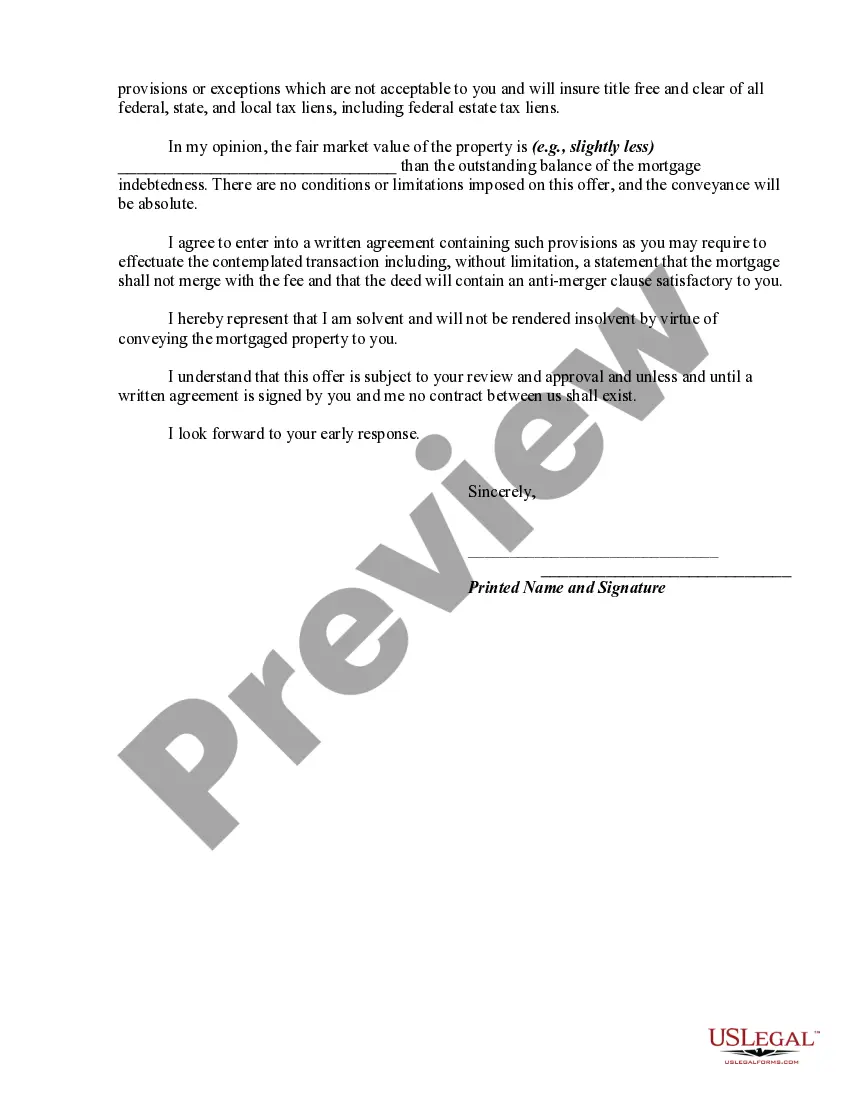

A deed in lieu of foreclosure is a method sometimes used by a lienholder on property to avoid a lengthy and expensive foreclosure process, with a deed in lieu of foreclosure a foreclosing lienholder agrees to have the ownership interest transferred to the bank/lienholder as payment in full. The debtor basically deeds the property to the bank instead of them paying for foreclosure proceedings. Therefore, if a debtor fails to make mortgage payments and the bank is about to foreclose on the property, the deed in lieu of foreclosure is an option that chooses to give the bank ownership of the property rather than having the bank use the legal process of foreclosure.

Kentucky Offer by Borrower of Deed in Lieu of Foreclosure

Description

How to fill out Offer By Borrower Of Deed In Lieu Of Foreclosure?

US Legal Forms - one of several biggest libraries of authorized types in the United States - provides an array of authorized papers themes you are able to download or produce. Utilizing the website, you may get a huge number of types for enterprise and individual reasons, categorized by groups, claims, or keywords.You can find the newest variations of types just like the Kentucky Offer by Borrower of Deed in Lieu of Foreclosure within minutes.

If you currently have a monthly subscription, log in and download Kentucky Offer by Borrower of Deed in Lieu of Foreclosure from the US Legal Forms local library. The Acquire button will show up on every develop you look at. You gain access to all earlier saved types within the My Forms tab of your own bank account.

