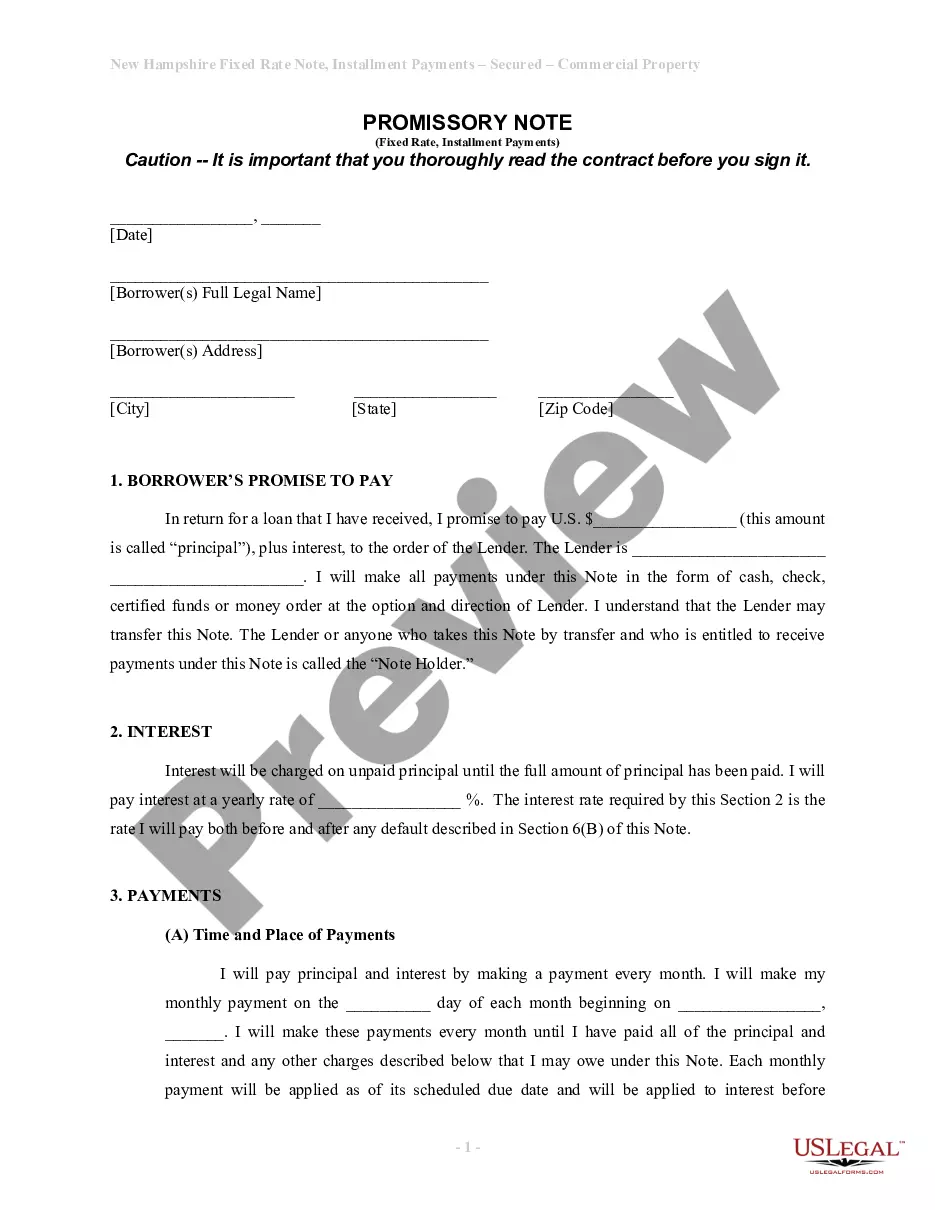

A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

Kentucky Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note

Description

How to fill out Letter Tendering Full Payment Of Existing Balance Of Promissory Note Due To Acceleration Or Prepayment Of Note?

US Legal Forms - one of the largest collections of legal templates in the United States - offers an extensive variety of legal document layouts that you can download or print.

While using the site, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of documents such as the Kentucky Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note in seconds.

Check the form description to confirm you have selected the right document.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you have a subscription, Log In and download the Kentucky Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note from the US Legal Forms library.

- The Acquire button will appear on each form you view.

- You can access all previously obtained forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have chosen the correct form for your city/state.

- Click the Preview button to review the form’s content.

Form popularity

FAQ

When a promissory note matures, the borrower must repay the remaining balance to the lender. Failure to do so can lead to penalties, and potentially legal action. If the borrower has issues repaying on time, options like a Kentucky Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note can help settle the balance. It’s essential to understand the terms outlined in your note to avoid complications.

To write a simple promissory note, begin by clearly stating the amount borrowed. Include the names and addresses of both the borrower and lender. Specify the repayment terms, including interest rates and due dates. Lastly, both parties should sign the document to make it legally binding, ensuring a smoother process in cases like a Kentucky Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note.

Generally, a notarized promissory note is more likely to hold up in court as it adds a layer of authenticity. Notarization provides proof that both parties agreed to the terms willingly and knowingly. When combined with the principles of the Kentucky Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note, a notarized note enhances legal credibility. Use uslegalforms for guidance on notarization processes.

Accelerating a promissory note involves declaring the entire balance due immediately upon certain conditions, often outlined in the note itself. This usually occurs after defaults or other breaches of contract. Understanding the Kentucky Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note is critical during this process. Using uslegalforms can help you with the necessary notices and procedures.

Yes, promissory notes are legally enforceable if they meet specific requirements of contract law. They must have clear terms, signatures, and an agreed-upon amount. The implications of the Kentucky Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note enhance their enforceability. You can find templates on uslegalforms for crafting compliant documents.

Yes, you can sue with a promissory note if the terms have been violated. The Kentucky Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note provides a legal basis for enforcing your rights. By demonstrating that the borrower failed to meet the agreed-upon terms, you can seek repayment in court. Legal platforms like uslegalforms can assist you in drafting necessary documents.

Standard clauses in a promissory note typically include the principal amount, interest rate, repayment schedule, and any applicable prepayment clauses. Additionally, provisions regarding default and consequences, as well as governing law clauses, are common. When examining your Kentucky Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note, reviewing these standard clauses helps ensure clarity and compliance.

A promissory note is not considered legal tender in the traditional sense. Legal tender refers to currency that a creditor must accept as payment for debts. However, a promissory note can serve as a clear agreement to repay a borrowed amount, often used in scenarios involving the Kentucky Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note. If you find yourself in a situation involving such notes, uSlegalforms provides the tools and templates to effectively manage and execute these agreements.