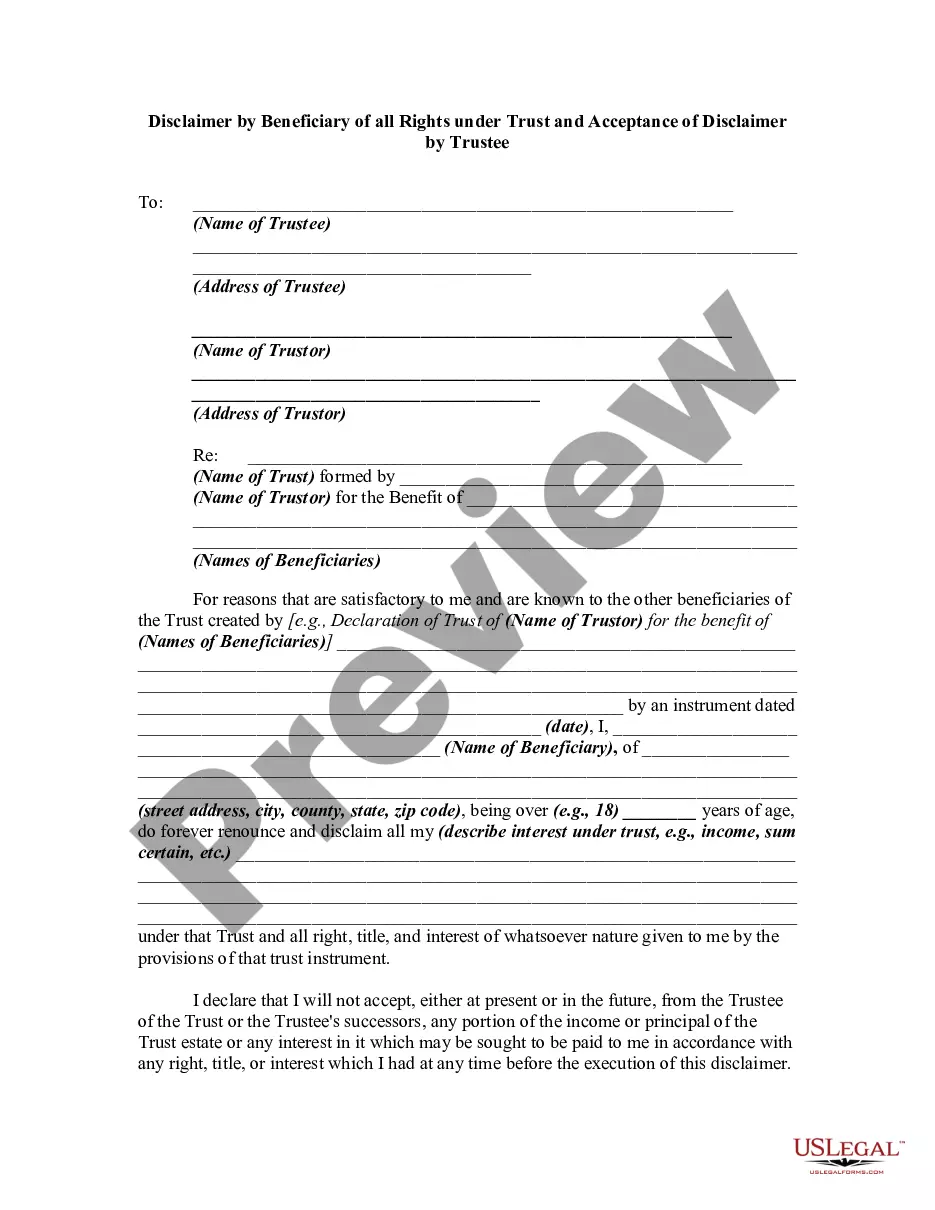

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Kentucky Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Description

How to fill out Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee?

US Legal Forms - one of the most important collections of legal forms in the United States - offers a vast selection of legal document templates that you can download or print.

Through the website, you can locate thousands of forms for business and personal use, categorized by types, states, or keywords.

You can find the latest versions of forms like the Kentucky Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee in just a few minutes.

If the form does not meet your requirements, utilize the Search box at the top of the screen to find the one that does.

Once you are satisfied with the form, confirm your selection by clicking the Download now button. Then, choose the payment plan that suits you and provide your details to register for an account.

- If you already have a membership, sign in and download the Kentucky Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee from the US Legal Forms library.

- The Download option will appear on every form you view.