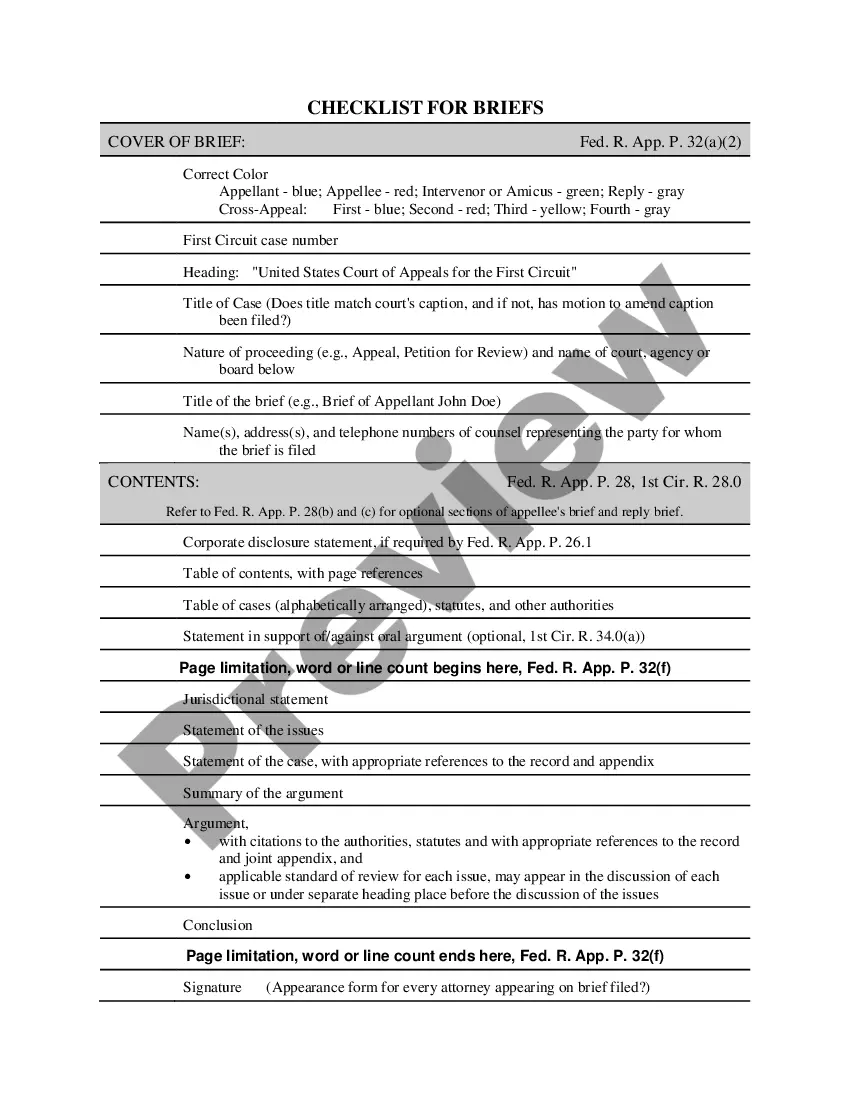

In order to use US Legal Forms initially, allow me to share straightforward directions to get you started:

