Kentucky Sample Letter for Withheld Delivery

Description

How to fill out Sample Letter For Withheld Delivery?

If you desire to be thorough, download, or print sanctioned document templates, use US Legal Forms, the largest assortment of official forms available online. Utilize the site's straightforward and user-friendly search to find the documents you need.

A range of templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to obtain the Kentucky Sample Letter for Withheld Delivery with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the Kentucky Sample Letter for Withheld Delivery. You can also retrieve forms you previously downloaded in the My documents section of your account.

Each legal document template you acquire is yours indefinitely. You have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Compete and download, and print the Kentucky Sample Letter for Withheld Delivery with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal requirements.

- Step 1. Confirm you have chosen the form for the correct city/state.

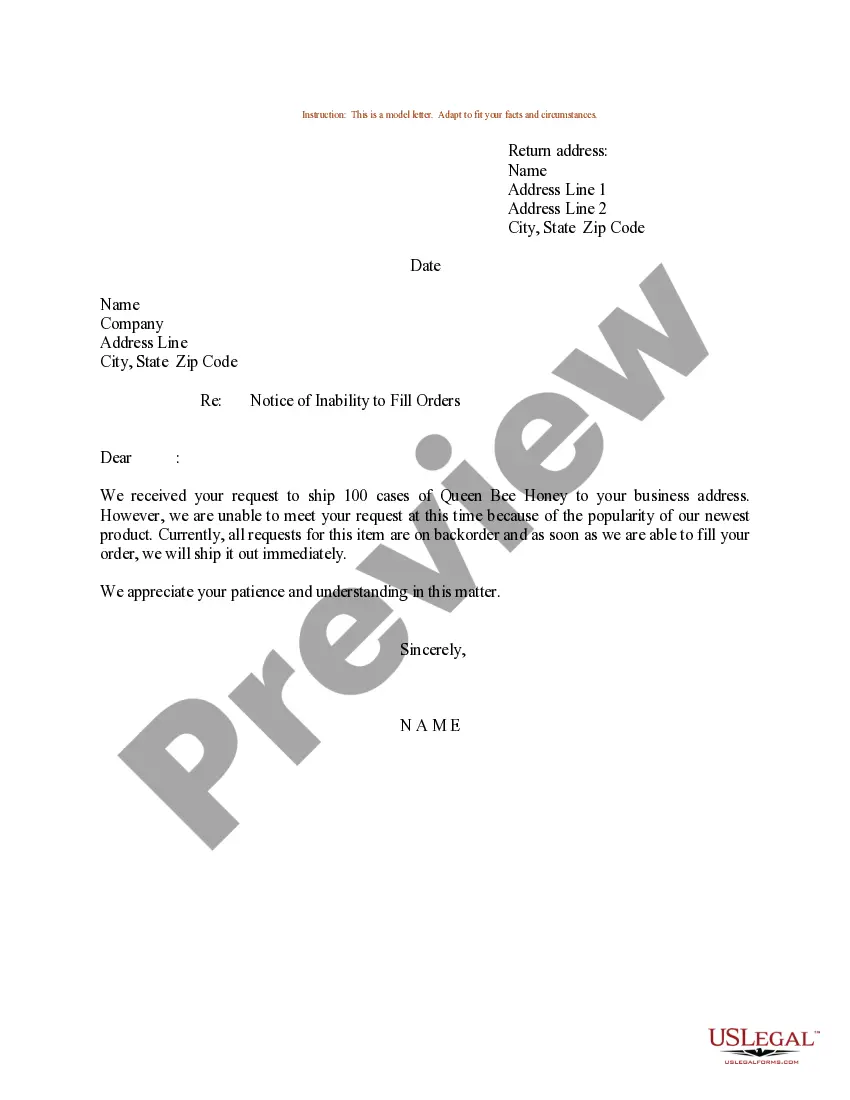

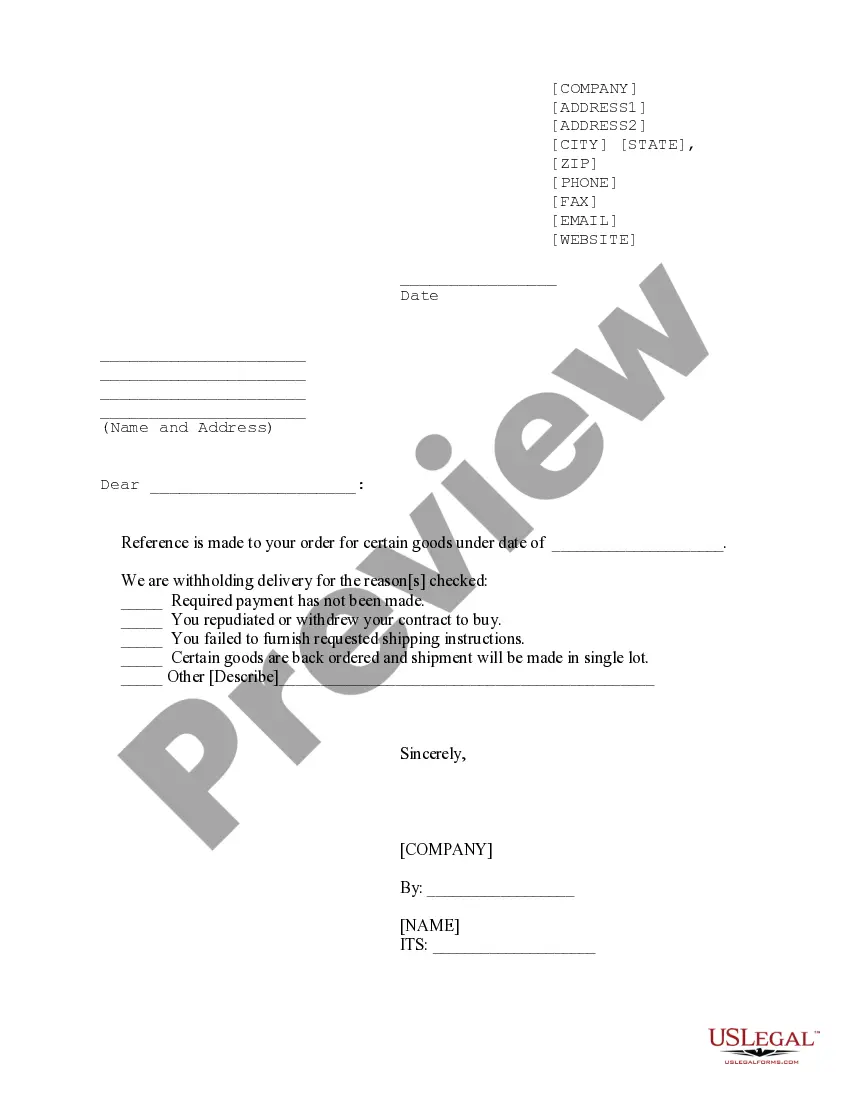

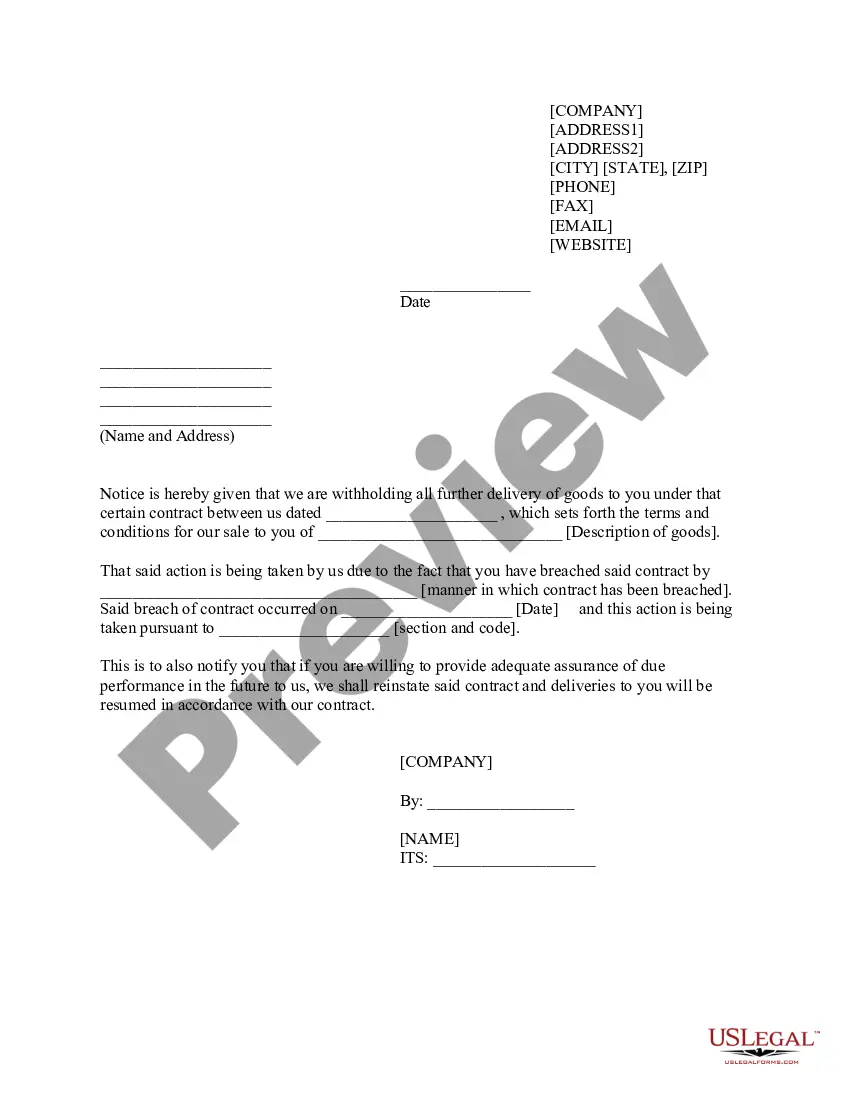

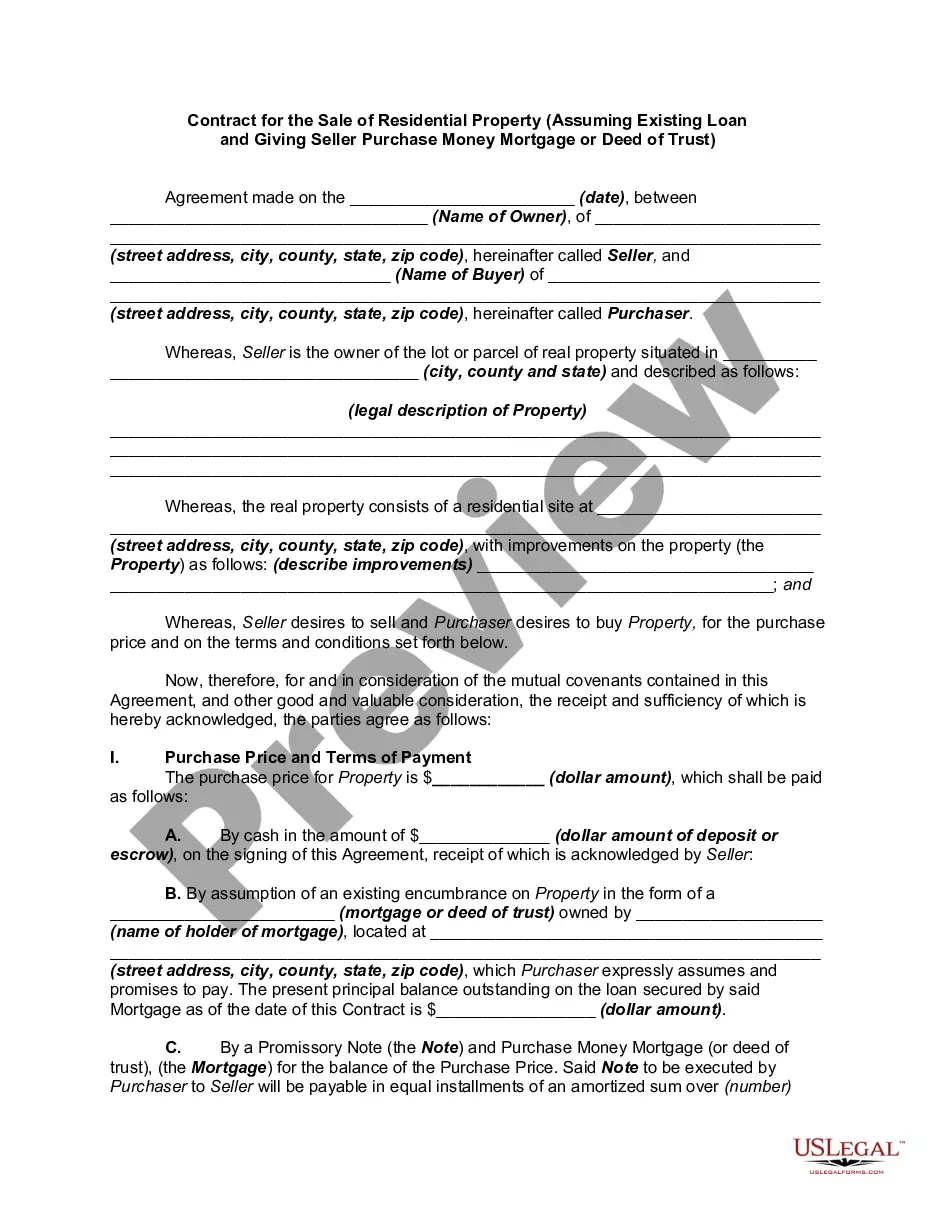