- You can access all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

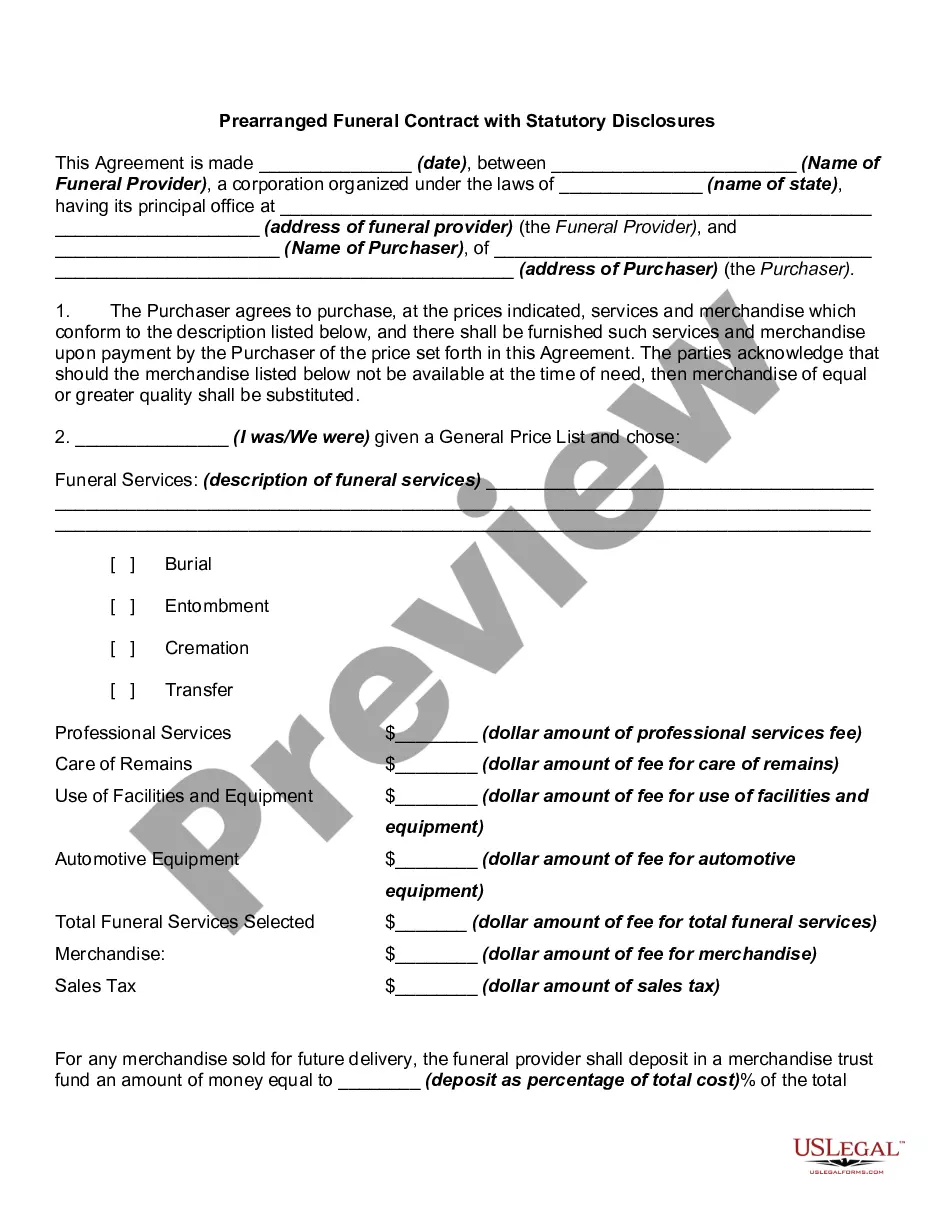

