Kentucky Revocable Trust for Lottery Winnings

Description

How to fill out Revocable Trust For Lottery Winnings?

US Legal Forms - one of the foremost collections of legal documents in the United States - provides a vast selection of legal template options that you can download or print.

Through the platform, you can access numerous forms tailored for commercial and individual needs, organized by categories, states, or keywords. You can retrieve the latest forms such as the Kentucky Revocable Trust for Lottery Winnings in moments.

If you already hold a subscription, Log In and retrieve the Kentucky Revocable Trust for Lottery Winnings from the US Legal Forms collection. The Download button will appear on every document you view. You can access all previously saved forms from the My documents section of your account.

Complete the transaction. Use a Visa, Mastercard, or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, and print/sign the saved Kentucky Revocable Trust for Lottery Winnings. Every template you save to your account does not expire and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your area/region.

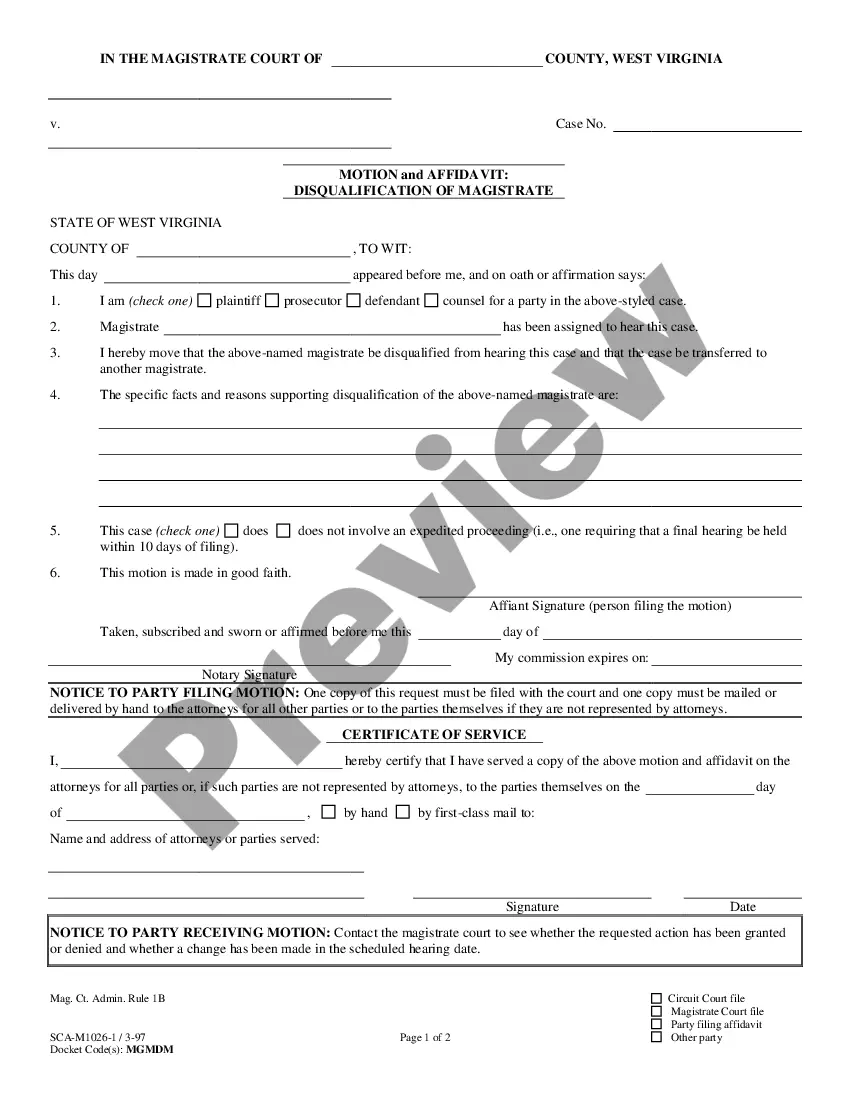

- Click on the Preview button to inspect the document's details.

- Review the document summary to ensure you have selected the accurate form.

- If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your details to register for the account.

Form popularity

FAQ

The first step after winning the lottery is to secure your ticket and consider your privacy options. Next, think about setting up a Kentucky Revocable Trust for Lottery Winnings to protect your identity and manage your assets professionally. Consulting with financial and legal experts can provide guidance through this transformative experience.

The best investment following a lottery win often includes diversified options such as stocks, bonds, and real estate. It is wise to consult with a financial advisor to create a tailored investment strategy. Additionally, utilizing a Kentucky Revocable Trust for Lottery Winnings can help manage these investments effectively.

To avoid gift tax on lottery winnings, it’s essential to consult with a tax advisor about transferring wealth responsibly. Consider setting up a Kentucky Revocable Trust for Lottery Winnings. This type of trust can manage your assets and distribute them in a way that minimizes tax implications while maintaining compliance with tax laws.

The Kentucky Revocable Trust for Lottery Winnings is often the best option for managing your lottery prize. This trust offers flexibility, allowing you to make changes as necessary. It also aids in safeguarding your winnings from potential lawsuits or claims, contributing to long-term financial stability.

The best trust to consider when winning the lottery is the Kentucky Revocable Trust for Lottery Winnings. This trust provides flexibility in managing your funds while allowing you to maintain control over your assets. Additionally, it can help minimize estate taxes and offer protection from creditors.

Yes, Kentucky allows lottery winners to remain anonymous if they win a substantial amount. This option can provide security and privacy for your financial affairs. Many choose to set up a Kentucky Revocable Trust for Lottery Winnings to protect their identity while managing their assets efficiently.

To claim your lottery winnings in Kentucky, you must present your ticket at a lottery office or authorized retailer if your prize is under a certain amount. For larger prizes, forming a Kentucky Revocable Trust for Lottery Winnings can help manage your funds and maintain anonymity. After claiming your prize, consider financial planning to maximize your winnings over the long term. Utilizing platforms like uslegalforms can guide you in setting up your trust efficiently.

In Kentucky, laws allow for limited anonymity when claiming lottery winnings. You can set up a Kentucky Revocable Trust for Lottery Winnings, which lets you receive your prize without revealing your identity to the public. This trust can protect your privacy and safeguard your newfound wealth. It’s advisable to consult with a legal expert to properly establish the trust and meet all necessary legal requirements.

The best place to deposit your lottery winnings is a reputable bank that offers secure financial services. Consider opening an account that accommodates large balances and comes with services tailored to high-net-worth individuals. A Kentucky Revocable Trust for Lottery Winnings can also be a helpful way to manage these funds, allowing for seamless transactions and strategic withdrawal plans. Using such a trust ensures that your finances are organized and your winnings are protected.