Kentucky Sample Letter for Request for Instructions

Description

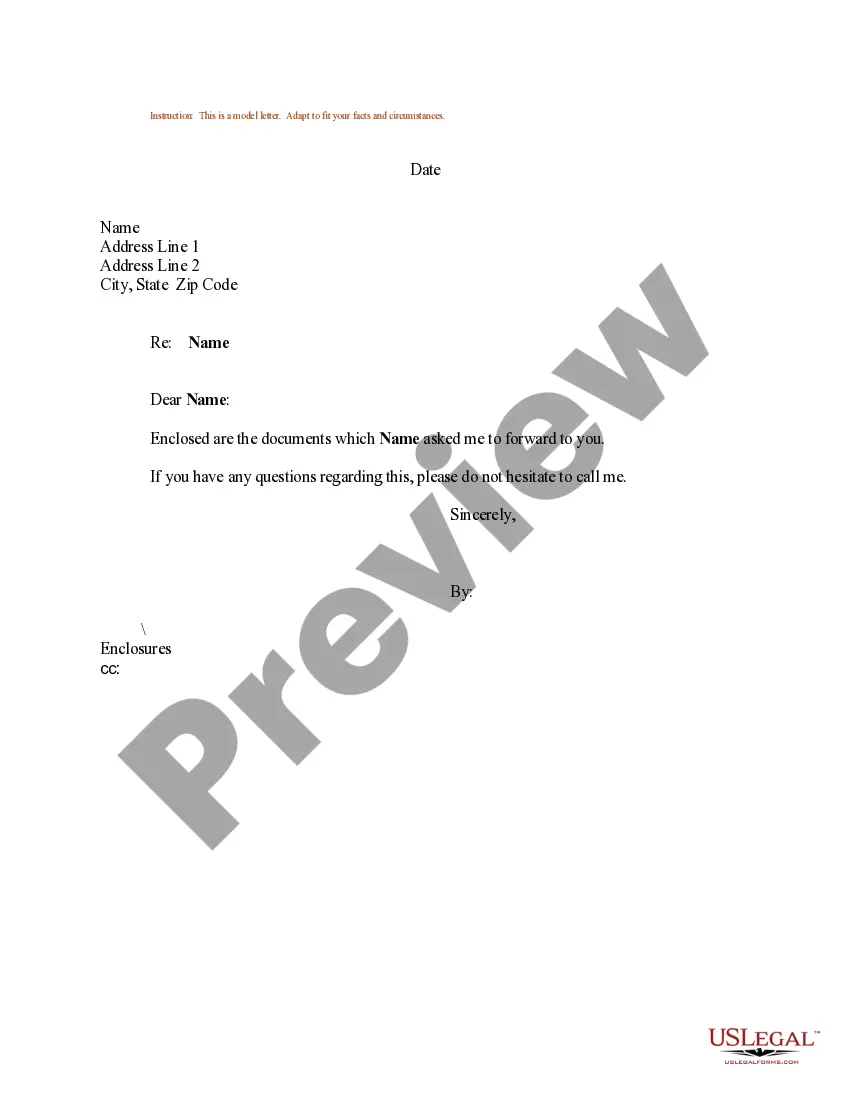

How to fill out Sample Letter For Request For Instructions?

Locating the appropriate approved document template might be a challenge.

Certainly, numerous templates are available online, but how can you find the approved document you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Kentucky Sample Letter for Request for Instructions, suitable for both business and personal uses.

You can view the form using the Preview button and read the form description to confirm it is indeed the right one for you.

- All forms are vetted by professionals and meet state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to access the Kentucky Sample Letter for Request for Instructions.

- Use your account to search through the legal documents you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the documents you desire.

- If you are a new user of US Legal Forms, here are some simple instructions for you to follow.

- First, ensure you have selected the correct document for your specific city/county.

Form popularity

FAQ

Determining whether to file form 720 primarily depends on your business activities and revenue streams in Kentucky. If your business is subject to specific tax obligations, you will likely need to file this form. Regularly reviewing your business status against state requirements is advisable. A Kentucky Sample Letter for Request for Instructions can provide the necessary information to make this determination confidently.

Form 725 is another tax-related form in Kentucky, specifically for corporate income and limited liability entities. This form is essential for those businesses that prefer to file as corporations instead of pass-through entities. Ensuring compliance with form 725 can prevent issues down the road. Utilize resources like the Kentucky Sample Letter for Request for Instructions for more clarity.

The purpose of form 720 is to provide the Kentucky Department of Revenue with essential financial information from businesses for tax assessments. It helps maintain transparency and ensures that businesses fulfill their tax obligations. Understanding the role of this form will guide you in your financial planning. For detailed insights, a Kentucky Sample Letter for Request for Instructions can be beneficial.

Yes, Kentucky provides an e-file authorization form for taxpayers wishing to file their taxes electronically. This form streamlines the electronic filing process, making it more efficient and secure. Ensuring you complete this form correctly is crucial for proper submission. Review your details alongside a Kentucky Sample Letter for Request for Instructions for optimal guidance.

To obtain a letter of good standing in Kentucky, you need to request it from the Secretary of State's office. This letter confirms that your business is compliant with state regulations and is a valuable document for various business transactions. You may submit your request online or through the mail. A Kentucky Sample Letter for Request for Instructions can assist you in drafting your request effectively.

In Kentucky, LLCs are generally taxed as pass-through entities, meaning the profits are taxed at the personal income level of the owners. However, LLCs can also elect to be taxed as corporations if that suits their business model better. It’s important to understand the implications of each option. Consulting a Kentucky Sample Letter for Request for Instructions may help clarify your choices.

Form 720 is a tax form used in Kentucky for reporting specific financial information related to business activities. This form is crucial for maintaining compliance with state tax regulations. Completing it accurately ensures that you meet your tax obligations. Consider reviewing a Kentucky Sample Letter for Request for Instructions to help clarify any doubts you may have.

Filing form 720 incorrectly can result in penalties that vary based on the nature of the error or delay. If you miss the deadline, you may incur late fees. It is essential to prepare your documents carefully to avoid these issues. Using the Kentucky Sample Letter for Request for Instructions can guide you in the correct filing process.

Yes, Kentucky conforms to section 174, specifically concerning how businesses can deduct research and experimental expenditures. Staying informed about such regulations is crucial for tax planning. If you want to navigate these regulations more easily, our Kentucky Sample Letter for Request for Instructions can provide valuable guidance.

Filing articles of organization in Kentucky involves completing the necessary forms and providing required information about your LLC. You can file online through the state’s business portal or submit paper documents via mail. For a detailed walkthrough, consider our Kentucky Sample Letter for Request for Instructions, which highlights steps to make the process easier.