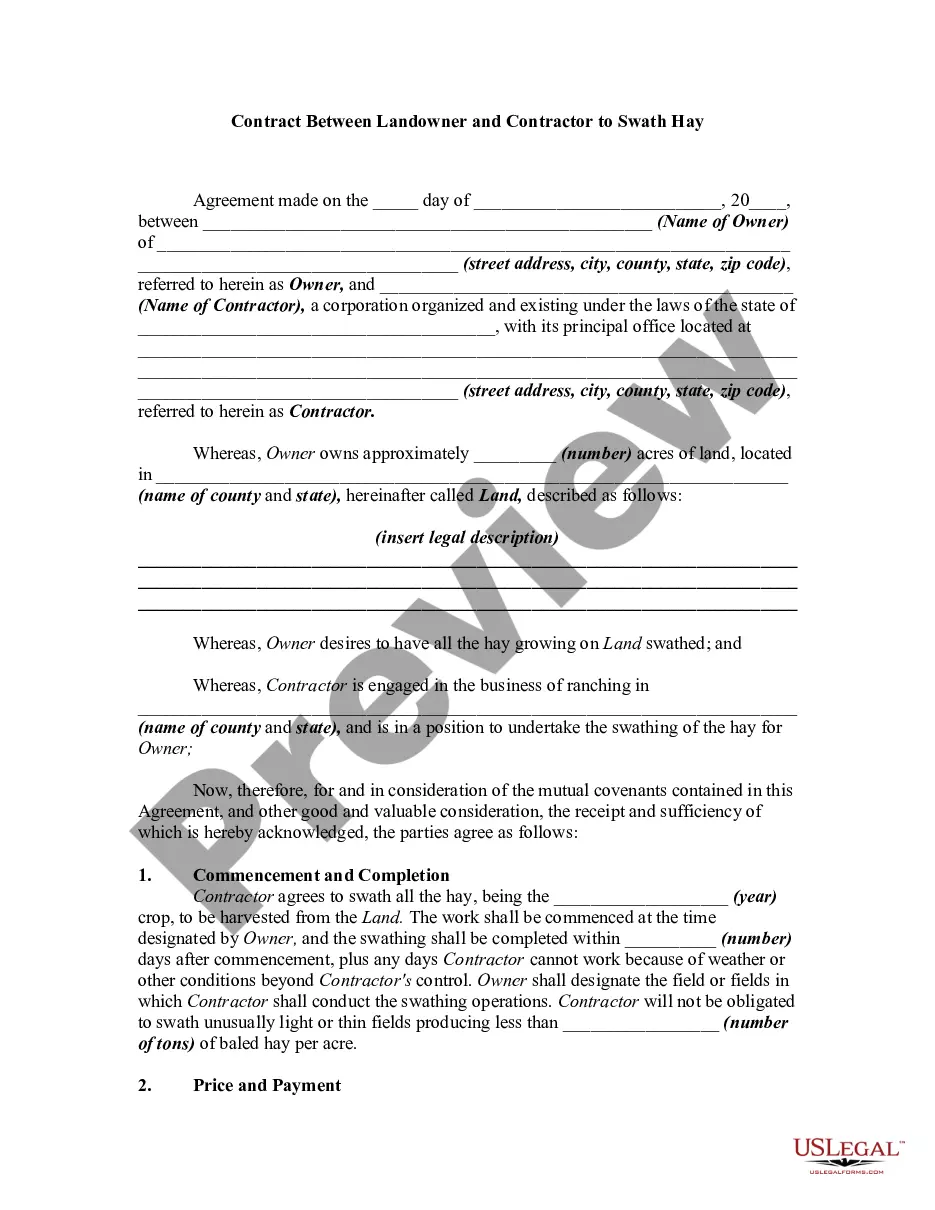

- Check the Review option to see the contents of the form.

