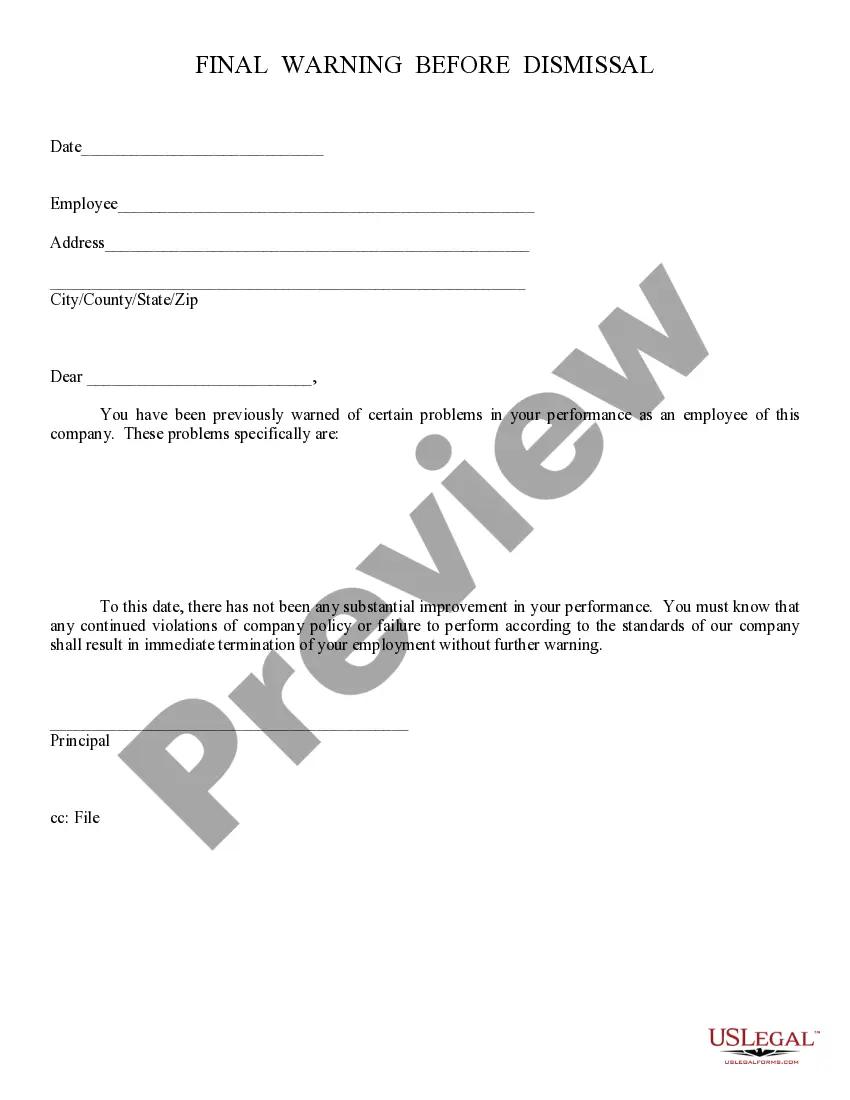

- Step 2. Use the Review method to check out the form`s articles. Do not forget to learn the outline.

- Step 3. When you are not happy together with the form, use the Research industry near the top of the screen to get other variations in the authorized form design.

- Step 4. After you have located the shape you will need, go through the Buy now button. Opt for the prices prepare you like and add your credentials to register for the account.

- Step 5. Method the deal. You can use your bank card or PayPal account to perform the deal.

- Step 6. Find the format in the authorized form and download it on your own system.

- Step 7. Comprehensive, modify and print out or indicator the Kentucky Conveyance of Deed to Lender in Lieu of Foreclosure.

Each authorized papers design you buy is the one you have for a long time. You have acces to every single form you saved inside your acccount. Select the My Forms segment and select a form to print out or download once more.

Remain competitive and download, and print out the Kentucky Conveyance of Deed to Lender in Lieu of Foreclosure with US Legal Forms. There are millions of professional and status-certain types you may use for the organization or personal requires.

Form popularity

FAQ

Primary tabs. A conveyance is the transfer and assignment of any property right or interest from one individual or entity (the conveyor) to another (the conveyee). This is usually accomplished through a written instrument - most often a deed - that transfers title to, or creates a lien on property.

The grantors must sign the deed and the signatures must be acknowledged (notarized). The grantor and grantee must sign the consideration statement & the signatures must be notarized. The document must be filed in the county clerk's office of the county where the property is located (or the greater part).

Transfer the possession of the bargainor, releasor, covenantor, or. grantor, to the bargainee, releasee, grantee, or person entitled to. the use for the estate or interest which he has or shall have in. the use and intends to convey."

Conveyance is the act of transferring property from one party to another. The term is commonly used in real estate transactions when buyers and sellers transfer ownership of land, building, or home. A conveyance is done using an instrument of conveyance?a legal document such as a contract, lease, title, or deed.

If the lender agrees to accept a deed in lieu of foreclosure, this releases the lien on the home. This way, the lender gets to recoup on their losses without forcing a foreclosure on you. A deed in lieu agreement also releases you from the remainder of your mortgage payments.

Kentucky has a lenient time requirement for probate. ing to the Kentucky Revised Statutes 395.010, it must be completed within 10 years after the person's death. However, it is better to file soon after the person's death and to complete the probate process as quickly as possible.

Deed-in-lieu of foreclosure: A document (instrument) executed by the homeowner conveying title to a lender in lieu of the lender proceeding with foreclosure on the home (the security property).

Redemption Period After a Foreclosure Sale in Kentucky In Kentucky, if the home sells for less than two-thirds of its appraised value at the foreclosure sale, you get six months to redeem the property. (Ky. Rev. Stat.