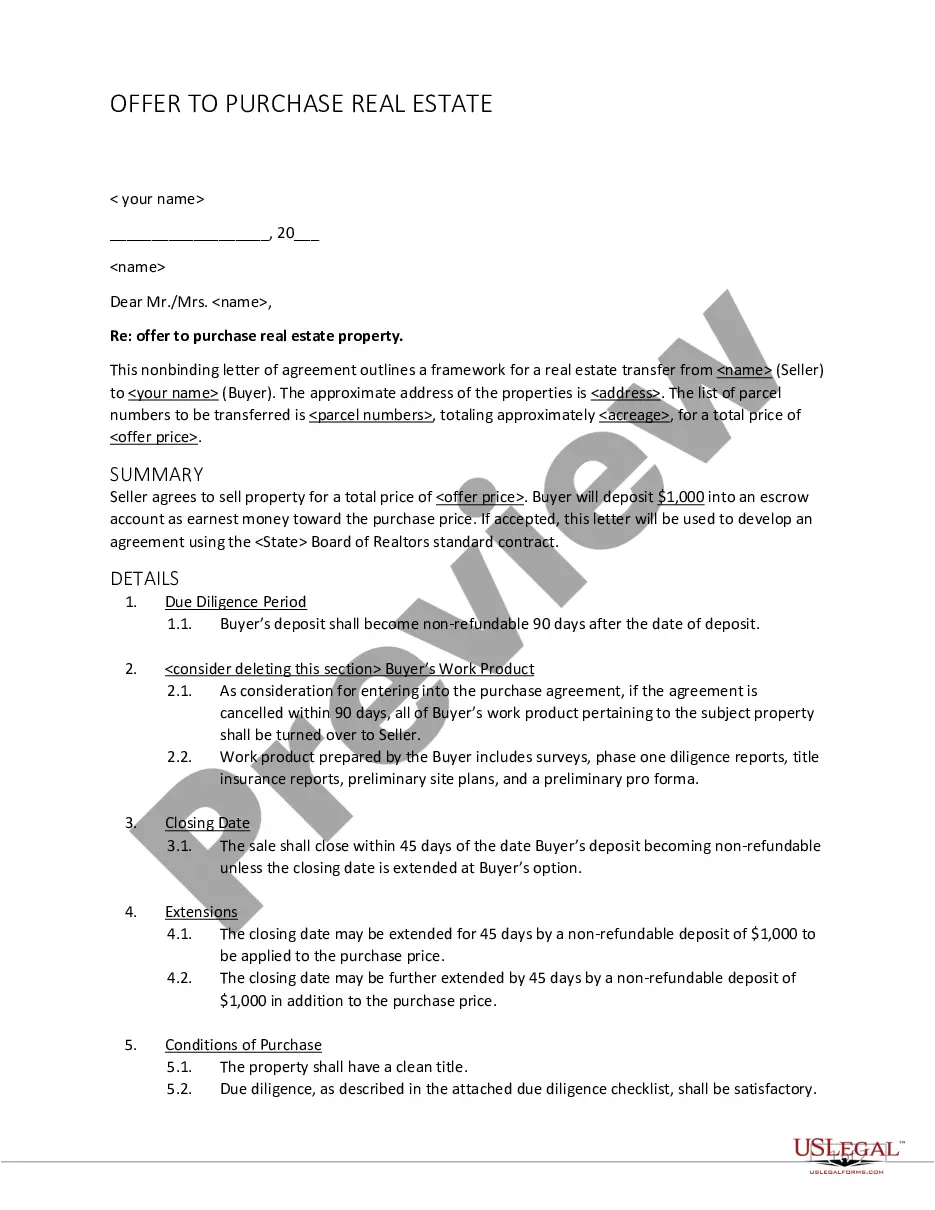

- Make sure you have picked out the proper develop for the area/area. Select the Preview button to analyze the form`s information. See the develop explanation to ensure that you have chosen the right develop.

- If the develop does not match your specifications, take advantage of the Look for industry at the top of the monitor to find the one which does.

- In case you are satisfied with the shape, affirm your selection by visiting the Buy now button. Then, opt for the prices program you prefer and give your accreditations to register for an bank account.

- Approach the transaction. Use your credit card or PayPal bank account to perform the transaction.

- Select the file format and download the shape on your own product.

- Make alterations. Fill out, revise and produce and indication the saved Kentucky Offer by Borrower of Deed in Lieu of Foreclosure.

Every single template you included in your money does not have an expiration date and is also yours for a long time. So, if you would like download or produce yet another backup, just go to the My Forms segment and click on about the develop you need.

Get access to the Kentucky Offer by Borrower of Deed in Lieu of Foreclosure with US Legal Forms, probably the most considerable local library of authorized papers themes. Use a huge number of professional and condition-distinct themes that fulfill your business or individual requirements and specifications.

Form popularity

FAQ

Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop. You also won't be able to easily get another mortgage if you have a deed in lieu on your credit report.

By accepting a deed in lieu of foreclosure, lenders may take possession of the property sooner and keep it in better condition. The lender may be more likely to approve a request for a deed in lieu on a home in good condition so they can sell the property quickly and at a fair market rate.

Under Kentucky law, the new owner from the foreclosure sale gets the right to possess the property after ten days' notice to the former owners. Then, the purchaser can get a writ of possession from the court.

A deed in lieu of foreclosure is an agreement with your mortgage lender in which you give them the deed to your home in order to avoid foreclosure on your home.

Redemption Period After a Foreclosure Sale in Kentucky In Kentucky, if the home sells for less than two-thirds of its appraised value at the foreclosure sale, you get six months to redeem the property. (Ky. Rev. Stat.

You may be able to avoid foreclosure by making arrangements with your lender, such as getting forbearance or agreeing to a loan modification. Other options may include refinancing with a hard money loan or reverse mortgage.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

In Kentucky, foreclosures go through a judicial process, meaning foreclosures are handled by the courts. When it is determined that a borrower is in default on a loan, the lender files a foreclosure suit with the circuit court.