Form popularity

FAQ

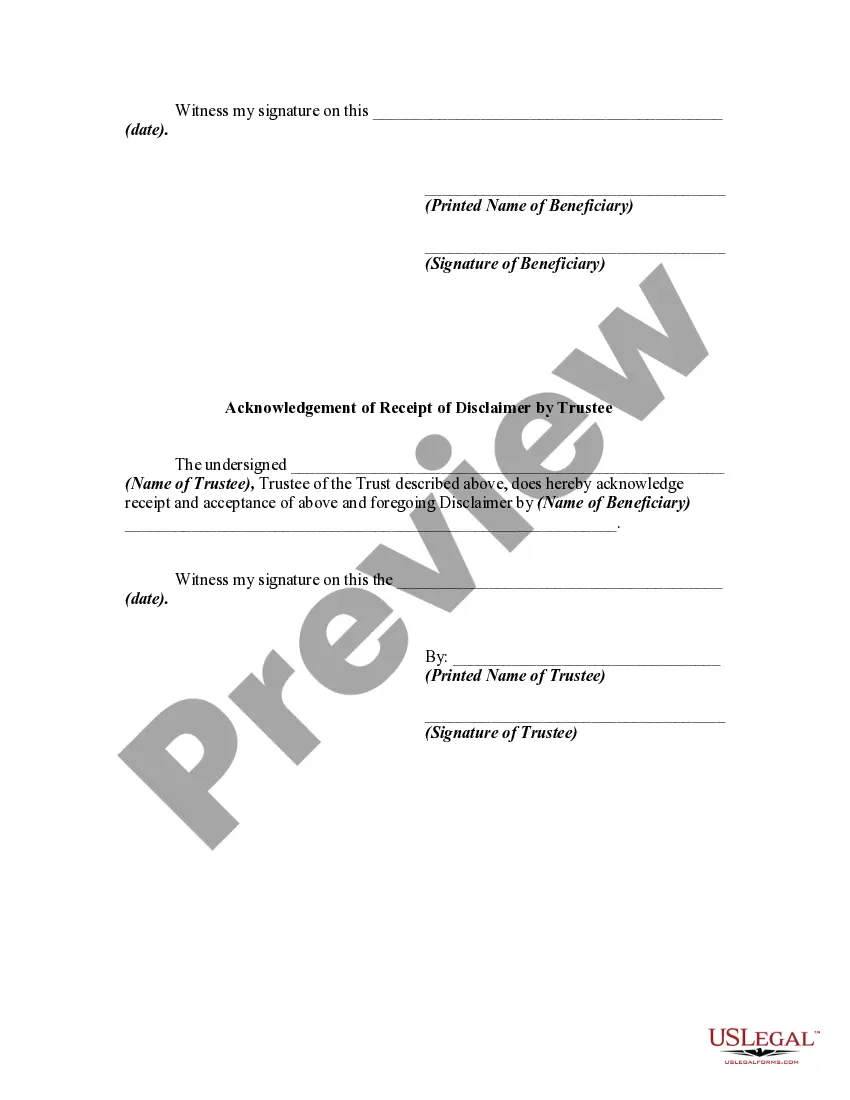

To file a disclaimer in Kentucky, you need to submit a written statement to the trustee or the court. This document should clearly state your intent to disclaim your rights under the Kentucky Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. It's essential to follow the specific legal requirements to ensure your disclaimer is valid, and using platforms like US Legal Forms can simplify this process by providing the necessary templates and guidance.

An inheritance disclaimer is a formal document stating a beneficiary's decision to reject their inheritance. For example, a beneficiary may draft a disclaimer that articulates their choice not to accept funds or property, which can then allow the assets to pass to other beneficiaries. This is often aligned with the guidelines in the Kentucky Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, helping facilitate an appropriate estate distribution.

To write a beneficiary disclaimer letter, include your full name, address, and the date at the top. Clearly state your intentions to disclaim rights to the inheritance, specifying any relevant details about the estate and referencing the Kentucky Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Ensuring clarity in your wording will help prevent misunderstandings and promote a smooth estate process.

A disclaimer trust is an estate planning tool that allows beneficiaries to refuse an inheritance in favor of a trust that benefits them. For example, if a beneficiary disclaims an inheritance, the assets may be transferred into a disclaimer trust, ensuring they are managed according to the beneficiary's long-term goals. In this context, understanding the Kentucky Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is crucial for effective planning.

A beneficiary can disclaim an inheritance by submitting a written disclaimer to the estate administrator or trustee. This document should clearly state the beneficiary's intention to decline the inheritance, referencing the applicable Kentucky Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. By taking this action, the beneficiary ensures that the inheritance passes to the next eligible recipient as outlined in the trust or will.

To write an inheritance disclaimer letter, start by clearly stating your intent to disclaim any rights to specific inheritances. Include pertinent details such as your name, the name of the deceased, and a reference to the applicable Kentucky disclaimer laws. Don't forget to mention the Kentucky Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, as it supports your case and clarifies the legal context.

An inheritance letter for a beneficiary can serve as official notification of a beneficiary's status and their rights. In this letter, you would include essential details such as the testator's name, the specific inheritance, and any relevant terms related to the Kentucky Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. This letter helps clarify rights and responsibilities in the inheritance process.

In Kentucky, a disclaimer of inheritance typically does not require notarization. However, it is advisable to check specific requirements, as some cases may benefit from it. By understanding the Kentucky Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, you can ensure that your disclaimer is valid and effective.

A disclaimer trust can have drawbacks, including a complex setup and potential taxation issues if not managed properly. Additionally, once a beneficiary disclaims their interest, they cannot later reclaim it. It may also require careful planning to ensure it aligns with the overall estate plan. Consulting resources about the Kentucky Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee can help mitigate these disadvantages.

A credit trust is designed to take advantage of a tax credit for married couples, ensuring the estate tax exclusion is maximized. Conversely, a disclaimer trust allows a beneficiary to refuse their inheritance, letting the assets shift to a different trust. Each serves varying financial strategies, and knowing the distinctions helps in effective estate planning. The Kentucky Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is crucial to understanding these differences.