- Step 2. Use the Preview feature to review the form's details. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you've identified the form you need, click the Get now button. Choose your preferred payment plan and enter your details to sign up for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Fill out, edit and print or sign the Kentucky Sample Letter for Withheld Delivery.

Form popularity

FAQ

The K1, K2, and K3 forms in Kentucky serve unique purposes related to income reporting and tax withholding. The K1 is generally used for income from partnerships, K2 for corporations, and K3 is for non-residents. For any questions regarding which form applies to your situation, consulting a Kentucky Sample Letter for Withheld Delivery can provide valuable insights.

The withholding percentage you choose depends on various factors, including your income level and the number of allowances you claim. To select the appropriate percentage, you can use the tax tables provided by the Kentucky Department of Revenue as a guide. A Kentucky Sample Letter for Withheld Delivery could help you understand any specific situations impacting your selection.

The K3 tax form in Kentucky is issued to report income and withholding for non-residents and is essential for accurate income tax reporting. If you need to file this form, ensure you complete it accurately to avoid potential penalties. For further information about filling out the K3 form, reach for the Kentucky Sample Letter for Withheld Delivery.

In Kentucky, bonuses are typically treated as supplemental income and taxed at a flat rate as specified by the state. As tax laws can change, it's essential to confirm the current rates that apply to your bonuses. If you have withholding concerns, consider referencing a Kentucky Sample Letter for Withheld Delivery for detailed guidelines.

Kentucky K-3 is a tax form that individuals and businesses use to report and calculate non-resident withholding. This form assists taxpayers in ensuring the right amount is withheld for income earned in Kentucky. If you need clarity on completing this form, a Kentucky Sample Letter for Withheld Delivery can provide you with additional insights.

Yes, Kentucky requires nonresident withholding on income earned by non-residents within the state. This withholding ensures that the appropriate taxes are collected upfront. If you are concerned about compliance, consider using the Kentucky Sample Letter for Withheld Delivery for clear guidance.

Non-residents who earn income from Kentucky sources generally must file a Kentucky income tax return. The specifics can depend on the amount of income and the type of taxation involved. If you find yourself in this situation, consider using tools such as the Kentucky Sample Letter for Withheld Delivery to navigate the filing process efficiently.

Certain individuals may be exempt from Kentucky income tax, including some retirees and those with specific income thresholds. Specific criteria can be found on the Kentucky Department of Revenue's website. If you believe you qualify for an exemption, a Kentucky Sample Letter for Withheld Delivery can help simplify the inquiry process.

Currently, Kentucky state refunds may take several weeks to process. The processing time typically depends on the volume of returns the Department of Revenue receives. If you want to ensure your refund is processed smoothly, consider using a Kentucky Sample Letter for Withheld Delivery to clarify any withholding issues.

For inquiries about your tax refund in Kentucky, you can contact the Kentucky Department of Revenue. Their phone number is readily available on their website, and they can provide real-time information about your refund status. Keep your Kentucky Sample Letter for Withheld Delivery handy; it can assist you in case specific documentation needs to be referenced.